Investing can be an intimidating endeavor for many individuals, especially those who lack a deep understanding of financial markets and investment strategies. Having dollar cost averaging explained in simple terms can help you to make better decisions when it comes to growing a portfolio. Dollar-cost averaging (DCA) presents a straightforward and beginner-friendly approach to investing.

In this article, we will delve into the definition of dollar-cost averaging and explain what it is, how it works, and why it can be an effective investment strategy. Let’s get started.

Key takeaways

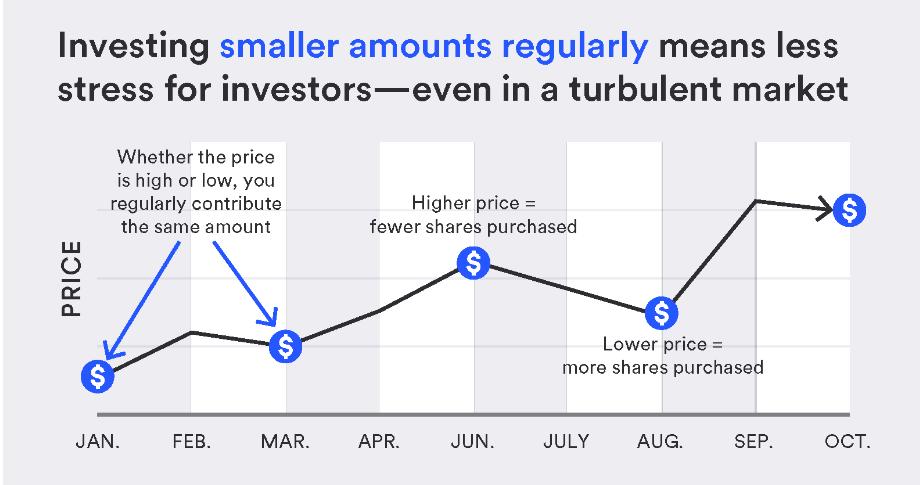

- Dollar-cost averaging (DCA) simply means to invest equal amounts of money at regular intervals.

- Employing dollar-cost averaging can help mitigate the influence of price fluctuations and lead to a reduced average cost per share.

- Through purchasing the asset regularly in both rising and falling markets, investors acquire more shares (or pieces of the asset) when prices are lower and fewer shares when prices are higher.

- The objective of dollar-cost averaging is to avoid making a large lump sum investment at a potentially higher price due to bad timing.

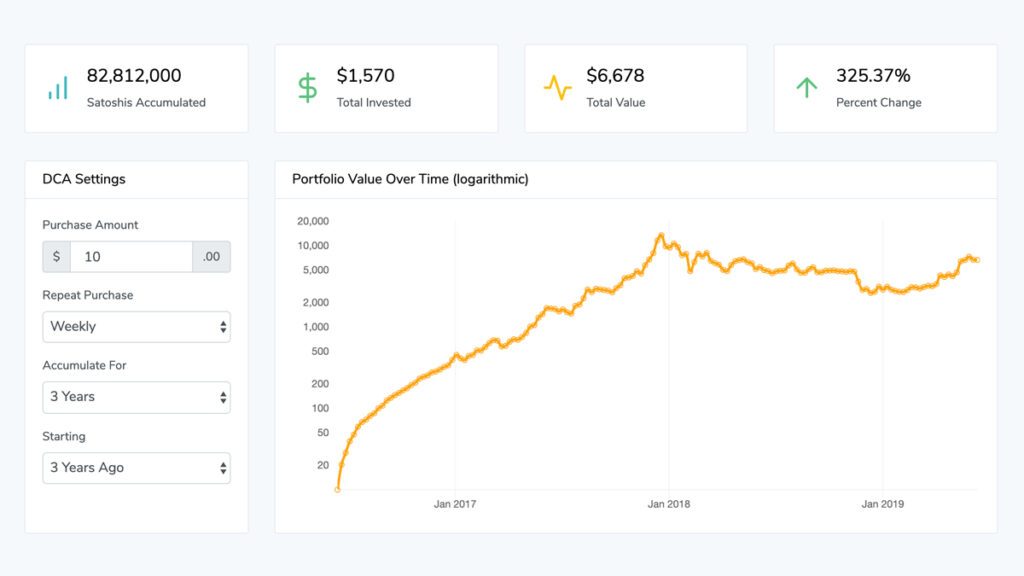

- Dollar-cost averaging has been proven a successful strategy to grow a portfolio over the long-term with pristine saving assets such as Bitcoin.

