ATTENTION: The life of your dreams is just one decision away.

If you feel trapped in your current situation, you are not alone.

Millions of people like you, are in debt and struggling to believe they can ever achieve financial freedom.

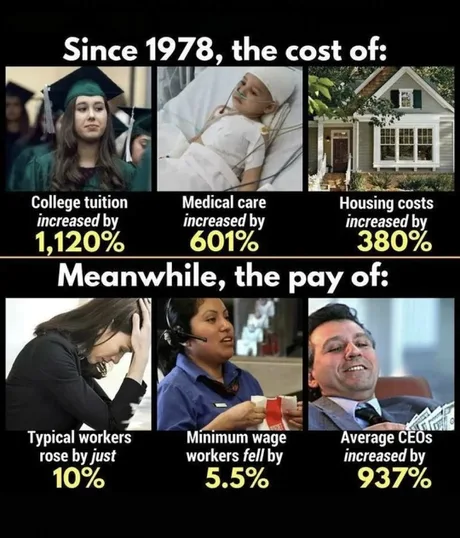

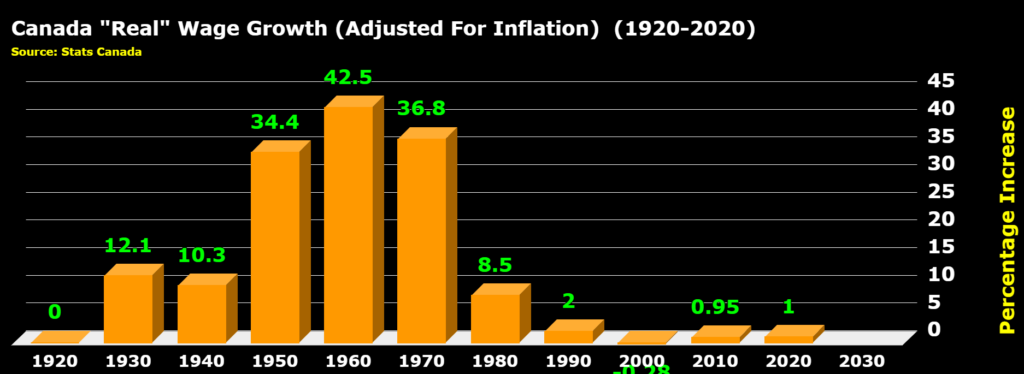

Your hard earned money melts away because life got SO EXPENSIVE.

But there is a solution!

Join the DCA Signals community today because the life of your dreams is just one decision away!

👀 What is Dollar Cost Averaging?

Dollar cost averaging or DCA means to purchase an asset on a recurring basis always for the same amount.

Dollar-cost averaging is a way of investing your money little by little over time. Instead of putting all your money into something all at once, you spread it out. It’s like buying a little bit of candy every week instead of all the candy in one day. This can be a good idea because sometimes things cost more and sometimes they cost less. By doing this, you can try to get a good average price for what you’re buying. It can help make your investment less risky and give you a better chance of getting good value.

DCA Strategy: The Psychological Benefits

What are the psychological benefits of the DCA Strategy? In this article we'll explain it. What is a DCA Strategy?Psychological Benefits of DCA-ingWhat is a Bitcoin DCA Strategy?What Is The Best Crypto DCA Strategy?DCA Stock StrategyConclusion What is a DCA Strategy?...

🔐

DCA Signals Membership Benefits:

- Get Started with Bitcoin in Minutes

- Bullet-proof DCA Strategy

- Expert guidance and Q&A

- Access to insider community

- Step-by-step course material

- Daily updates and signals

- & much more

-

Dollar Cost Averaging vs Value Averaging Comparison

In this article you will learn the basics about Dollar Cost Averaging vs Value Averaging We will show you simple examples and lay out differences b...

-

How To Become Millionaire with “Buy & Hold” 2023

Many people currently face financial challenges. How to become Millionaire is not something most people are interested in. Their minds are focused ...

-

The Best DCA Apps to buy Bitcoin on a regular basis

If you are looking to set up a recurring buy, you need the right app. In this comparison we take a look at the best Apps you can use to put your Bi...

-

What is Dollar Cost Averaging Bitcoin?

What is Dollar Cost Averaging Bitcoin? In this short article we explain the fundamentals of Dollar Cost Averaging (DCA) as well as the particular c...

-

Dollar cost averaging explained in short

Dollar-cost averaging (DCA) is a simple and effective investment strategy that can help reduce the impact of market volatility and potentially lowe...

-

Inflation Protection – Five Tips To Secure Your Money

Inflation is a common problem. And inflation protection is something every individual has to consider to protect wealth from losing value. 1. Study...

A Few Facts About Your Money:

Every day fresh money gets printed

Without Your Agreement

Prices for daily products go up

>> INFLATION <<

But do you get paid more? No!

