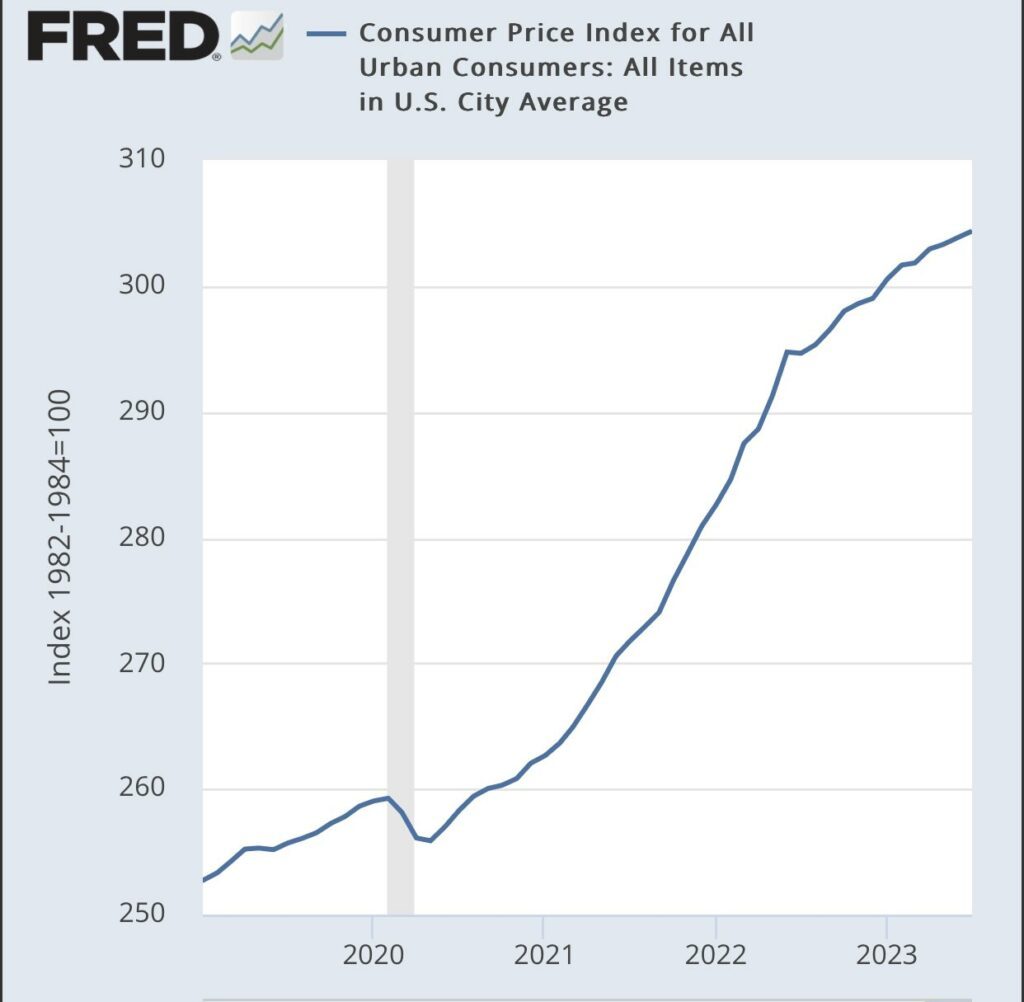

Inflation is a common problem. And inflation protection is something every individual has to consider to protect wealth from losing value.

1. Study Bitcoin

Bitcoin is the best inflation protection you can find due to its unique characteristics as ultra sound money.

Some people criticize Bitcoin and argue it’s not a hedge against inflation due to the ongoing volatility.

But if we look at the past performance we can record the fact that bitcoin is the best performing asset in human history. If you want to protect yourself from money debasement and have a 5+ year horizon then Bitcoin is certainly an interesting option.

2. DCA Strategy + hard asset

If you find an asset such as Bitcoin that is worth to accumulate over time, you can use a Estrategia del DCA to convert bad money into a long-term storehold of wealth. If you accumulate a hard asset you have excellent inflation protection.

3. Real Estate As Inflation Protection

Real estate can work as an inflation protection as it’s much harder to inflate the supply of real estate. But you also have to understand the risks of using real estate as an inflation hedge.

Let’s see if real estate fared any better compared to Bitcoin. The cryptocurrency delivered a whopping 1,576% average annual return and an 18,912% total return from 2010 to 2021, while the Vanguard Real Estate ETF had an average annual return of 13.49% and a total return of 161.91% over the same period.

| Año | Bitcoin Return (%) | Vanguard Real Estate ETF Return (%) |

| 2005 | – | 12 |

| 2006 | – | 35.2 |

| 2007 | – | -16.38 |

| 2008 | – | -36.98 |

| 2009 | – | 29.76 |

| 2010 | 9,900 | 28.44 |

| 2011 | 1,473 | 8.62 |

| 2012 | 186 | 17.67 |

| 2013 | 5,507 | 2.42 |

| 2014 | -58 | 30.29 |

| 2015 | 35 | 2.37 |

| 2016 | 125 | 8.53 |

| 2017 | 1,331 | 4.95 |

| 2018 | -73 | -5.95 |

| 2019 | 95 | 28.91 |

| 2020 | 301 | -4.72 |

| 2021 | 90 | 40.38 |

| 2022 | -81.02 | -26.21 |

4. Precious Metals

For thousands of years people have used gold and silver as a store of value. By the way, other commodities and precious materials can also work as a store of value.

There are two major downside to this solution. Firstly, it’s hard to move gold around and verify it’s authenticity. Second, it probably will not re-monetize and become a reserve currency considering the ongoing adoption of Bitcoin.

5. Inflation protected bonds

Special funds such as the “Vanguard Inflation-Protected Securities Fund Investor Shares” promise inflation protection to investors. However, if we analyze the actual returns of these funds, it’s probably better to burn your money on parties and in restaurants. You will have more fun losing your money when you can spend it yourself.

| Año | Capital return by NAV | Income return by NAV | Total return by NAV | Benchmark1 |

|---|---|---|---|---|

| 2022 | -18.56% | 6.62% | -11.95% | -11.85% |

| 2021 | 0.42% | 5.14% | 5.56% | 5.96% |

| 2020 | 9.48% | 1.41% | 10.90% | 10.99% |

| 2019 | 5.69% | 2.36% | 8.06% | 8.43% |

| 2018 | -4.37% | 2.88% | -1.49% | -1.26% |

| 2017 | 0.46% | 2.35% | 2.81% | 3.01% |

| 2016 | 2.44% | 2.09% | 4.52% | 4.68% |

| 2015 | -2.57% | 0.74% | -1.83% | -1.44% |

| 2014 | 1.66% | 2.16% | 3.83% | 3.64% |

| 2013 | -10.39% | 1.47% | -8.92% | -8.61% |

| 2012 | 4.16% | 2.61% | 6.78% | 6.98% |

| 2011 | 8.68% | 4.56% | 13.24% | 13.56% |

| 2010 | 3.59% | 2.58% | 6.17% | 6.31% |

| 2009 | 8.94% | 1.86% | 10.80% | 11.41% |

| 2008 | -7.47% | 4.62% | -2.85% | -2.35% |