What are the psychological benefits of the DCA Strategy? In this article we’ll explain it.

Índice

What is a DCA Strategy?

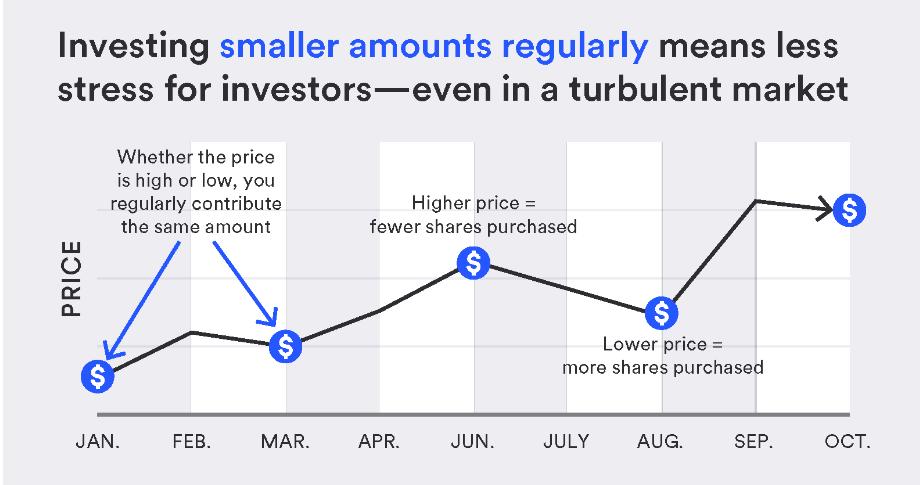

Dollar Cost Averaging (DCA) is a strategy that has been gaining popularity among investors over the past few years. The strategy involves investing a fixed amount of money at regular intervals in a particular asset or security, regardless of the market conditions.

DCA Strategy Example

In the graph below you can easily see how the recurring purchase leads to a growth of the portfolio over time while picking up the asset at different times.

Psychological Benefits of DCA-ing

A DCA Strategy is great for your psychology because it provides a sense of security and helps you sleep well at night.

With the DCA strategy, you are not at the mercy of the market, and you do not have to worry about missing out on profits. You invest your money in a disciplined manner, with a long-term perspective, and without worrying about short-term fluctuations.

This gives you peace of mind and allows you to focus on your life’s other aspects, without the stress of actively following the markets.

Reduce FOMO and Panic

One of the most significant psychological benefits of DCA is that it helps you stay away from FOMO (Fear Of Missing Out) and panic selling.

FOMO is a common phenomenon among investors, where they invest in an asset because they feel that they may miss out on potential gains. However, this can lead to impulsive decisions, causing investors to invest more money than they can afford to lose. Panic selling, on the other hand, occurs when investors sell their assets in a panic during market downturns.

With DCA, investors can avoid both FOMO and panic selling, as they invest a fixed amount of money at regular intervals, regardless of the market conditions.

A DCA Strategy Saves You Time

Not having enough time can be a major cause of stress and psychological illness. If you try to time the market with risky investment strategies you might be close to a burnout soon.

DCA saves a lot of time because it can be automated. Investors do not need to actively monitor the market, and they do not have to spend time analyzing charts and financial data. DCA is a passive investment strategy, and it is automated, making it an ideal choice for investors who do not have the time or the expertise to actively manage their investments.

Reduce Stress

DCA causes less stress than active trading because it is a passive and automated strategy. Active trading requires constant monitoring of the market, analysis of charts and financial data, and making quick and informed decisions. This can be stressful, and it can take a toll on an investor’s mental health. With DCA, investors can avoid this stress, as the strategy is automated, and there is no need for constant monitoring of the market.

Other than active trading, DCA gives you peace of mind because you don’t need to follow the markets actively. There is no need to check charts daily or follow financial news closely. The DCA strategy is like putting your investments on autopilot. You can focus on other aspects of your life while knowing that your investments are working for you.

Less Risk

DCA is less risky because there is far less chance for human error. Human emotions can cloud judgment, leading to impulsive investment decisions. With DCA, investors are not at the mercy of their emotions, and they invest a fixed amount of money at regular intervals, regardless of market conditions. This significantly reduces the chances of making impulsive decisions, leading to a lower risk of loss.

