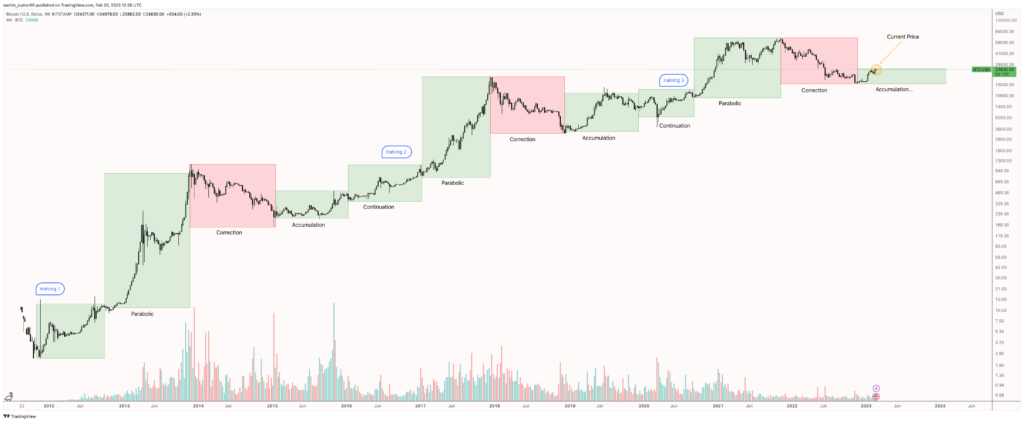

Bitcoin, the pioneering cryptocurrency, has seen a remarkable journey since its inception in 2009. Throughout its history, there have been several bitcoin market cycles, each marked by distinct phases of growth, consolidation, and correction.

Table of Contents

What is the Bitcoin Market Cycle?

The bitcoin market cycle is the cyclical pattern of price behavior, characterized by alternating periods of price appreciation and depreciation, in the bitcoin market. This cycle is the consequence of the beliefs and behaviors of market participants, such as buying and selling, and it is influenced by a number of variables, such as market mood, legislative changes, technical advancements, and the state of the overall economy.

A four-year cycle has historically been seen for the bitcoin market in relation to the typically four-year-long bitcoin halving events. The bitcoin payment miners earn for creating new blocks and validating transactions is reduced by 50% during a halving event; as a result, the supply of bitcoin continues to grow, albeit more slowly. If demand for bitcoin stays the same or grows following a halving, the result might be a sharp spike in price.

What are the Bitcoin Market Cycle Phases?

Accumulation

It occurs when prices are low but there are tinier indicators of increase. This stage marks the window of greatest financial opportunity as purchasers amass cheaper bitcoin.

Typically, the bitcoin market is in a gloomy mood, with prices oscillating in a narrow range and volume being low.

Continuation

Price is still climbing toward all-time high. This has traditionally been a halving event, accompanied by dwindling exchange reserves as purchasers snatched up supply in an effort to lock in rising prices ahead of new all-time highs in the bitcoin market.

Parabolic

When the price surpasses the previous record high, price movement will begin to surge exponentially upward, bringing the price to a new record high that significantly outperforms the old one. This stage is very erratic, with sharp price spikes and sharp corrections of the bitcoin market.

As some investors lock in healthy profits, sell volume increases, but many bitcoin market participants will keep purchasing because they think the bull market has more room to run. Given that the purchase and sell volumes start to balance against a background of overconfidence, price volatility is consequently modest. Many investors would now notice that Extreme Greed was flashing on the Fear & Greed Index.

Correction

This is the time when the market will see a significant downward correction after the euphoria of the Parabolic phase. Previous bear markets have produced 80% or more draw-downs from the peak and around a year of downward price movement. In the most recent instance, the cost decreased from an all-time high of $69,000 (in November 2021) to $15,476 (in November 2022).

Telling Signs in Historical Bitcoin Cycle Patterns

The small amount of bitcoin stored in exchange wallets indicates that investors are waiting for higher prices and are anticipating a new all-time high. This HODLing reduces the supply (even more so during a time of high demand), and as can be seen below, this has a significant impact on pricing.

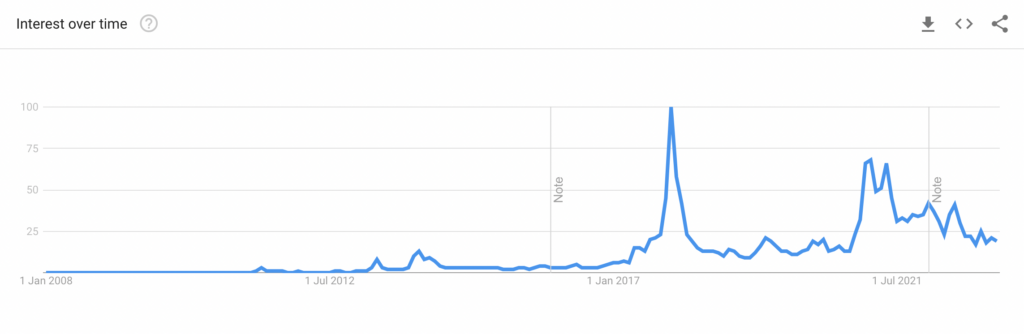

Measuring the Cycle with New Interest in Bitcoin

Google search volume data shows that the peak in interest in bitcoin coincided with a bull market run-up to an all-time high in December 2017. Since then, the volume of searches for “Bitcoin” hasn’t matched that of the 2017 bull run, according to Google trends.