Big Banks, Big Governments and Big Corporate WIN

EVERYONE else is LOSING!

Profit With DCA Signals

Learn the #1 Strategy to protect your money from the world’s leading experts

👍 1-to-1 Expert Coaching

👍 Live Discussion Group

👍 Become DCA insider within hours

👍 Bulletproof DCA Strategy Template

👍 Job & Career Guidance

👍 Step-by-step Course Material

👍 Access To Special Deals

👍 Social Live Events

And much, much more!

All included in the DCA Signals Membership!

What you can expect:

Expert DCA Strategy Template

Take the shortcut to success with our bulletproof DCA templates and step-by-step guides. Our coaches will personally assist you on every step.

Live Discussion Groups

Join our active member-only discussion group to share your ideas and dive more deeply into the topics we discuss in the workshops. Led by our team of coaches.

Weekly Coaching

Our coaching will allow you to quickly and easily advance your knowledge.

Job & Career Guidance

If you’re looking to make a career in Bitcoin, our resume tips and best practices help you get your foot in the door at your dream company.

Step-by-step Course Material

Explore step-by-step premium video course material.

Social Live Events

Get to know your other DCA Signals members in a relaxed environment.

And much, much more!

All included in the DCA Signals Membership:

Without a STRATEGY your money is at risk

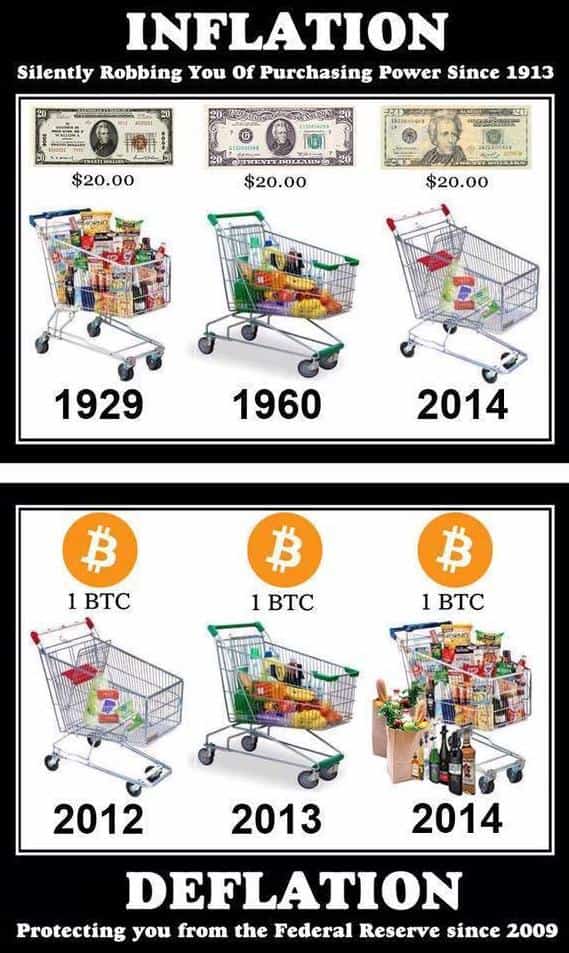

Due to INFLATION, the Dollar has lost almost all its purchasing power. Without the right STRATEGY, you are losing money.

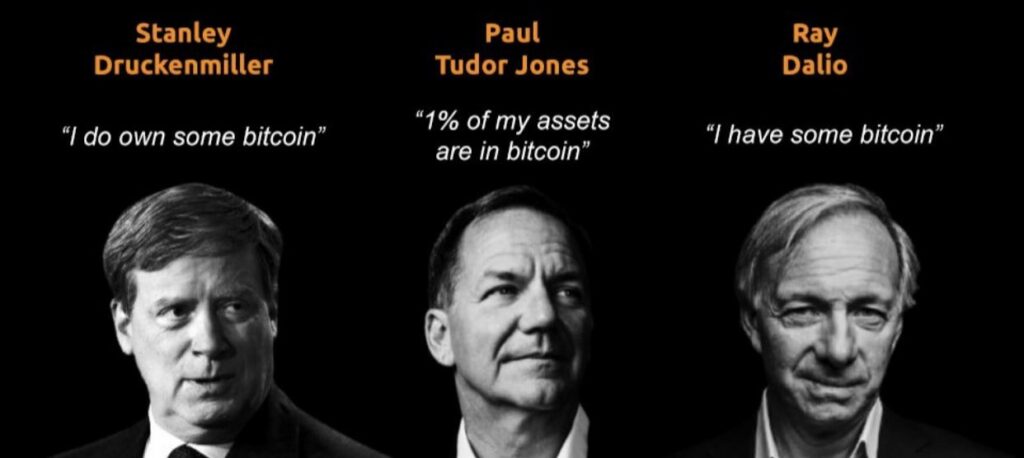

WATCH: Billionaire Investors use Bitcoin to protect their wealth

Prices go up, but your wage doesn’t!

