What is inflation? As prices go up and up, you might have wondered about the reason for inflation and increasing prices.

In this article we will explain what inflation is, how it works and how you can protect yourself.

Índice

Quick Take: What is inflation?

In short, most people use the term “inflation” to describe increasing prices for goods and services. Economists established that inflation means “Devaluation of currency over a period of time.”

What is inflation according to the international monetary fund?

According to the IMF:

Inflation measures how much more expensive a set of goods and services has become over a certain period, usually a year

IMF

What causes inflation?

Politicians and mainstream economists argue that inflation is caused by all kinds of factors such as climate change or Putin. But what is inflation really? Those who benefit from inflation avoid to explain that an increase in the money supply is a key factor. But economics experts know that the key driver for inflation is of course when more money is created and injected into the market.

What are the factors for increasing prices?

- Increase in money supply

If the amount of money in an economy is doubled, it’s value is halfed. It’s that simple. - Decrease in demand for money

If suddenly people reduce their demand for a certain money this could lead to an oversupply of money and lead to increasing prices. - Decrease in supply of goods

If the supply of goods is inelastic or reduced, prices for these goods will go up. - Increase in demand for goods

If more people demand certain goods but the supply does not respond, the prices for these goods will go up.

The following section is republished text written by the amazing economist Henry Hazlitt.

Cause and Cure of Inflation

1. Inflation is an increase in the quantity of money and credit. Its chief consequence is soaring prices. Therefore inflation—if we misuse the term to mean the rising prices themselves—is caused solely by printing more money. For this the government’s monetary policies are entirely responsible.

2. The most frequent reason for printing more money is the existence of an unbalanced budget. Unbalanced budgets are caused by extravagant expenditures which the government is unwilling or unable to pay for by raising corresponding tax revenues. The excessive expenditures are mainly the result of government efforts to redistribute wealth and income—in short, to force the productive to support the unproductive. This erodes the working incentives of both the productive and the unproductive.

3. The causes of inflation are not, as so often said, “multiple and complex,” but simply the result of printing too much money. There is no such thing as “cost-push” inflation. If, without an increase in the stock of money, wage or other costs are forced up, and producers try to pass these costs along by raising their selling prices, most of them will merely sell fewer goods.

The result will be reduced output and loss of jobs. Higher costs can only be passed along in higher selling prices when consumers have more money to pay the higher prices.

4. Price controls cannot stop or slow down inflation. They always do harm. Price controls simply squeeze or wipe out profit margins, disrupt production, and lead to bottlenecks and shortages. All government price and wage control, or even “monitoring,” is merely an attempt by the politicians to shift the blame for inflation on to producers and sellers instead of their own monetary policies.

5. Prolonged inflation never “stimulates” the economy. On the contrary, it unbalances, disrupts, and misdirects production and employment. Unemployment is mainly caused by excessive wage rates in some industries, brought about either by extortionate union demands, by minimum wage laws (which keep teenagers and the unskilled out of jobs), or by prolonged and over-generous unemployment insurance.

6. To avoid irreparable damage, the budget must be balanced at the earliest possible moment, and not in some sweet by-and-by. Balance must be brought about by slashing reckless spending, and not by increasing a tax burden that is already undermining incentives and production.

Inflation Definition

In economics, inflation refers to a rise in the overall price level of goods and services within an economy, leading to reduced purchasing power for each unit of currency.

This means that money can buy fewer goods and services as prices increase. Inflation contrasts with deflation, which is a decrease in the general price level.

