In the wake of the COVID-19 pandemic, investors worldwide have faced unprecedented challenges and opportunities. This is a comprehensive analysis of the performance of the top six best-performing asset classes in history since the pandemic, focusing on how an investor utilizing the DCA $100 strategy would fare in each asset class.

DCA $100 strategy involves investing a fixed amount of $100 into chosen assets at regular intervals, regardless of market conditions. This systematic approach helps investors benefit from market fluctuations by purchasing more shares when prices are low and fewer shares when prices are high. While DCA does not guarantee profits, it minimizes the impact of market volatility on investment returns over time.

Table of Contents

Asset Classes in the DCA $100 Strategy Under Analysis

- Stocks: Historically, stocks have provided substantial returns over the long term, albeit with higher volatility. Major stock indices, such as the S&P 500 and the Dow Jones Industrial Average, witnessed significant fluctuations during the pandemic, but have since rebounded to new highs.

- Bonds: Bonds are considered safer investments compared to stocks, offering fixed interest payments and capital preservation. Amidst economic uncertainties, government bonds have served as a haven for investors seeking stability and income.

- Real Estate: The real estate market experienced mixed trends during the pandemic, with residential properties witnessing increased demand due to remote work trends, while commercial properties faced challenges amidst lockdowns and social distancing measures.

- Commodities: Commodities, including oil, gold, and agricultural products, exhibited heightened volatility during the pandemic. While demand for certain commodities fluctuated, others experienced supply chain disruptions, impacting prices.

- Precious Metals: Gold and silver, regarded as safe-haven assets, experienced heightened demand during periods of economic turmoil. Investors turned to precious metals as a hedge against inflation and currency devaluation.

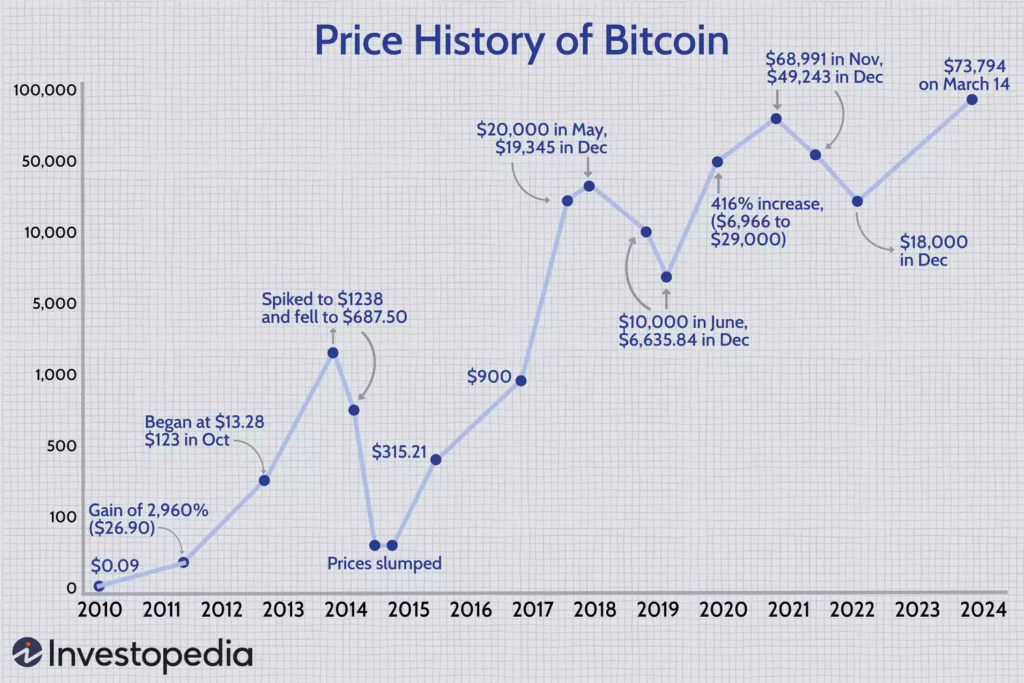

- Digital Currencies: Digital currencies, such as Bitcoin and Ethereum, gained mainstream acceptance and witnessed unprecedented price surges post-pandemic. The decentralized nature of digital currencies appealed to investors seeking alternatives to traditional financial systems.