🤬

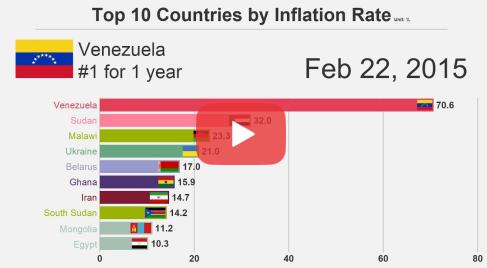

When the currency collapses, the economy goes down too:

Venezuela was a rich country.

It had a lot of oil and tourism.

Everything seemed OK…

Until hyperinflation destroyed the money.

And thus, the economy crashed.

Now the shelves in the supermarkets are empty.

Everything is super expensive.

Even necessities like toilet paper cost a fortune.

This is how much money you have to pay for one roll of toilet paper in Venezuela.

Inflation is a real danger

No country or currency is safe from hyperinflation.

Central banks keep printing money every day.

Inflation can come quickly and destroy a currency within months.

It can happen in ANY country even in yours.

as seen on

WATCH: HOW EXPERTS GENERATE WEALTH

⇊

Protect Your Wealth & Your Future

Learn The #1 Bitcoin Strategy from Top Experts

Get ready to live a better life than you ever imagined.

Join The Movement That Makes INFLATION DISAPPEAR

Did You Know This Fact?!:

$25 worth of bitcoin bought weekly for 9 years

would now be worth over $3.000.000

Because bitcoin is up 47964.49%* since launch.

*Approximate Return on Investment. Source coinmarketcap.com

The World’s Richest Investors Buy Bitcoin

Ray Dalio, Stan Druckenmiller and Paul Tudor Jones are among the world’s best hedge fund managers. They manage billions of dollars. And they all buy bitcoin.

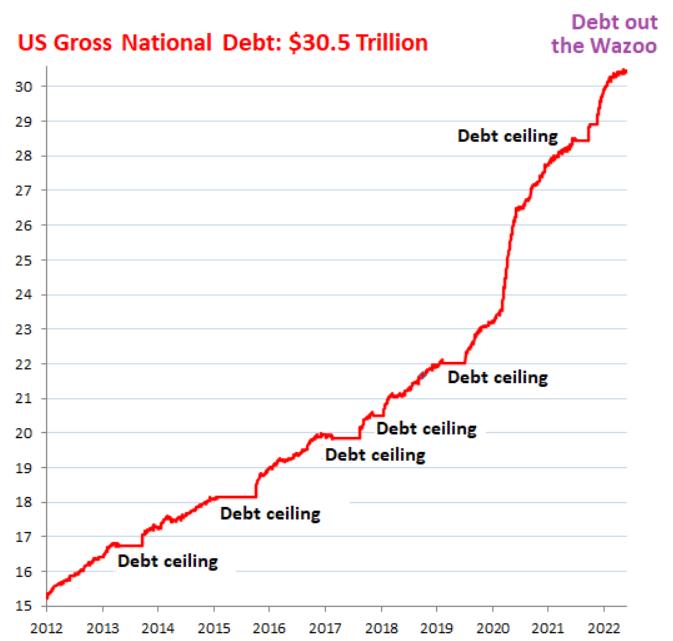

Learn Why The Debt Bubble Is a $400 Trillion Problem And How To Get Out:

What Our Members Say:

DCA Signals has helped me to get started with Bitcoin fast and comfortable. I’ve been learning so much and my portfolio is growing on autopilot now. Thanks so much guys!

Avoid Missing Out, Avoid Losing

DCA Signals was designed to save you money and time.

Be ahead of the mass adoption curve. Because nothing in the world gets rewarded better than being the first.

But how can you be first?

Just like in any other discipline you need the right training and understand the keys to success. Only with the correct method and tactic will you be able to win.

The best athletes in the world also have the best mentors and trainers in the world. They utilize the best training equipment based on scientific research to achieve the best result.

You can do the same with your money. While your banker has never changed his advice in the past 40 years but has lost his clients millions, others have been smarter.

The world is changing rapidly and the strategy to survive and adapt is right here.

Don’t listen to people who don’t have a track record of being the best in their game. Your bank manager or insurance broker will not be able to help you this time.

Only take advice from the best:

Learn from the world’s leading bitcoin experts

Bitcoin is for everyone who is willing to do what it takes to be on the winning side.

Get started with bitcoin and realize your dreams.

It’s easier than you think.

Stop wasting money on fake experts and scammers.

Stop losing money from trading and bad advice.

Stop risking your savings without understanding the market.

