The Federal Reserve’s denial of master accounts, impacts innovative banking ventures. It underscores concerns about transparency, accountability, and the need for regulatory reform to accommodate evolving financial landscapes.

Why it matters: A Fed master account is the holy grail for bitcoin-touching firms to permit seamless transaction. But those firms argue there’s no clear heuristic on who can get one, and who can’t. Is it corrupt?

Key Insights:

- Innovation Roadblocks: The Federal Reserve’s denial of master accounts to innovative banking ventures, exemplified by cases like Lionel Danenberg’s, poses challenges for disruptive business models aiming to transform traditional financial systems.

- Cryptocurrency Industry Impact: Denials in the cryptocurrency sector suggest potential regulatory pressures, spotlighting a broader industry struggle for acceptance within the traditional financial ecosystem.

- Transparency and Regulatory Reform: The lack of transparency in the Federal Reserve’s decision-making process underscores the need for reform to ensure fair access to financial infrastructure and a regulatory framework that adapts to the evolving landscape of financial innovation.

Índice

Challenging Beginnings for Innovative Banking Ventures

In August 2022, Lionel Danenberg‘s company received preliminary approval for a banking charter from the Idaho Department of Finance, marking a pivotal moment in his journey to establish an app-based payments bank for small-business commodity producers. However, his aspirations hit a roadblock when his request for a Federal Reserve master account was denied.

Concerns and Controversies Acerca de Federal Reserve’s denial of master accounts

Despite having a well-structured business plan that aimed to ensure safety and profitability, Danenberg’s hopes were dashed when the Federal Reserve Bank of San Francisco denied his master account request. The denial was based on concerns about the perceived risk associated with his novel business model, as well as potential vulnerabilities to money laundering and terrorism financing.

A Broader Trend of Denials

Danenberg’s experience is not isolated, as other innovative banks, including those in the cryptocurrency sector, have also faced denials for master accounts. This growing trend raises questions about the transparency and accountability of the Federal Reserve’s decision-making process.

Unveiling Transparency Challenges

The Unchecked Power of the Federal Reserve

Critics highlight the unique regulatory landscape surrounding banking, where institutions submit to the authority of the Federal Reserve and other regulators in exchange for access to essential infrastructure and potential bailouts. However, this arrangement lacks proper oversight, leading to concerns about arbitrary decisions and unchecked power.

Cryptocurrency Industry Under Scrutiny

The Federal Reserve’s denial of master accounts has particularly impacted the cryptocurrency industry, triggering speculation of a regulatory crackdown. Entrepreneurs, like Danenberg and others, feel the industry is being marginalized, resulting in limited access to basic banking services. The broader implications of this denial raise questions about how financial innovation is being assessed.

The Call for Reform and Transparency

Shaping the Future of Financial Innovation

The challenges faced by Danenberg and other entrepreneurs underscore the need for reform in the distribution of master accounts. The evolving landscape of financial innovation necessitates a transparent and accountable approach that ensures fair access to critical financial infrastructure.

Reimagining the Regulatory Landscape

As the financial sector evolves, the question of who gets access to the Federal Reserve’s infrastructure becomes increasingly important. Calls for greater transparency and clearer selection criteria resonate with those who believe the current regulatory framework needs to adapt to the changing dynamics of the financial industry.

In a world of continuous innovation, the lessons from Danenberg’s journey shed light on the need for a more inclusive and equitable approach to granting master accounts, fostering an environment where innovation can thrive while upholding financial stability.

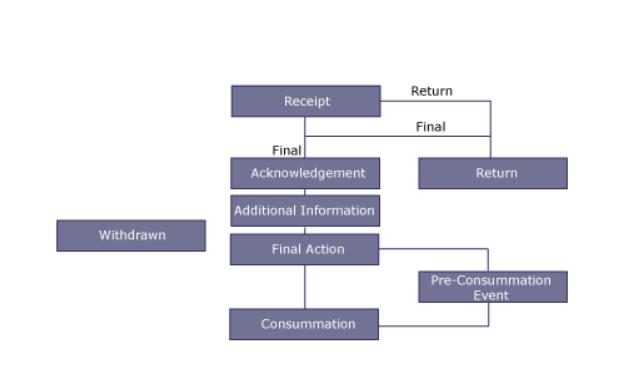

What is a FED Master Account?

A Master Account is the record of financial rights and obligations of an Account Holder and the Administrative Reserve Bank (or any other Reserve Bank maintaining a Master Account as permitted by Operating Circular 1) with respect to each other, where opening, intraday and closing balances are determined.

A Master Account is identified by a Primary nine-digit Routing Transit Number (RTN).

Who has access to FED Master Accounts?

While The Federal Reserve’s denial of master accounts is a serious problem for most players who try to apply, some “trusted” few have access to master accounts. The list is public and can be found on the FED’s website.

Who is behind the FED?

Federal Reserve’s denial of master accounts is the sole responsibility of the board.

The seven members of the Board of Governors of the Federal Reserve System are nominated by the President and confirmed by the Senate.

The Chair and the Vice Chair of the Board, as well as the Vice Chair for Supervision, are nominated by the President from among the members and are confirmed by the Senate. They serve a term of four years. A member’s term on the Board is not affected by his or her status as Chair or Vice Chair

Board Member Assignments – Board Committees

Committee on Board Affairs

Governor Jefferson, Chair and Oversight Governor for the Office of the COO

Vice Chair for Supervision Barr, Member

Committee on Consumer and Community Affairs

Governor Bowman, Chair and Oversight Governor for DCCA

Vice Chair for Supervision Barr, Member

Governor Cook, Member

Committee on Economic and Monetary Affairs

Governor Waller, Member

Governor Jefferson, Member

Committee on Financial Stability

Vice Chair for Supervision Barr, Chair and Oversight Governor for FS

Governor Cook, Member

Committee on Federal Reserve Bank Affairs

Governor Waller, Chair and Oversight Governor for RBOPS

Governor Cook, Member

Committee on Supervision and Regulation

Vice Chair for Supervision Barr, Chair and Oversight Governor for S&R

Governor Bowman, Member

Governor Jefferson, Member

Subcommittee on Smaller Regional and Community Banking

Governor Bowman, Chair

Governor Cook, Member

Governor Jefferson, Member

Committee on Payments, Clearing, and Settlement

Vice Chair for Supervision Barr, Chair

Governor Bowman, Member