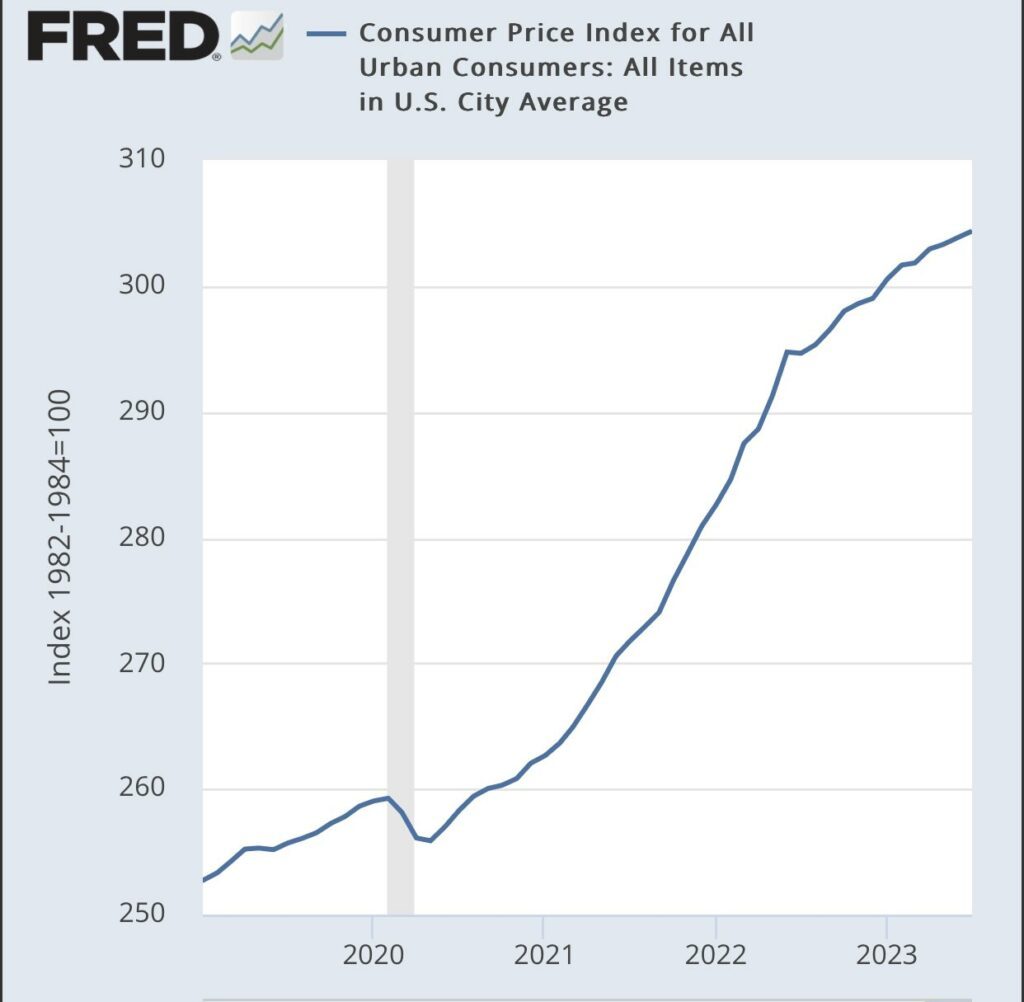

The standard gauge for inflation is the inflation rate, indicating the annualized percentage change in a general price index. The consumer price index (CPI) is commonly employed to measure this, as it captures varied price changes faced by households.

In the Austrian School of Economics, inflation is seen as a monetary phenomenon resulting from an increase in the money supply, potentially causing distortions in relative prices and resource allocation within the economy.

Alternative ways to measure inflation

- Core Inflation: Excludes volatile elements like food and energy prices to capture underlying inflation trends.

- Trimmed Mean Inflation: Removes extreme high and low price changes from the full basket of goods for a more balanced view.

- Median Inflation: Based on the middle value in a ranked list of price changes, reducing the impact of outliers.

- Personal Consumption Expenditures (PCE) Price Index: Considers changes in consumption patterns and includes a broader range of items compared to the CPI.

- Producer Price Index (PPI): Measures price changes at the wholesale level, offering insights into potential future consumer price changes.

- Chained Consumer Price Index: Adjusts for changes in consumption patterns, reflecting consumer responses to price changes.

- Cost of Living Index: Accounts for regional cost differences, providing a localized view of inflation’s impact.

- Big Mac Index: Compares the price of a Big Mac burger across countries to assess currency valuation.

- Hedonic Price Index: Considers changes in product quality and features over time.

- Asset Price Inflation: Examines price changes in financial assets like stocks, real estate, and commodities.

- Shiller P/E Ratio: Uses cyclically adjusted price-to-earnings ratio to assess stock price valuation.

- Chapwood Index: Focuses on 500 commonly consumed items, tracked quarterly without manipulation or biases, providing a clear view of cost changes in Americans’ daily lives. It includes a comprehensive range of expenses and can be localized to specific metropolitan areas.

We hope we were able to answer you the question “what is inflation?”. If you still struggle to understand how inflation works, how it is measured and how you can protect your savings, please become a member of DCA Signals and get expert help