What is Value Averaging?

Value averaging, also known as dollar value averaging, is an investment method in which the amount invested in a certain asset is adjusted based on its market value and a predetermined growth path.

This strategy assists investors in maintaining a regular pace of growth in their portfolios.

Value averaging, as opposed to dollar-cost averaging, requires investors to buy more shares when prices are low and less shares when prices are high.

When compared to other systematic investment approaches, this strategy may result in greater long-term success.

Table of Contents

Introduction

In a world of ever-changing markets and investment strategies, the concept of Value Averaging Investing stands as a beacon of financial prudence and steady growth.

Unlike traditional investment approaches, Value Averaging offers a unique blend of discipline and flexibility, designed to help investors achieve their financial goals while navigating the uncertainties of the market.

In this article, we dive deep into the world of Value Averaging Investing, exploring its principles, strategies, and the myriad benefits it brings to those who embrace it.

How Value Averaging Investing Works

The main purpose of value averaging (VA) is to buy more stock when prices are falling and less stock when prices are increasing.

This also occurs with dollar-cost averaging, but the effect is less pronounced. Several independent studies have indicated that over long periods of time, value averaging can provide slightly better returns than dollar-cost averaging, while both roughly approximate market returns.

Dollar-cost averaging requires investors to make the same recurring investment. The only reason people acquire more shares when prices are low is because the shares are less expensive. Value averaging investing, on the other hand, allows investors to buy more shares because prices are lower, and the approach ensures that the majority of investments are spent on acquiring shares at lower prices.

Value averaging works by taking into account the current value of your portfolio, relative to your overall investment goal, to determine how much you need to invest each month.

So, if your portfolio is up and you’re ahead on your goal progress, then you’d adjust your monthly contribution down. On the other hand, if your portfolio’s value shrinks then you’d increase your contribution to making up the gap.

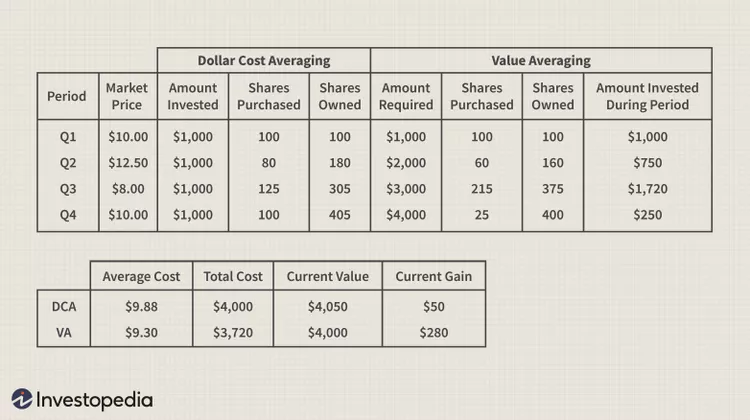

Below is an image showing the comparison between dollar cost averaging and value averaging investments.

Example of Value Averaging

Let’s consider an example of an investor named Sarah who is following the Value Averaging Investing model:

Sarah’s Value Averaging Plan:

Month 1:

- Sarah begins her Value Averaging strategy with an initial investment of $10,000.

- Her target for Month 1 is to have a portfolio value of $10,500, aiming for a 5% increase.

Month 2:

- At the end of Month 1, the value of her portfolio is $10,200, falling short of her target.

- To catch up, she invests an additional $1,000 in Month 2, bringing her total investment to $11,000.

- Her new target for Month 2 is to reach a portfolio value of $11,550, a 5% increase from the new total.

Month 3:

- Sarah’s portfolio performs well, and by the end of Month 2, it’s worth $11,600, exceeding her target.

- She does not make any additional investments in Month 3, allowing her portfolio to grow naturally.

Month 4:

- Market conditions are favorable, and her portfolio is now valued at $12,000 at the end of Month 3.

- Sarah’s target for Month 4 is to have a portfolio value of $12,600, aiming for a 5% increase.

Month 5:

- Unfortunately, the market experiences a downturn, and her portfolio is worth $12,400 at the end of Month 4, falling short of her target.

- To catch up again, she invests an additional $1,200 in Month 5, bringing her total investment to $13,600.

- Her new target for Month 5 is to reach a portfolio value of $14,280, a 5% increase from the new total.

Month 6:

- Market conditions stabilize, and her portfolio value reaches $14,400 at the end of Month 5, exceeding her target.

- She decides not to make any additional investments in Month 6, allowing her portfolio to continue growing.

Repeat:

- Sarah continues this Value Averaging process month by month, adjusting her contributions based on her portfolio’s performance and her predetermined targets.

This example illustrates how an investor like Sarah can use Value Averaging to work towards her long-term financial goals while navigating the ups and downs of the market.

A Table Outlining the Pros and Cons of Value Averaging Investing

This table provides a concise overview of the advantages and disadvantages of Value Averaging Investing, helping investors make informed decisions about whether this strategy aligns with their financial goals and risk tolerance.

| Pros of Value Averaging Investing | Cons of Value Averaging Investing |

|---|---|

| 1. Disciplined Investing: Helps maintain a disciplined approach to investing by requiring regular contributions. | 1. Complex Calculations: Requires continuous monitoring and adjustments, which can be complex and time-consuming. |

| 2. Mitigates Market Volatility: Reduces the impact of market volatility by buying more when prices are low and less when prices are high. | 2. Potential for Missed Opportunities: In rapidly rising markets, you may buy fewer shares than with lump sum investing. |

| 3. Risk Management: Offers risk management by allowing you to set predetermined targets for your investments. | 3. Emotional Challenges: Investors might still struggle with emotions during market downturns, impacting decision-making. |

| 4. Flexibility: Adaptable to various financial goals, including long-term wealth building and retirement planning. | 4. May Not Outperform Lump Sum: In some cases, lump-sum investing may outperform value averaging, especially in bull markets. |

| 5. Dollar-Cost Averaging Benefits: Combines the benefits of dollar-cost averaging with strategic adjustments for potential higher returns. | 5. Requires Steady Income: Dependent on a steady income stream to make regular contributions. |

| 6. Consistent Contributions: Encourages consistent contributions regardless of market conditions, promoting financial discipline. | 6. Initial Capital Required: Requires an initial capital investment to begin the value averaging process. |

| 7. Long-Term Growth: Suited for long-term investors looking to steadily grow their wealth over time. | 7. Learning Curve: New investors may need time to understand the mechanics and principles of value averaging. |

Frequently Asked Questions – FAQ

How does Value Average Investing differ from Dollar-Cost Averaging (DCA)?

While both VAI and DCA involve regular investments, VAI goes further by dynamically adjusting contributions to meet specific portfolio value targets. DCA involves fixed contributions at regular intervals, regardless of the portfolio’s performance.

Can anyone use Value Averaging Investing, or is it only for experienced investors?

VAI is suitable for investors of various experience levels. However, it does require an understanding of the mechanics and regular monitoring. New investors may benefit from studying the strategy before implementing it.

How often should I adjust my contributions in Value Averaging Investing?

The frequency of adjustments depends on your investment horizon and goals. Some investors choose to do it monthly, while others may opt for quarterly or annually. The key is to stay consistent with your approach.

Can Value Averaging Investing be automated?

Yes, you can automate VAI by setting up regular contributions and using investment platforms or tools that allow you to adjust targets automatically based on portfolio performance.