Bitcoin investing while maintaining tax optimization strategies using Dollar-Cost Averaging (DCA) plans in the United States involve maximizing tax efficiency while complying with IRS regulations.

Table of Contents

Does one pay taxes on Bitcoin investing?

There is still a lot of ambiguity over Bitcoin’s taxation more than ten years after its launch. Although it was intended to be a tool for everyday transactions, it hasn’t yet taken off as a form of payment. In the meantime, it has gained popularity among traders and speculators looking to capitalize on its volatility.

Bitcoin investing has garnered significant attention in recent years as it represents a groundbreaking shift in the world of finance and investment. Born in the aftermath of the 2008 financial crisis, Bitcoin is a decentralized digital currency that operates on a technology called blockchain.

Its unique features, including limited supply and border-less nature, have made it a popular choice for investors seeking alternatives to traditional assets like stocks and bonds.

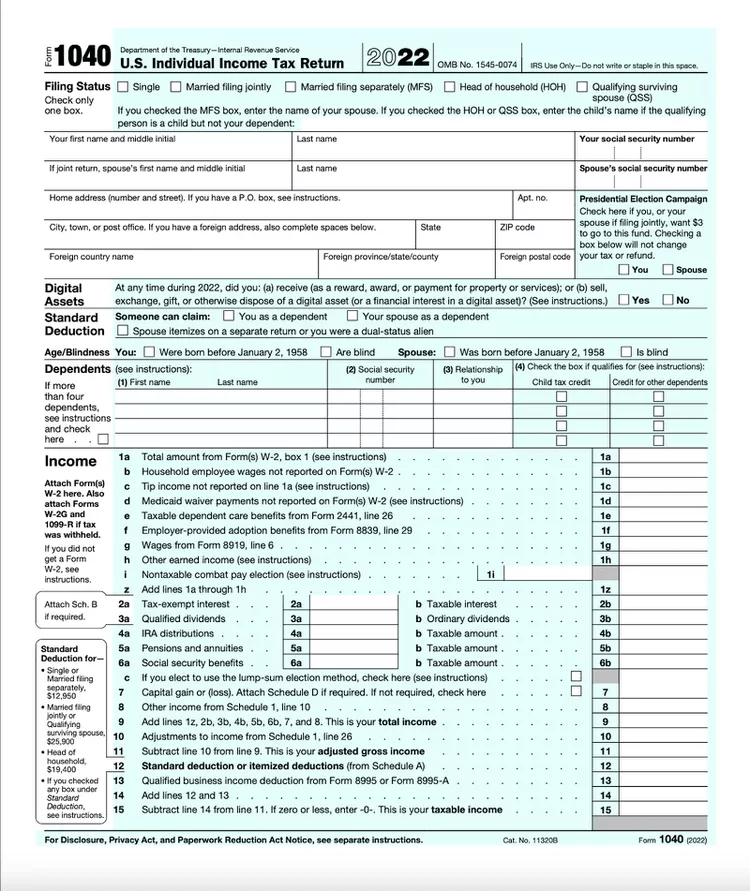

In its notice 2014-21, the Internal Revenue Service examined bitcoin transactions. According to the organization, bitcoin will be handled like real estate as an asset. In order to ascertain whether the taxpayer had any bitcoin transactions during the relevant tax year, the IRS started asking on its Form 1040 in 2020.

Wages, salaries, taxable interest, capital gains, pensions, Social Security payments, and other sources of income are all requested on the 1040 income section.

The new tax law abolished a number of deductions, including relocating expenditures for employment (with the exception of active-duty military personnel) and yet to be reimbursed employee expenses.

As of late, Bitcoin has been coupled with important global currencies like the US dollar and the Euro and is listed on exchanges making analysts consider bitcoin investing lucrative.

According to the IRS, virtual currency is a type of digital representation of value that is not a U.S. dollar or another type of currency. Whether it is Bitcoin, Ethereum, or lesser virtual currency is recognized as property, and conventional tax laws usually apply to these assets.

