You want to get started with bitcoin but don’t know which strategy is right? In this article we explain the five most common and successful bitcoin strategies.

To navigate the world of Bitcoin effectively, understanding various bitcoin strategies is crucial.

The most battle tested Bitcoin strategies are: Buy and Hold, Trading, Dollar-Cost Averaging (DCA), Value Averaging (VA), and Lump Sum investing.

Each strategy caters to different risk profiles and investment objectives, offering unique ways to engage with the cryptocurrency.

Table of Contents

1. Buy and Hold: The Foundation of Bitcoin Strategies

The Buy and Hold strategy is the bedrock of many Bitcoin strategies, emphasizing a long-term perspective on investment.

Investors, or better ‘Savers’, who subscribe to this approach purchase Bitcoin and hold onto it for extended periods, regardless of short-term price fluctuations.

This strategy is rooted in the belief that Bitcoin’s value will appreciate over time, making it a store of value and a hedge against traditional financial systems.

| Advantages | Considerations |

|---|---|

| – Simplicity: Minimal active management required | – Requires patience during market downturns |

| – Long-term growth potential | – Psychological resilience in volatile markets |

| – Reduced exposure to short-term volatility |

The majority of Bitcoin experts agree that buy & hold is one of the easiest and most profitable bitcoin strategies.

However, since it requires time, you should lock in your allocation for at least four years. Most bitcoin experts have even longer time horizons of 20 years and more.

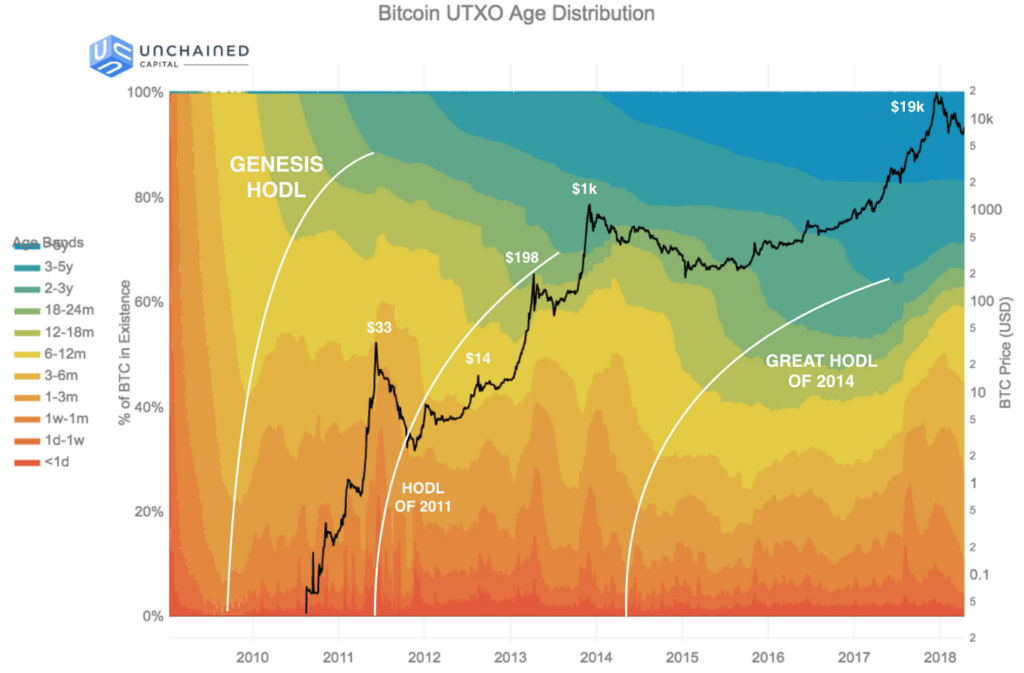

As you can see on the hodl wave chart below, an ever growing percentage of the bitcoin supply is not moving for five years or more suggesting the buy and hold strategy is applied.

2. Trading: Seizing the Bitcoin Markets

Trading is a dynamic strategy that involves buying and selling Bitcoin within shorter time frames to capitalize on price movements.

Traders employ various techniques such as technical analysis, chart patterns, and market indicators to make informed decisions.

However, most traders admit that most of the trading techniques are just as risky as going to the casino or playing poker. The difficulty to predict the market and future outcomes makes trading a strategy that is not fit for beginners.

For that reason, many bitcoin experts agree that trading is a bitcoin strategy which only very experienced and talented traders can make use of.

| Advantages | Considerations |

|---|---|

| – Potential for short-term gains | – High risk due to Bitcoin’s volatility |

| – Actively adapt to market trends | – Requires deep understanding of market dynamics |

| – Opportunity for frequent profits | – Emotional discipline to avoid impulsive trading |

Since bitcoin is the world’s scarcest and best performing asset, trading is seen as risky strategy by most experts. While it is true that seasoned traders may drive home big wins, the risks are not worth it for most investors.

Bitcoin is best understood as savings technology and a risk-off asset that is continuously gaining in popularity, adoption and therefore marketcapitalization.

