You probably know how to backup your Bitcoin seed words. But what are multisignature wallets? In this comprehensive guide, we’ll dive deep into what multisig is, why it’s superior to traditional single-signature wallets, and how you can leverage this technology to safeguard your Bitcoin fortune.

Table of Contents

What is Multisignature (Multisig)?

At its core, multisignature is a method of securing Bitcoin that requires multiple private keys to approve a transaction.

Unlike traditional single-signature wallets where one key holds all the power, multisig distributes this control across multiple keys.

To better understand multisig, let’s break down its structure:

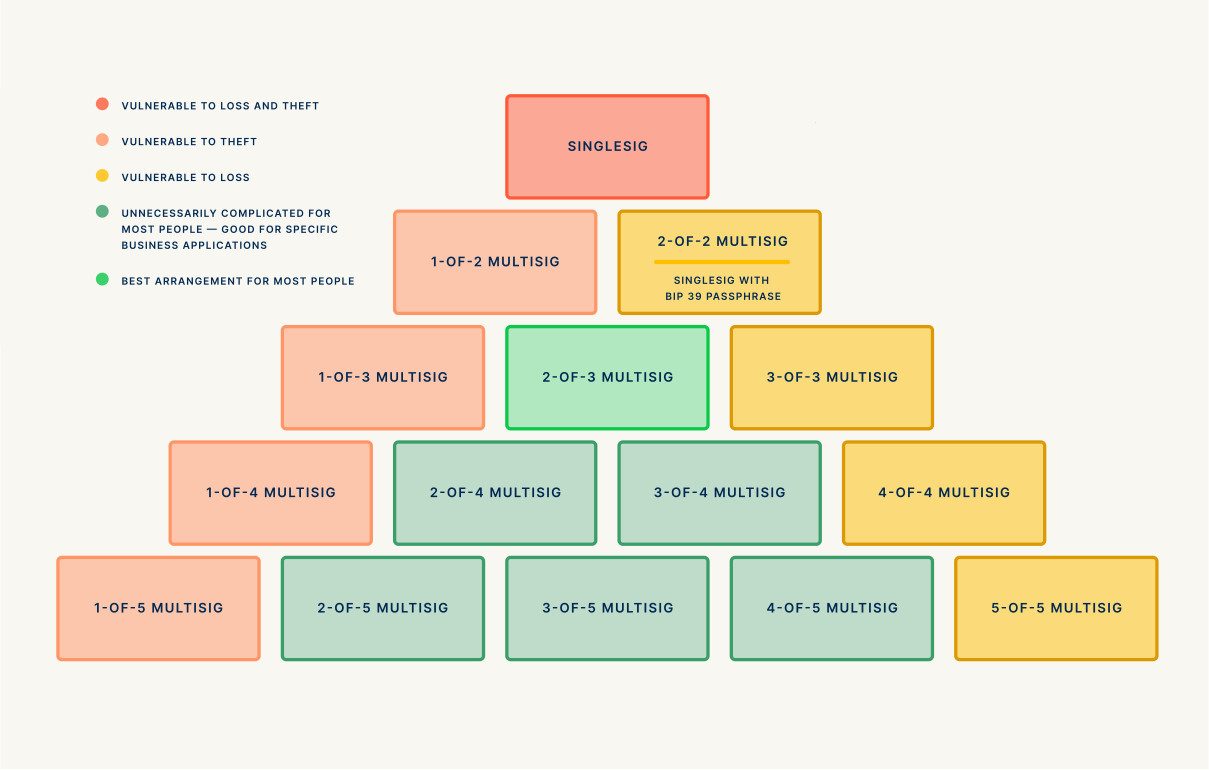

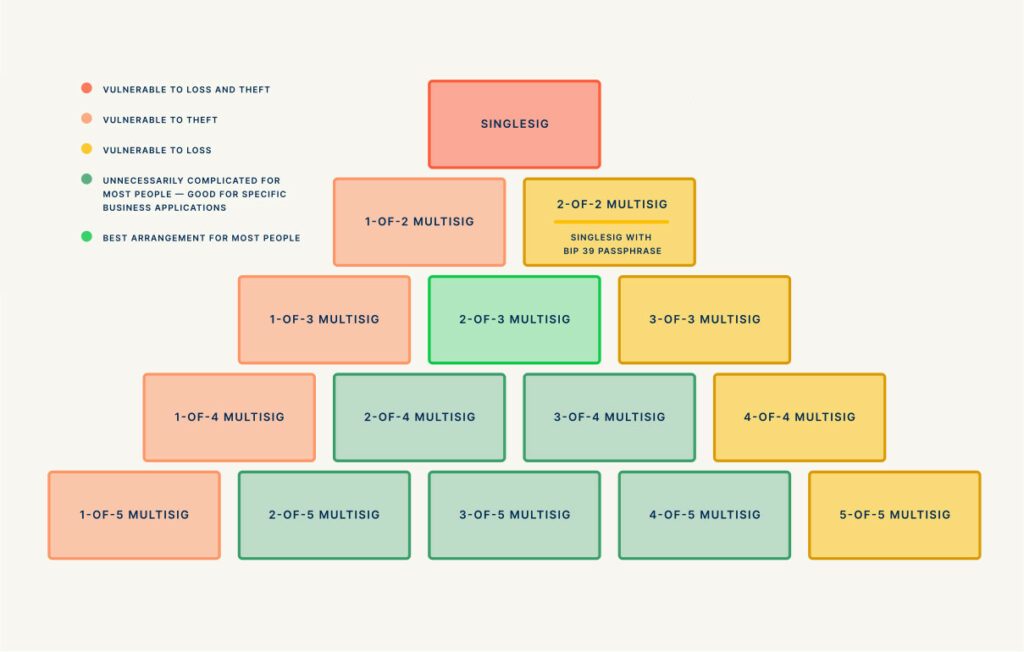

- M-of-N Quorum: This is the foundation of multisig. ‘M’ represents the number of signatures required to approve a transaction, while ‘N’ is the total number of keys in the setup.