When virtual currency is used in a transaction, it is seen as a short-term gain or loss if it has been kept for one year or less. A gain or loss on virtual currency is regarded as long-term if it has been held for more than a year.

You must record any capital gains or losses on the sale of virtual currency when you sell it. The deductibility of the taxpayer’s capital losses is subject to limitations on the gains or losses recorded.

Bitcoin Tax Optimization Strategies for DCA

- Hold for Over a Year (Long-Term Capital Gains)

One of the most effective strategies to reduce taxes is to hold your Bitcoin investments for more than one year. This qualifies you for the long-term capital gains tax rates, which are typically lower than short-term rates in bitcoin investing. A lower capital gains tax rate applies to long-term gains. Depending on your income, these rates (0%, 15%, or 20% at the federal level) change.

The 3.8% Net Investment Income Tax on gains or other income may also apply to higher income people. Your ordinary income tax rate, which is typically a higher, less-favorable rate, is applied to short-term gains when it comes to bitcoin investing.

You may determine if you have a capital gain or loss when you sell your cryptocurrency by deducting your cost basis from the sale price. If the proceeds are higher than the cost basis, a capital gain has been realized. You will suffer a capital loss in your bitcoin investing if not. - Tax-Loss Harvesting

You must pay capital gains tax on the amount of profit you generated from selling your cryptocurrency if you did so at a profit. Some investors decide to sell some of their assets at a loss in order to lower their capital gains for a specific tax year and is what is known as Tax-loss harvesting.

The IRS now has a “wash sale rule” in place to stop investors from selling stocks at a loss and then buying them back again right away. If you purchase the same investment 30 days before or after selling it, you are not permitted to write off a stock’s capital loss.

The IRS is clear that only securities are covered by wash sale regulations. According to IRS advice, cryptocurrencies are considered property rather than securities. This indicates that as of right now, it’s likely that bitcoin investing exempt from the wash sale restriction.

To find tax-loss harvesting opportunities and reduce their capital gains, many investors decide to hold off until the end of the tax year. Because bitcoin investing is so volatile, investors frequently have many opportunities to benefit from tax-loss harvesting throughout the course of a year, making this strategy less than optimal.

Investors who frequently take advantage of these price drops can save money and have less stress at the end of the tax year enjoying the fruits of their bitcoin investing. - Use Tax-Efficient Investment Accounts

Consider using tax-advantaged accounts like Individual Retirement Accounts (IRAs) or 401(k)s if eligible. Contributions to traditional retirement accounts can be tax-deductible, and gains are tax-deferred until withdrawal. There are also self-directed IRAs that allow you to optimize tax in your bitcoin investing journey.

Investment selection and asset allocation are the most important factors that affect returns. The study found that minimizing the amount of taxes you pay also has a significant effect. There are two reasons for this: You lose the money you pay in taxes and two; you lose the growth that money could have generated if it were still invested.

Your after-tax returns matter more than your pre-tax returns. It’s those after-tax dollars, after all, that you’ll be spending now and in retirement. If you want to maximize your returns and keep more of your money, tax-efficient investing is a must. - Gifts and Inheritance

Bitcoin presents are given the same respect as conventional gifts. In 2022, the yearly gift tax exemption threshold was lower than $16,000 if you gave less than that amount of cryptocurrencies to another person in a single calendar year.

When you made the gift, you were not required to submit a gift tax return or use any of your $12.06 million lifetime federal gift tax exemption.

If you’re married, you can send up to $32,000 worth of cryptocurrencies to each recipient each year by combining your annual gift tax exemptions with those of your spouse.