DCA Signals was created by expert bitcoin investors with one goal in mind:

To help you get rich and save you time with the top strategy!

For decades bankers have lived the good life without ever really working.

While you have been busy spending many hours at work, they could just create new money out of nothing.

But today we are getting closer and closer to a big change in the world.

Nothing will be like before. It could actually become chaotic and troublesome.

But with the right knowledge, the right network and the right strategy you will benefit massively.

Let’s be honest, we all make mistakes.

The biggest mistake is to miss a ONCE-IN-A-LIFETIME OPPORTUNITY

A small amount of Amazon or Apple stock bought back in 1999 would be million dollar fortune today. If you hadn’t missed a ‘once-in-a-lifetime opportunity’ you could be ultra-rich and retired.

So…

There is a new Lifetime Opportunity right here!

BUT: Lifetime opportunities are rare. Most of us get one or two in their entire life. You see, the success of Amazon on Apple it was hard to predict and only very few people actually had enough luck!

With Bitcoin it’s different. Simple math allows you to make a predictable bet. Everyone can participate because there is no need to pick a specific stock. Bitcoin itself is the internet stock. The protocol itself can be owned.

Simply become part of the network itself.

Start today, for a future in financial freedom

In the world of bitcoin you will face many challenges. It’s not easy at start and you can do many mistakes.

However, most of the mistakes can be avoided because many people before you have already made these mistakes. Join us and learn about the most common mistakes and learn how to avoid them.

DCA Signals includes all the important tools and tips to succeed with bitcoin.

Join millions who used the DCA strategy to grow wealth that will last generations.

With the leading bitcoin strategy you will get a bulletproof, step by step method that you can apply without prior knowledge or long training.

Start to grow your bitcoin portfolio today.

Join now and start your bitcoin journey

Stop giving your money to the bankers!

Join DCA Signals as a Member

Benefit 1

Learn to protect your money against inflation

Benefit 2

Take the knowledge from world leading experts

Benefit 3

Be on the winning side of the crisis

The financial elites can print money but you have to work for it.

Profit With DCA Signals

Learn the #1 Strategy from the world’s leading experts:

What’s in for YOU?

The DCA Membership is a Ultra-High-Value package and your direct pathway to long-term profit.

DCA Strategy Template

Take the shortcut to success with our bulletproof DCA templates and step-by-step guides. Our coaches will personally assist you on every step.

Live Discussion Groups

Join our active member-only discussion group to share your ideas and dive more deeply into the topics we discuss in the workshops. Led by our team of coaches.

Weekly Coaching

Our coaching will allow you to quickly and easily advance your knowledge.

Job & Career Guidance

If you’re looking to make a career in Bitcoin, our resume tips and best practices help you get your foot in the door at your dream company.

20 Premium Course Material

Explore over 20h of premium video course material.

Social Live Events

Get to know your other DCA Signals members in a relaxed environment.

And much, much more!

Join DCA Signals

Chose the plan that’s right for you:

Free

Tight budget? Don't worry, join our open community forum for free.- 1 DCA guide

- Access to open community

- Free updates

BASIC

The ideal package for small to medium investors and beginners.- Access to Insider Community

- All DCA Strategy Templates

- 20h of Course Material

- Daily Signals and Updates

- 1x 20 min Strategy Coaching

- Browser Extension

- Basic Support

Pro

Exclusive package for professionals and business owners.- Access to Insider Community

- All DCA Strategy Templates

- 20h of Course Material

- Exclusive Extended Material

- Daily Signals and Updates

- 2x 1h Personal Strategy Coaching

- Browser Extension

- Custom Signals

- Business DCA Strategy

- Premium Support

- Emergency Contact

Start growing your wealth

$25 worth of bitcoin bought weekly for 9 years

would now be worth over $3.000.000

Because bitcoin is up 47964.49%* since launch.

Read the latest DCA news

Stay up-to-date with our DCA news service

How to Set Up Your Coinos Account Today

Coinos is a bitcoin web wallet that supports various forms of bitcoin payments, including the Lightning Network. With its user-friendly interface and robust security features, Coinos is an excellent choice for both beginners and experienced Bitcoin users. In this...

Top DCA Strategies for Buying Bitcoin

Dollar-Cost Averaging (DCA) is a popular investment strategy that involves buying a fixed amount of an asset at regular intervals, regardless of the asset's price. DCA Strategies are often used in the world of digital currency, particularly with Bitcoin. By utilizing...

Bitcoin Savings Plan: Top Accounts to Get Started With

A Bitcoin savings plan is a strategic approach to growing your savings and investments in the digital currency space. This comprehensive article will provide an in-depth analysis of the best accounts to consider for your Bitcoin savings plan. We will discuss various...

Need more details?

Get a FREE assessment call

Schedule a call and our team will reach out to you!

Don’t leave, follow us!

And get the best DCA content on social media