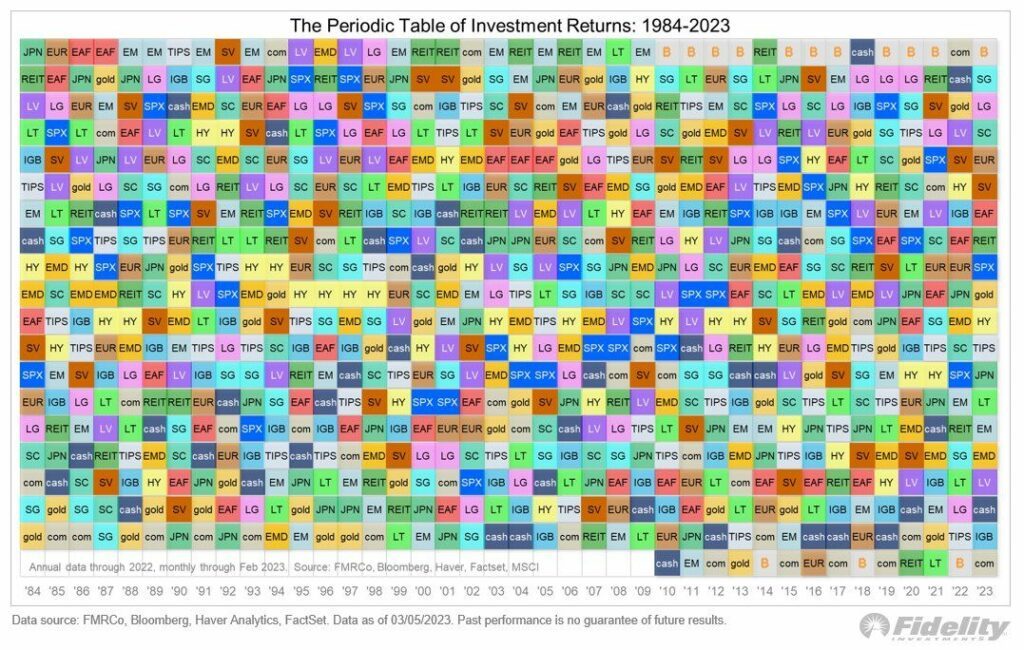

As you see in the graphic below, Bitcoin has become the best performing asset in recent history.

3. Dollar-Cost Averaging (DCA): Mitigating Volatility

Dollar-Cost Averaging (DCA) is a disciplined approach to Bitcoin investment. Investors allocate a fixed amount of funds at regular intervals, regardless of Bitcoin’s price. This strategy minimizes the impact of market volatility by buying more Bitcoin when prices are low and less when prices are high.

| Advantages | Considerations |

|---|---|

| – Reduces the impact of market timing | – Requires consistent commitment to investing |

| – Smoother entry into the market | – Potential to miss out on price dips |

| – Minimized emotional response to price changes | – Potential to accumulate less during bull markets |

4. Value Averaging (VA): Balancing Growth and Risk

Value Averaging (VA) combines elements of DCA and active portfolio management. Investors set a target portfolio value and adjust their investments based on whether the portfolio’s value has exceeded or fallen short of the target. This strategy aims to balance portfolio growth while navigating market fluctuations.

| Advantages | Considerations |

|---|---|

| – Balances investment growth with market changes | – Requires regular monitoring and adjustments |

| – Flexible approach to capitalize on market shifts | – Requires more active management than DCA |

| – Opportunity to buy more during market dips | – May be more suitable for experienced investors |

5. Lump Sum Investing: Capitalizing on Opportunities

Lump Sum investing involves deploying a significant amount of capital into Bitcoin at once. This strategy is suitable for investors who believe in Bitcoin’s potential and want immediate exposure to price movements. However, it’s crucial to conduct thorough research and risk assessment before implementing this approach.

| Advantages | Considerations |

|---|---|

| – Immediate exposure to Bitcoin’s potential | – Exposes to potential short-term price volatility |

| – Opportunity for substantial gains | – Requires careful timing and research |

| – Simplified approach for one-time investments | – Potential for regret in case of mistimed entry |

Incorporating Bitcoin Strategies into Your Portfolio

Incorporating various bitcoin strategies into your investment portfolio requires a well-defined understanding of your financial goals, risk tolerance, and market outlook. Here’s how you can utilize these strategies effectively:

- Diversification: Consider blending multiple strategies to diversify your approach. For instance, combine Buy and Hold with DCA to benefit from long-term potential while minimizing short-term volatility.

- Investment Horizon: Align your chosen strategy with your investment horizon. If you’re seeking quick gains, trading or Lump Sum investing might be more appropriate. If you’re focused on long-term wealth preservation, Buy and Hold or DCA could be better.

- Risk Management: Regardless of the strategy you choose, maintaining effective risk management is crucial. Allocate only what you can afford to lose, and avoid overexposing yourself to Bitcoin.

- Education: Continuously educate yourself about Bitcoin, the cryptocurrency market, and the evolving economic landscape. This knowledge will inform your decisions and help you adapt to changing circumstances.

- Flexibility: Markets are unpredictable, so be prepared to adjust your strategies when necessary. Having a flexible approach allows you to respond to unexpected developments.

Conclusion

Navigating the world of Bitcoin requires careful consideration of various investment strategies.

Whether you choose the steadfast Buy and Hold strategy, the dynamic approach of Trading, the disciplined DCA method, the balanced approach of Value Averaging, or the strategic Lump Sum investment, your decision should align with your financial goals and risk tolerance.

Each strategy offers unique benefits and challenges, so take the time to understand which strategy or combination suits you best. By integrating these strategies effectively, you can navigate the intricate landscape of Bitcoin and position yourself for potential success in the exciting realm of cryptocurrency investment.