To use a DCA calculator is a straightforward process that helps you plan and execute your investment strategy over time.

Dollar-Cost Averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions, to reduce the impact of market volatility on your investments.

Here’s how to use a DCA calculator:

- Select a DCA Calculator: You can find various DCA calculators online or within investment platforms. Choose a reliable and user-friendly calculator.

- Input Initial Investment: Start by entering the initial amount of money you’re willing to invest.

- Choose Investment Frequency: Decide how often you want to invest (e.g., weekly, monthly, quarterly). This will determine how frequently you’ll be adding to your investment.

- Enter Investment Period: Define the duration for which you plan to follow the DCA strategy. It could be a few months, a year, or even longer.

- Provide Investment Amount: Specify the fixed amount you’ll invest in each interval. This amount remains consistent throughout the investment period.

- Input Asset or Stock: If applicable, indicate the asset or stock you’re investing in. Some calculators might have options to consider potential growth rates.

- Run the Calculation: Once you’ve input all the required information, run the calculation. The DCA calculator will provide you with results based on your inputs.

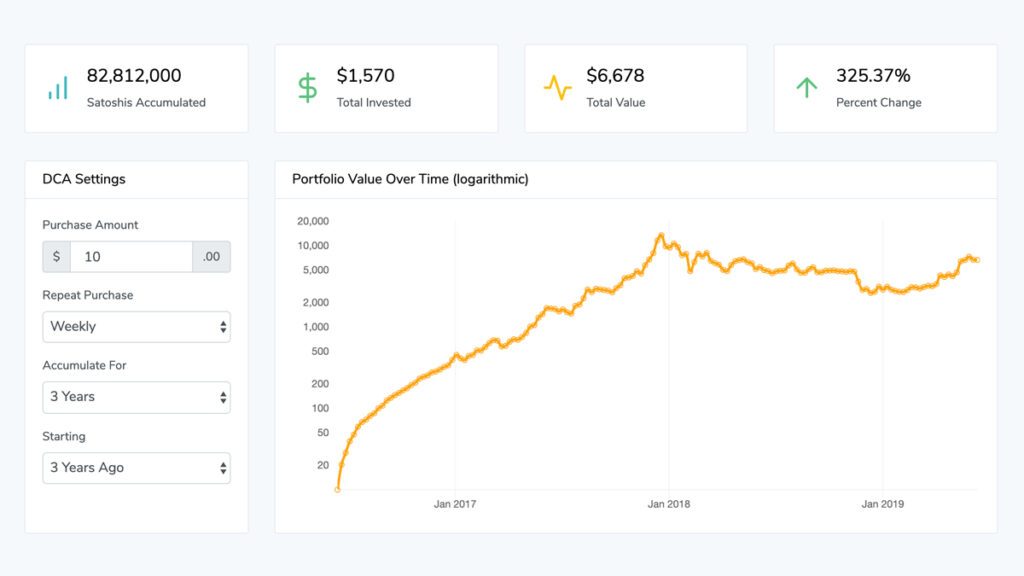

- Review Results: The calculator will generate a summary of your DCA investment strategy. It may show you the total amount invested, the number of investments made, the average cost per share/coin, and the final value of your investment based on historical performance.

- Compare Strategies: Some DCA calculators allow you to compare DCA with lump-sum investments. This can help you evaluate how the DCA strategy compares to investing a lump sum all at once.

- Adjust Inputs: You can experiment with different investment frequencies, periods, and amounts to see how they affect your results. This can help you fine-tune your strategy based on your goals and risk tolerance.

- Make Informed Decisions: Armed with the calculated data, you can make more informed decisions about your investment strategy. DCA calculators provide valuable insights into potential outcomes.

Remember that DCA calculators use historical performance data to provide estimates. They can help you visualize how a DCA strategy might play out, but actual market conditions can vary. Additionally, DCA does not guarantee profits, but it can help mitigate the impact of market volatility over time.

Always do your own research and consider seeking advice from financial professionals before making investment decisions.