DCA $100 Strategy into Each Asset Class

Stocks: If you had using the DCA $100 strategy monthly into a diversified portfolio of blue-chip stocks since the start of the pandemic, your investment would have grown significantly. The S&P 500, for example, has seen a return of over 30% since the start of 2020.

However, the exact returns would depend on the specific stocks chosen and the timing of the investments. This is because the stock market is subject to fluctuations based on a variety of factors including economic indicators, corporate earnings reports, geopolitical events, and others.

- Apple Inc. (AAPL): Implementing the DCA $100 strategy into Apple stock would have been beneficial, considering its resilience and growth trajectory. As of March 2024, Apple has demonstrated consistent revenue and profit growth, driven by its diverse product portfolio and services segment.

- Microsoft Corporation (MSFT): Implementing the DCA $100 strategy into Microsoft stock would have been rewarding, given its steady revenue streams from cloud services, software products, and hardware devices. Microsoft’s market capitalization has soared in recent years, making it a staple in many investment portfolios.

- Amazon.com Inc. (AMZN): Despite occasional volatility,implementing the DCA $100 strategy into Amazon stock would have been lucrative due to its dominant position in e-commerce, cloud computing, and digital streaming services. Amazon’s stock price has appreciated significantly since the pandemic, fueled by increased online shopping and cloud adoption.

Bonds: By implementing the DCA $100 strategy monthly into government bonds would have provided stable returns, albeit with lower yields compared to other asset classes. The exact returns would depend on the specific bonds chosen and the timing of the investments.

Bonds are generally considered lower risk than stocks, and they can provide a steady stream of income through interest payments. However, the return on bonds can be affected by factors such as changes in interest rates, inflation, and the creditworthiness of the issuer. Over the past decade, the average annual return for bonds has been around 3-5%.

- 10-Year Treasury Note: DCA $100 into 10-year Treasury notes would have offered steady returns, with yields hovering around 2% to 3% annually since the pandemic. Despite low yields, these bonds provide diversification benefits and act as a hedge against equity market volatility.

- 30-Year Treasury Bond: Implementing the DCA $100 strategy into longer-term Treasury bonds would have provided slightly higher yields, albeit with increased interest rate risk. The 30-year Treasury bond serves as a benchmark for long-term interest rates and is favored by income-seeking investors.

Real Estate: Implementing the DCA $100 strategy into real estate investment trusts (REITs) or real estate crowdfunding platforms since the start of the pandemic, your investment would have grown. For instance, Groundfloor, a real estate investing platform, reported returns of around 10% on some of its short-term loans. Real estate can provide both income (through rental payments) and capital appreciation.

Commodities: Through implementing the DCA $100 strategy into commodity index funds or exchange-traded funds (ETFs) would have allowed you to capitalize on commodity price movements over time. For instance, the Bloomberg Commodities Spot Index, a measure of 22 raw material prices, is up 78% from the March 2020 low when the pandemic first hit.

Precious Metals: If you had been implementing the DCA $100 strategy into gold or silver bullion or ETFs since the start of the pandemic, your investment would have grown. For instance, gold prices rose by 7.6% while the stock market sank 19.8% during the early stages of the pandemic. Precious metals can serve as a hedge against inflation and currency devaluation, preserving purchasing power in the long run.

Digital Currencies: Investing $100 monthly into digital currencies would have provided exposure to the volatile but potentially high-growth digital asset class. For example, Bitcoin, the largest digital currency by market cap, has seen a significant increase in value since the start of the pandemic.

The DCA $100 strategy offers a disciplined approach to investing in various asset classes, enabling investors to navigate market uncertainties and achieve long-term financial goals.