Table of Contents

Dollar Cost Averaging Definition

Dollar cost averaging (DCA) is an investment strategy that aims to apply value investing principles to regular investment. The term was first coined by Benjamin Graham in his book The Intelligent Investor. Graham writes that dollar cost averaging “means simply that the practitioner invests in common stocks the same number of dollars each month or each quarter. In this way he buys more shares when the market is low than when it is high, and he is likely to end up with a satisfactory overall price for all his holdings.”

Understanding Dollar Cost Averaging

Dollar-cost averaging is an investment strategy that involves spreading out investments over regular intervals, regardless of the current market conditions.

Instead of trying to time the market or making lump-sum investments, DCA investors consistently invest fixed amounts at predetermined intervals, such as weekly or monthly. This approach aims to minimize the impact of market volatility by averaging the cost of acquiring assets over time.

The Mechanics of Dollar Cost Averaging

Let’s illustrate dollar-cost averaging with a simple example. Imagine Jane, a beginner investor, decides to invest $100 in a particular stock every month for a year, regardless of whether the stock’s price is high or low. In month one, the stock may be trading at $10 per share, so she buys 10 shares. In month two, the stock price drops to $8, and she purchases 12.5 shares. In month three, the stock rises to $12.5, and she buys 8 shares. Over the year, Jane has invested a total of $1,200 and accumulated 30.5 shares of the stock.

Advantages of Dollar Cost Averaging

- Reducing the Impact of Market Volatility: Since DCA spreads investments over time, it reduces the risk associated with investing large sums during market peaks, which is a common concern for novice investors. By avoiding large one-time investments, DCA provides a cushion against severe market downturns.

- Eliminating the Need for Market Timing: Market timing is challenging even for experienced investors. DCA frees investors from making precise predictions about market movements. Instead, it encourages a disciplined and regular investment approach.

- Emotional Discipline: DCA promotes emotional discipline by detaching investors from day-to-day market fluctuations. Investors may be less likely to panic-sell during market downturns if they have a long-term perspective and maintain consistent investments.

- Lowering the Average Cost: The strategy ensures that more shares are purchased when prices are low and fewer when prices are high. This leads to a lower average cost per share over time, increasing the potential for higher returns in the long run.

- Ease of Implementation: Dollar-cost averaging is a straightforward strategy that is accessible to anyone, regardless of their investment knowledge. It can be easily set up through various investment platforms, making it a great option for beginners.

Dollar Cost Averaging Example

Let’s walk through an example of dollar-cost averaging with Bitcoin:

Suppose you are interested in investing in Bitcoin over the course of six months using the dollar-cost averaging strategy. You have $1,000 to invest each month, and the Bitcoin price at the beginning of each month is as follows:

Month 1 (June): Bitcoin price = $35,000 Month 2 (July): Bitcoin price = $30,000 Month 3 (August): Bitcoin price = $28,000 Month 4 (September): Bitcoin price = $32,000 Month 5 (October): Bitcoin price = $40,000 Month 6 (November): Bitcoin price = $45,000

Now, let’s see how your investment would unfold with dollar-cost averaging:

- June: You invest $1,000 at a Bitcoin price of $35,000. You can purchase approximately 0.0286 BTC.

- July: You invest another $1,000, but the Bitcoin price has dropped to $30,000. With this investment, you can buy approximately 0.0333 BTC.

- August: You invest $1,000 again, and the Bitcoin price falls further to $28,000. Now, you can purchase approximately 0.0357 BTC.

- September: Once more, you invest $1,000, and the Bitcoin price rises to $32,000. This time, you can buy approximately 0.0313 BTC.

- October: Your $1,000 investment coincides with a higher Bitcoin price of $40,000. You can acquire approximately 0.0250 BTC.

- November: For the last month of your investment plan, you invest $1,000, and the Bitcoin price climbs to $45,000. This time, you can buy approximately 0.0222 BTC.

Now, let’s calculate the total BTC accumulated and the average cost per Bitcoin:

Total BTC accumulated = 0.0286 + 0.0333 + 0.0357 + 0.0313 + 0.0250 + 0.0222 ≈ 0.1761 BTC

Total amount invested = $1,000 x 6 = $6,000

Average cost per Bitcoin = $6,000 ÷ 0.1761 BTC ≈ $34,092

With dollar-cost averaging, you accumulated approximately 0.1761 BTC at an average cost of around $34,092. Even though the Bitcoin price experienced fluctuations during the six months, this strategy allowed you to acquire more Bitcoin when the price was lower and less when it was higher, potentially resulting in a lower average cost compared to a single lump sum investment.

Dollar Cost Averaging For Crypto

Dollar cost averaging also makes sense when it comes to crypto investing such as building a bitcoin portfolio. Here are five ways in which DCA helps your bitcoin strategy:

- Mitigates Market Timing Risks: Bitcoin’s price is often volatile, making it challenging to time the market perfectly. DCA helps reduce the risk of making poor investment decisions by spreading your purchases over time, regardless of short-term price fluctuations.