Use a DCA Calculator for Bitcoin

If you want to use a DCA calculator for Bitcoin we recommend the one on our page. It is simple to used and based on historical data.

Let’s calculate the hypothetical results of someone investing $100 into Bitcoin every Monday since 2010. Let’s use a DCA calculator for this simple operation.

Assumptions:

- Investment amount: $100 every Monday

- Starting date: January 1, 2010

- Ending date: August 1, 2023

- Bitcoin price data: Using average weekly closing prices

Here’s a simplified breakdown of the calculations:

- Number of Weeks: From January 1, 2010, to August 1, 2023, there are approximately 725 weeks.

- Total Investment: $100/week * 725 weeks = $72,500

- Bitcoin Accumulation: For each week, you would purchase an amount of Bitcoin equivalent to $100 divided by the Bitcoin price for that week.

- Bitcoin Value Calculation: Multiply the total accumulated Bitcoin by the current Bitcoin price (as of August 1, 2023).

- Potential Gain: Calculate the potential gain by subtracting the total investment from the current Bitcoin value.

The amount accumulated would be over 40 Bitcoin and today worth $1’000’000.

Benefits of using a DCA Calculator

Using a Dollar-Cost Averaging (DCA) calculator offers several benefits that can help you make informed investment decisions and optimize your investment strategy. Here are the key advantages:

- Visualize Investment Growth: To use a DCA calculator allows you to see how your investments might grow over time using the DCA strategy. You can visualize how consistent contributions can potentially lead to long-term accumulation and growth.

- Quantify Potential Returns: By inputting various investment amounts, frequencies, and periods, you can estimate potential returns based on historical performance data. This helps you set realistic expectations and gauge the effectiveness of the DCA strategy.

- Mitigate Emotional Decisions: To use a DCA calculator can help you plan your investments systematically, reducing the likelihood of making emotional decisions driven by market fluctuations. This promotes disciplined investing and helps you stick to your strategy even during market downturns.

- Reduce Timing Risk: DCA strategy eliminates the need to time the market perfectly. The calculator shows how investing consistently over time can smooth out the impact of market volatility on your investment returns.

- Flexibility and Experimentation: To use a DCA calculator often allows you to adjust various parameters, such as investment frequency and amount, to see how they affect your outcomes. This flexibility lets you experiment with different scenarios and find a strategy that aligns with your goals.

- Comparison with Lump Sum: If you use a DCA calculator you can compare the DCA approach with investing a lump sum all at once. This comparison helps you understand the trade-offs between these two strategies and make a well-informed decision.

- Educational Tool: DCA calculators are educational tools that provide insights into the power of consistent investing. They can enhance your understanding of how time, compounding, and regular contributions work together to build wealth.

- Risk Management: Dollar-cost averaging inherently reduces the risk associated with investing large sums in a single market entry. The calculator showcases how DCA can help mitigate the impact of market downturns on your portfolio.

- Goal Setting: To use a DCA calculator can help you set achievable investment goals by estimating potential outcomes based on your financial input. This helps you align your investment strategy with your objectives.

- Long-Term Perspective: To use a DCA calculator encourages a long-term perspective on investing. It illustrates that short-term market fluctuations matter less when you’re consistently contributing over an extended period.

- Confidence Building: The calculated projections from the DCA calculator can boost your confidence in your investment strategy. You’ll have a better understanding of how your contributions can accumulate over time.

- Customization: DCA calculators often allow you to customize inputs based on your financial situation, risk tolerance, and goals. This customization ensures that the calculated outcomes are relevant to your circumstances.

Overall, a DCA calculator empowers you to make well-informed investment decisions, build a disciplined investing approach, and have a clearer understanding of how your investments can potentially grow over time.

List of DCA Calculators

- DCA Signals Investment Calculator

It is easy to use and you can see historical data which is kept up-to-date through our API connection. - Swan Bitcoin Calculator

Swan provides an easy-to-use tool to calculate your bitcoin allocation. - DCABTC Calculator

The original Bitcoin DCA tool - Percentage Tools Calculator

Calculate shares by initial investment and next investment