But since then, general interest in cryptocurrencies has increased. Google searches for “crypto” peaked during the 2021 bull run; today, focus is on the entire ecosystem, which has seen a significant transformation from the days of bitcoin domination.

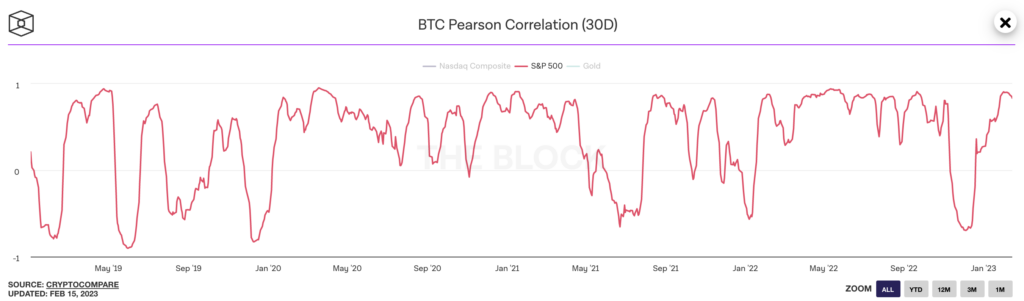

Macro & Bitcoin Correlation

It is generally positive that there is a correlation between bitcoin and the S&P 500. In other words, the S&P 500 and bitcoin values typically go up and down simultaneously. They do not, however, always follow one another, and even when they do, it is not necessarily with equal force or a strong association.

The favorable association between bitcoin and the S&P 500 has been apparent recently as the cryptocurrency market has become more mainstream and institutional investors have entered the ecosystem. The S&P 500’s average annual correlation to bitcoin from 2020 to 2022 was 0.51, 0.43, and 0.53 in that order, according to coefficient readings taken on the first weekday of each month. Using 2022 as an example, the benchmark index increased by 5.1% for every 10% increase in BTC.

The link between the bitcoin market and the S&P 500 can be influenced by a number of factors, including macroeconomic events, geopolitical tensions, and regulatory developments. It is crucial to keep in mind that correlation can change over time.

Mainstream Adoption of Bitcoin

The curve for mainstream bitcoin adoption has been steep. A small portion of the $164 billion that will be traded on Binance in January 2023, more than $11 billion worth of BTC was traded on Binance in January 2018. Over this time, the bitcoin market has gained the trust of an expanding group of retail and, more importantly, institutional investors, including public companies. For example, Tesla held $2.48 billion in BTC in the first quarter of 2021, and Microstrategy held 130k BTC as of January 2023, or 0.6% of the total supply of BTC, according to CoinGecko.

Only time will tell how widely used bitcoin and cryptocurrencies become in the future. Large-scale damaging events in the cryptocurrency ecosystem, like the FTX crash, have exposed a lack of regulatory oversight even while institutional interest has surged along with a rising retail base.

Many investors are hesitant to invest in the cryptocurrency market since there is no clear legal structure in place. However, governments throughout the world are stepping up their regulatory efforts, which should give cryptocurrency the credibility many investors are waiting for before investing.

In addition to investors, some nations support bitcoin. El Salvador became the first nation in the world to accept bitcoin as legal money in June 2021. The nation’s legislature passed a law requiring companies to accept bitcoin as payment for goods and services in addition to the US dollar, the country’s legal currency. If additional nations adopted similar policies, widespread acceptance would increase and make bitcoin a very alluring investment opportunity.

Historical Bitcoin Halving Market Cycle

The Role of Halving Events

One unique aspect of bitcoin’s market cycle is the occurrence of halving events, which take place approximately every four years. During a halving event, the number of new bitcoins mined per block is cut in half, reducing the rate at which new bitcoins enter circulation. This has significant implications for the supply and demand dynamics of bitcoin.

Pre-Halving Rally

Leading up to a halving event, there is often a pre-halving rally. Speculation about reduced supply in the future and the potential for increased demand can drive up bitcoin market prices.

Post-Halving Consolidation

After the halving event, the bitcoin market typically enters a consolidation phase. This phase can last for several months, as the market absorbs the impact of reduced mining rewards. Prices may fluctuate, but they often stabilize during this time.

Conclusion

In conclusion, the bitcoin historical market cycle is a complex and dynamic process that has repeated itself over the years. Understanding the phases of bull and bear markets, as well as the impact of halving events, can help investors make informed decisions in the world of cryptocurrency. As with any investment, it’s crucial to conduct thorough research, diversify your portfolio, and consider your risk tolerance when dealing with bitcoin or any other cryptocurrency.

Frequently Asked Questions – FAQ

Is bitcoin a good investment?

Bitcoin can be a potentially rewarding long-term investment, but it comes with risks due to its volatility. It’s crucial to do your research and consider your risk tolerance before investing.

What causes bitcoin’s market cycles?

Market cycles in bitcoin are primarily driven by factors such as supply and demand dynamics, investor sentiment, and external events like regulatory changes and economic crises.

When is the next bitcoin halving?

Bitcoin halving events occur approximately every four years. The most recent one took place in 2020, so the next halving is expected around March 2024.

How can I mitigate risks during a bear market?

Diversifying your investment portfolio, setting stop-loss orders, and having a long-term investment strategy can help mitigate risks during a bear market.

What is the best time to buy bitcoin?

The “best” time to buy bitcoin depends on your investment goals and risk tolerance. Some investors prefer to buy during bear markets when prices are lower, while others enter during bull markets.