- Smooth Entry into Bitcoin: For newcomers to the Bitcoin market, DCA provides a gradual and less overwhelming way to enter the space. It allows you to start investing with smaller amounts and avoids the pressure of trying to find the best entry point.

- Averages Out Price Volatility: Bitcoin’s value can experience significant ups and downs, but DCA helps to smooth out these fluctuations. By buying at different price levels over time, your average cost per Bitcoin becomes more stable.

- Disciplined Investing Approach: DCA instills a disciplined approach to investing in Bitcoin. Committing to regular investments helps you stay focused on your long-term goals, reducing the influence of emotions during times of market volatility.

- Potential for Lower Average Cost: With DCA, you can buy more Bitcoins when the price is low and fewer when it’s high. This strategy may lead to a lower average cost per Bitcoin compared to making a single lump sum investment at an uncertain price point.

Potential Limitations

While dollar-cost averaging is a widely praised strategy, it’s essential to be aware of its limitations:

- Potential Missed Opportunities: In rapidly rising markets, DCA may result in missed opportunities for significant gains. Since investments are spread over time, the full benefit of a market upswing may not be realized.

- Transaction Costs: Frequent investing can lead to higher transaction costs, especially for investors with high-frequency trading accounts.

- Bitcoin could break out and gain in value exponentially. While it is hard to forecast the bitcoin price, the past has shown that Bitcoin tends to explode every now and then. Many experts believe that a so-called “super-cycle” (Bitcoin shoots up exponentially) can happen any time.

Conclusion

Dollar-cost averaging for dummies offers an accessible and effective entry point into the world of investing. This straightforward strategy helps investors navigate the complexities of financial markets without requiring in-depth knowledge or expertise. By mitigating the effects of market volatility, removing the need for market timing, and promoting discipline, DCA can help beginners build wealth and achieve their long-term financial goals. While it may not guarantee astronomical returns, its consistency and simplicity make it a valuable tool for those looking to grow their wealth steadily over time. Remember, investing always carries inherent risks, and it’s essential to consult with a financial advisor to tailor the best strategy for your individual needs and circumstances.

Dollar Cost Averaging explained for dummies (ELI5)

Imagine you have a big jar, and every week, your mom or dad puts some money into the jar. They do this every week, no matter if the money they put in is a lot or a little. They just keep adding money regularly.

Now, let’s pretend this jar is like a magic piggy bank that buys small pieces of a special toy you really want. Some days, the toy pieces might be expensive, and other days they might be cheaper. But because your mom or dad keeps putting money in the jar every week, sometimes they buy more pieces when they are cheap, and other times they buy fewer pieces when they are expensive.

The cool thing is that over time, you start to collect more and more pieces of the toy. Some weeks you might get a lot of pieces, and other weeks you might get a few. But it doesn’t matter because your mom or dad keeps putting money in the jar every week, and the magic piggy bank keeps buying pieces of the toy.

By doing this, you get to have many toy pieces without worrying too much about how much they cost each time. This way, you can still get a lot of pieces even if the toy is sometimes very expensive.

Dollar-cost averaging is like your mom or dad’s jar. It’s a simple way for grown-ups to save money and invest it in things they want, like toys or even special grown-up things. Instead of trying to buy everything all at once, they put a little bit of money regularly, and over time, they get to have what they want without worrying too much about the ups and downs of the prices. It’s a smart way to make your money grow slowly but steadily!

Frequently Asked Question – FAQ

What is dollar-cost averaging?

Dollar-cost averaging (DCA) is an investment strategy that involves investing equal amounts of money at regular intervals, regardless of the current market conditions.

How does dollar-cost averaging work?

Instead of trying to time the market or making lump-sum investments, DCA investors consistently invest fixed amounts at predetermined intervals, such as weekly or monthly. This approach aims to minimize the impact of market volatility by averaging the cost of acquiring assets over time.

Can dollar-cost averaging be applied to cryptocurrencies?

Yes, dollar-cost averaging can be a beneficial strategy for investing in cryptocurrencies like Bitcoin. It helps mitigate the risks associated with market timing and smooths out price volatility.

What are the potential limitations of dollar-cost averaging?

Potential Missed Opportunities in rapidly rising markets

Transaction Costs for frequent investing

Bitcoin’s potential for exponential growth

Is dollar-cost averaging a guarantee of high returns?

No, dollar-cost averaging does not guarantee high returns. It is a long-term strategy that focuses on steady and consistent growth over time. However, it cannot predict or guarantee market outcomes.