- Most Common Setups:

- 2-of-3: Three keys exist, and any two are needed to move funds.

- 3-of-5: Five keys exist, and any three are required for transactions.

Think of multisig like a high-security vault in a bank. Instead of relying on a single key, it requires multiple keys held by different parties to open. This distributed control is what makes multisig so powerful and secure.

Why Choose Multisig Over Single-Signature Wallets?

To appreciate the benefits of multisig, let’s first understand the limitations of single-signature wallets:

Single-Signature Vulnerabilities:

- Single Point of Failure: If your one key is lost, stolen, or compromised, your entire Bitcoin holdings are at risk.

- No Backup Plan: Lose your key, and you lose access to your funds – potentially forever.

- Attractive Target: Thieves only need to compromise one key to gain full access.

Now, let’s explore how multisig addresses these issues:

- Enhanced Security

- Robust Backup Protection

- Theft Prevention

- Flexible Control

- Inheritance Planning

Deep Dive: How Multisig Works

To truly appreciate multisig, it’s essential to understand its mechanics:

- Key Generation

- Address Creation

- Transaction Signing

- Broadcasting

This process ensures that no single party has complete control over the funds, adding layers of security and flexibility to your Bitcoin storage.

Setting Up Your Multisig Wallet: DIY vs. Collaborative Custody

When it comes to implementing multisig, you have two primary options:

1. DIY Approach

For the tech-savvy Bitcoiner, setting up a multisig wallet independently can be a rewarding experience. Here’s how to get started:

Tools Needed:

- Hardware wallets (e.g., Trezor, Ledger, ColdCard)

- Multisig software (e.g., Sparrow Wallet, Electrum, Specter)

Steps:

a) Choose your preferred multisig software.

b) Generate keys on separate hardware wallets.

c) Use the software to combine these keys into a multisig wallet.

d) Securely back up all necessary information, including the wallet configuration file.

Pros:

- Complete control over your setup

- Maximum privacy

- Educational experience

Cons:

- Technical complexity

- Responsibility for all aspects of security and recovery

2. Collaborative Custody

For those seeking a balance between security and ease of use, collaborative custody solutions offer an attractive option. Companies like Unchained Capital provide 2-of-3 multisig setups where you control two keys, and they hold the third as a backup.

Steps:

a) Sign up with a reputable collaborative custody provider.

b) Generate two keys on your hardware wallets.

c) The provider generates the third key.

d) Set up the multisig wallet with guidance from the provider.

Pros:

- Expert support and guidance

- Simplified setup process

- Built-in backup and recovery options

Cons:

- Reliance on a third party (albeit with limited control)

- Potential privacy trade-offs

Best Practices for Multisig Security

Implementing multisig is just the first step. To maximize its benefits, follow these best practices:

- Geographic Distribution

- Use Hardware Wallets

- Secure Backups

- Regular Testing

- Educate Trusted Parties

- Consider Privacy

- Stay Updated

Multisig in Action: Real-World Use Cases

To better appreciate the versatility of multisig, let’s explore some practical applications:

- Personal Savings

- Business Treasury Management

- Inheritance Planning

- Escrow Services

- Cryptocurrency Exchanges

Potential Drawbacks and Considerations

While multisig offers significant advantages, it’s important to be aware of potential drawbacks:

- Complexity

- Higher Transaction Fees

- Recovery Challenges

- Compatibility Issues

- Increased Responsibility

Future of Multisig: Taproot and Beyond

The Bitcoin ecosystem is continually evolving, and multisig is no exception. The recent Taproot upgrade has opened up new possibilities for multisig:

- Enhanced Privacy

- Lower Fees

- Increased Flexibility

As these technologies mature, we can expect multisig to become even more powerful and user-friendly.

Conclusion: Embracing the Power of Multisig

In the world of Bitcoin, where you are truly your own bank, the importance of robust security cannot be overstated. Multisignature wallets offer a compelling solution, providing enhanced protection against theft, loss, and single points of failure.

While multisig does introduce additional complexity, the benefits far outweigh the challenges for those serious about securing their long-term Bitcoin holdings. Whether you choose a DIY approach or opt for a collaborative custody solution, implementing multisig can give you peace of mind knowing your digital fortune is protected by cutting-edge cryptographic security.

As you embark on your multisig journey, remember:

- Choose a setup that balances security with usability for your needs.

- Follow best practices for key management and backups.

- Regularly review and test your setup to ensure continued access.

- Stay informed about developments in Bitcoin security and multisig technology.

By embracing multisig, you’re not just securing your Bitcoin – you’re taking full advantage of the revolutionary financial sovereignty that Bitcoin offers. So take the plunge, set up your multisig wallet, and rest easy knowing your digital assets are protected by the gold standard in Bitcoin security.