Introduction

In a world characterized by economic uncertainties and evolving indebtedness, Bitcoin has emerged as a compelling narrative in the realm of generational wealth. Its meteoric rise from obscurity to global recognition has sparked debates, fueled investment frenzies, and positioned itself as a beacon of financial empowerment for generations to come.

Índice

The Genesis of Bitcoin – Generational Wealth

Born from the pseudonymous mind of Satoshi Nakamoto in 2008, Bitcoin introduced a revolutionary concept: a decentralized digital currency that transcended traditional financial institutions. With a fixed supply of 21 million coins, Bitcoin challenged the inflationary nature of fiat currencies and sparked the imagination of a generation disillusioned by the 2008 financial crisis. Its decentralized nature, enabled by blockchain technology, brought an air of transparency and trustlessness that resonated with those seeking alternatives to centralized financial systems.

The Rise to Prominence

Bitcoin’s ascent to prominence can be likened to a digital gold rush. As early adopters embraced its potential, the cryptocurrency garnered mainstream attention and significant media coverage. Bitcoin’s price, once a fraction of a cent, surged to astounding heights, reaching an all-time high of over $64,000 in 2021. This rapid appreciation not only captivated the investment community but also solidified Bitcoin’s status as a vessel for generational wealth accumulation.

Generational Shift in Investment

Traditionally, wealth has been passed down through real estate, stocks, and bonds. However, the digital age has ushered in a new paradigm, where intangible assets like cryptocurrencies hold the potential to redefine generational wealth.

Bitcoin’s scarcity, portability, and divisibility have positioned it as an attractive store of value for those who seek to preserve and grow their wealth across generations.

Challenges and Opportunities

Despite its allure, Bitcoin is not without its challenges. Regulatory uncertainties, price volatility, and environmental concerns have cast shadows over its potential as a generational wealth tool.

Governments around the world are grappling with how to categorize and regulate cryptocurrencies, which could impact their long-term viability. Moreover, the energy-intensive process of Bitcoin mining has raised questions about its environmental sustainability.

Yet, within these challenges lie opportunities for innovation and adaptation. Efforts are underway to make Bitcoin mining more environmentally friendly through the use of renewable energy sources.

Additionally, the evolving regulatory landscape could lead to increased legitimacy and broader adoption, ultimately bolstering Bitcoin’s status as a generational wealth asset.

Financial Inclusion and Empowerment

One of Bitcoin’s most profound impacts is its potential to empower those traditionally excluded from the formal financial system.

Across the globe, billions of people lack access to traditional banking services, leaving them vulnerable to economic instability.

Bitcoin, with its borderless nature and minimal entry barriers, provides an avenue for financial inclusion.

Individuals in underserved regions can now participate in a global economy, transact securely, and accumulate wealth without relying on intermediaries.

Educational Imperative

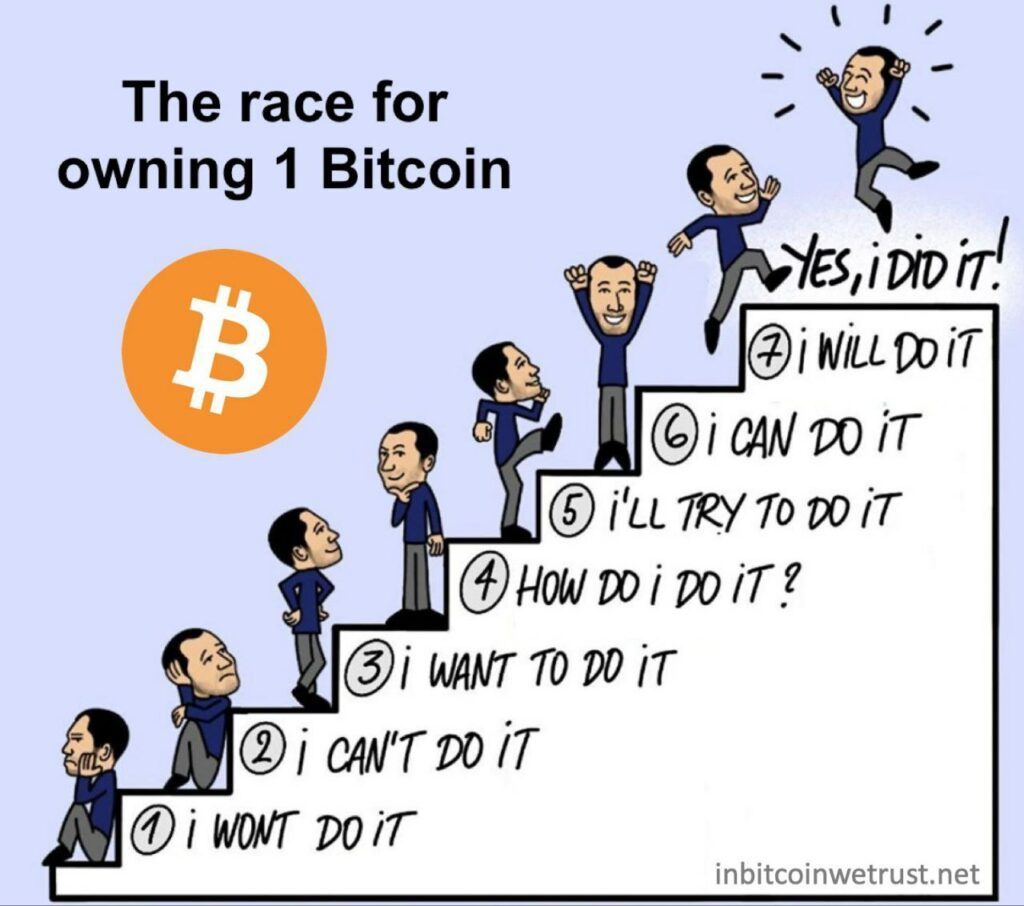

For Bitcoin to truly become a vessel of generational wealth, education is paramount. Its complex technological underpinnings and volatile price movements necessitate a deep understanding by those who wish to participate.

Educational initiatives, from online courses to community workshops, are essential to equip individuals with the knowledge needed to navigate the cryptocurrency landscape responsibly.

The Road Ahead

A key aspect of Bitcoin’s impact is its reorientation of incentives. The fiat system encourages high time preference decisions for short-term growth, while Bitcoin reintroduces values of hard work and long-term rewards.

Bitcoin’s consensus protocol, proof-of-work, incentivizes honesty, rewarding participants for their contributions. This contrasts with the current fiat system, where proximity to the money printer leads to unequal rewards.

By restoring proper incentives, Bitcoin encourages saving and investment, fostering a low-time preference mentality. This approach stands in contrast to the spend-centric fiat system. Bitcoin enables generational wealth by preserving purchasing power and facilitating long-term investments.

Conclusión

Bitcoin’s status as a generational wealth asset is no longer a speculative notion; it is a tangible reality reshaping the financial landscape.

Its decentralized nature, scarcity, and potential for financial inclusion have positioned it as a compelling option for those seeking to preserve and grow wealth across generations.

While challenges remain, the adaptability and innovation within the cryptocurrency space suggest a promising trajectory. As we venture further into the digital age, Bitcoin’s legacy as a beacon of generational wealth is poised to shine ever brighter.