In conclusion, DCA is a passive investment strategy that provides psychological benefits to investors. It provides a sense of security, helps investors sleep well at night, and avoids FOMO and panic selling. It is an automated strategy that saves time and causes less stress than active trading. Investors do not need to follow the markets actively, and the chances of making impulsive decisions are significantly reduced, leading to a lower risk of loss.

What is a Bitcoin DCA Strategy?

The DCA strategy is particularly relevant in the case of Bitcoin investments. Bitcoin has been known to exhibit high volatility and unpredictability, making it difficult for investors to stay calm and don’t sell in a panic or buy in a rush.

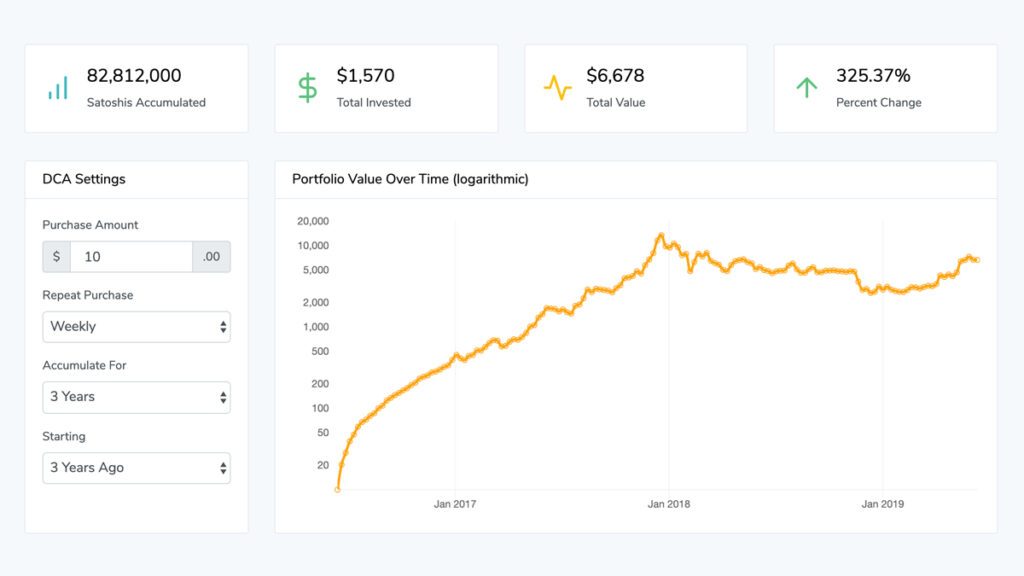

With a Bitcoin DCA Strategy you convert a fixed amount of fiat money into Bitcoin. This means you do regular purchases through a bitcoin exchange either manually or fully automated. While this strategy is great during bitcoin bear cycle, a lump-sum should always be considered to get initial exposure to Bitcoin.

As you can see by using a DCA calculator, the Estrategia del DCA works wonders with Bitcoin as you constantly grow your portfolio over time and protect your wealth from devaluation.

As Bitcoin continues to grow in popularity and becomes an important asset in the financial world, DCA investing in Bitcoin is an attractive option for investors. DCA allows investors to invest in Bitcoin in a disciplined and passive manner, providing psychological benefits while reducing the risks associated with investing in a volatile asset.

What Is The Best Crypto DCA Strategy?

At Señales DCA, we discuss the Bitcoin DCA Strategy extensively. On our program we also compare its performance to the suma global and value-averaging strategies.

The best crypto DCA Strategy is a bitcoin dca strategy since bitcoin is the only crypto asset that is worth to consider. Only bitcoin is a fully decentralized and censorship resistant crypto asset and has no second best.

Other crypto currencies are mere “projects” where founders and investors tend to dump on retail and exit scam.

The best dca strategy reddit suggests is to use the shortest timeframe i.e. hourly buys. If you want to dive deeper into the dca strategy and compare it with other strategies, feel free to join the DCA Signals community.

DCA Stock Strategy

Before the birth of bitcoin, people used the DCA stock strategy to purchase stocks they liked. For example if you had put $100 into Amazon stocks right at start and done so with a dca stock strategy for a longer time period, you’d be sitting on millions today.

Conclusión

In conclusion, the psychological benefits of the Estrategia DCA are clear. With its ability to reduce stress, save time, and provide a sense of security, DCA is an attractive investment option for those looking to invest in Bitcoin. Its automation and passive nature make it an excellent choice for those who do not have the time or expertise to actively manage their investments. As more investors begin to recognize the benefits of DCA investing, it is likely to become an increasingly popular investment strategy.