However, you must submit an IRS Form 709 gift tax return if you give more than $16,000 to anyone in a single year (or $32,000 if your spouse chooses gift splitting). This is quite a good technique for spouses who are into bitcoin investing. - Tax-Loss Carry-forwards

Net capital gain or loss is the distinction between capital profits and losses. You may deduct up to $3,000 in net capital losses each year on your tax return. If your net capital losses are greater than $3,000, the excess is a capital loss carry-forward and can be taken into account when calculating your capital gain for the subsequent tax year.

As an illustration; if your net capital loss for the first tax year was $5,000, you would deduct $3,000 from that sum on your tax return for that year. You would use the remaining $2,000 to determine your net capital gain or loss for tax year 2 by carrying forward $2,000 from the prior year.

The $2,000 carry-forward and any other carry-forward from tax year 2 might both be used in tax year 3 if you also made a loss in tax year 2. The carry-forward method is a good way to optimize your taxes in bitcoin investing. - Staking and Lending Strategies

How U.S. regulators view staking and lending is the ultimate point of distinction. Staking doesn’t appear to pose a significant threat to the Securities and Exchange Commission (SEC)—at least not one greater than that posed by cryptocurrencies as a whole.

When lending platforms BlockFi and Celcius bragged about their combined $35 billion in deposits in September 2021, they incited a hornet’s nest of politicians who claimed they were providing unregistered securities.

No matter how those of us who are into bitcoin investing feel about it, we have to recognize that the negative attention that crypto lending is receiving makes it less desirable as a long-term passive investment plan.

Some investors choose to earn interest or rewards through staking or lending their Bitcoin holdings. It’s important to be aware that these activities may have tax implications, including potentially being treated as interest income. Consult with a tax professional to understand the tax treatment of your specific activities. - Keep Detailed Records

It’s crucial to maintain accurate financial records of all your cryptocurrency-related transactions. For reliable documentation of your activity, you should preserve records whenever you buy, sell, or mine cryptocurrency.

For both your own records and the filing of your tax returns, this information is crucial.Any income or capital gains from bitcoin trading, selling, or mining must be reported on your tax return. You might be able to disclose your costs and losses anyway. You could be required to submit the GST/HST if you exchange taxable goods or services for bitcoin. - Consult with a Tax Professional

Tax laws and regulations can change, and the IRS’s treatment of bitcoin is evolving. It’s advisable to consult with a tax professional or CPA who specializes in cryptocurrency taxation to ensure compliance and optimize your tax strategy based on your unique circumstances.

Conclusion

Remember that tax optimization should be just one aspect of your overall bitcoin investment strategy. While minimizing tax liability is important, it’s equally crucial to make sound investment decisions and manage risk effectively. Always consult with a qualified tax professional to ensure that your tax optimization strategies align with current tax laws and regulations.

Frequently Asked Questions – FAQ

What are the key tax considerations for Bitcoin DCA?

Some key tax considerations include capital gains taxes, holding periods, and tax reporting requirements. It’s essential to understand how these factors affect your tax liability before venturing into bitcoin investing.

Why is tax optimization important when using DCA for Bitcoin?

Tax optimization is crucial because each Bitcoin purchase or sale can have tax implications. By strategically managing these transactions, you can potentially minimize your tax liability and maximize your returns on your bitcoin investing journey.

Are there any specific tax rules for Bitcoin in the United States?

Yes, the IRS has specific guidelines for reporting and taxing Bitcoin transactions. It treats Bitcoin as property, subjecting it to capital gains tax when sold or exchanged. This makes bitcoin investing subject to tax obligations.

Do these strategies apply to other cryptocurrencies or just Bitcoin?

While these strategies are generally applicable to other cryptocurrencies, tax rules may vary depending on the jurisdiction and the specific cryptocurrency. Always consult a tax professional for guidance before doing any bitcoin investing.

Are there any risks associated with these tax optimization strategies?

The risks primarily involve changes in tax laws and regulations. Tax laws can evolve, potentially affecting the effectiveness of these strategies. Staying informed and adapting to new tax rules is essential in bitcoin investing.