The world of finance is often a volatile and unpredictable one, where fortunes can be made or lost in the blink of an eye. While some investors rely on traditional strategies, others take a more contrarian approach, betting against the market when they believe it is overvalued or headed for a crash. Michael Burry, the investor known as the “Big Short,” rose to fame by accurately forecasting the historic collapse of the housing market in 2008.

Table of Contents

The Market Can Stay Irrational Longer Than You Can Stay Solvent: The Rise and Fall of Two Investors

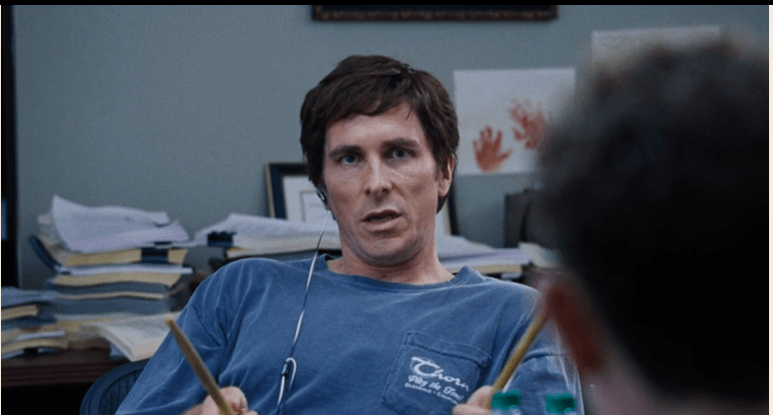

Two such investors, Michael Burry and Alexander Fordyce, made accurate predictions about market crashes, but their outcomes were vastly different. Burry, the real-life inspiration for the character portrayed by Christian Bale in the film “The Big Short,” made a fortune by shorting mortgage-backed securities before the 2008 financial crisis. Fordyce, on the other hand, went bankrupt after shorting East India Company stock in the 1770s.

What accounts for this stark contrast in outcomes? The key difference lies in their timing and risk management strategies.

Michael Burry: Timing and Patience

Michael Burry’s success can be attributed to his ability to identify market imbalances and then wait patiently for the market to correct itself. He meticulously analyzed data and financial reports, identifying the underlying issues that would lead to the crash of the subprime mortgage market.

Despite the skepticism of his peers, Michael Burry remained steadfast in his conviction and refused to be swayed by market fluctuations. He shorted mortgage-backed securities, betting against their value, and held his position until the market imploded in 2008. This bold move earned him a substantial profit, proving his foresight and risk-management prowess.

Alexander Fordyce: Timing and Liquidity

Alexander Fordyce’s story, on the other hand, highlights the importance of timing and liquidity. He correctly predicted the decline of the East India Company, recognizing the company’s unsustainable debt and mismanagement. However, his timing was off, and he was forced to close his short position prematurely due to liquidity constraints.

The East India Company’s stock price initially remained strong, despite Fordyce’s warnings. This led to investor pressure and forced him to sell his position at a loss. As the company’s financial situation worsened, its stock price plummeted, but it was too late for Fordyce to recoup his losses.

Lessons Learned

The contrasting stories of Michael Burry and Alexander Fordyce offer valuable insights for investors, particularly those considering contrarian strategies.

- Be patient and disciplined: Don’t be swayed by market fluctuations or short-term setbacks. Stick to your investment thesis and wait for the market to vindicate your analysis.

- Manage risk effectively: Consider your risk tolerance and ensure you have sufficient capital to weather market downturns. Don’t overextend yourself and risk losing more than you can afford.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversifying your investments can help mitigate risk and protect your portfolio from sudden market disruptions.

- Do your research: Before making any investment decisions, conduct thorough research and analysis. Understand the underlying fundamentals of the assets you’re considering and assess potential risks.

Conclusion

While betting against the market can be a lucrative strategy, it requires careful planning, patience, and risk management. Timing is crucial, and investors must be prepared to hold their positions for extended periods. Understanding the lessons of Michael Burry and Alexander Fordyce can help individuals make informed decisions and navigate the complexities of the financial markets.