Are you wondering how the credit card payment process looks like when you tap your card?

When we make a contactless credit card payment, several transactions happen in the background. Often over four transactions are done to complete your payment.

Table of Contents

Breakdown of the key steps:

- Tokenization: Wen you make your credit card payment, your physical card details (card number, expiration date, etc.) are not directly transmitted during a contactless transaction. Instead, your phone or wearable device that supports contactless payments (like Apple Pay or Google Pay) uses a secure process called tokenization. A unique digital token is created specifically for that transaction.

- Authorization Request: During the credit card payment, the tokenized information from your device is sent to the merchant’s payment terminal securely.

- Network Communication: The payment terminal then communicates with the payment network (e.g., Visa) through an intermediary processor.

- Issuer Bank Verification: The next step in your credit card payment is that the network sends the authorization request to your issuing bank (the bank that issued your Visa card).

- Fraud Checks: The issuing bank performs various fraud checks using sophisticated algorithms and may even communicate with you for additional verification (depending on the transaction amount and risk profile).

- Authorization Response: Based on the verification results, the issuing bank sends an authorization response back to the network, either approving or declining the transaction.

- Transaction Confirmation: The final step in your credit card payment is where the network transmits the authorization response back to the merchant’s terminal. If approved, you’ll typically see a confirmation message on the terminal and your device.

How many transactions happen under the hood?

There isn’t a single number that encompasses all contactless transactions, here’s a general idea:

- Minimum of 3-4 transactions: Tokenization, authorization request, network communication, and authorization response are essential steps and would always occur.

- Potential for more: Additional communication might happen during fraud checks, especially if your bank requires further verification.

Important to Note:

- The entire process happens very quickly, often within seconds, creating a seamless user experience.

- Security measures are prioritized throughout, protecting your sensitive card data.

What Happens When I Swipe My Credit Card?

Swiping, tapping, or entering your credit card details online has become second nature for many of us. But have you ever stopped to think about the complex journey your payment takes behind the scenes?

Understanding the credit card payment process can shed light on transaction fees, security measures, and how your credit score might be impacted. Let’s break down the key steps involved.

- The Swipe (or Tap, or Dip): This is where it all begins. Whether you swipe, tap for contactless payment, or insert your chip card, your card’s data is securely transmitted to the merchant’s payment terminal.

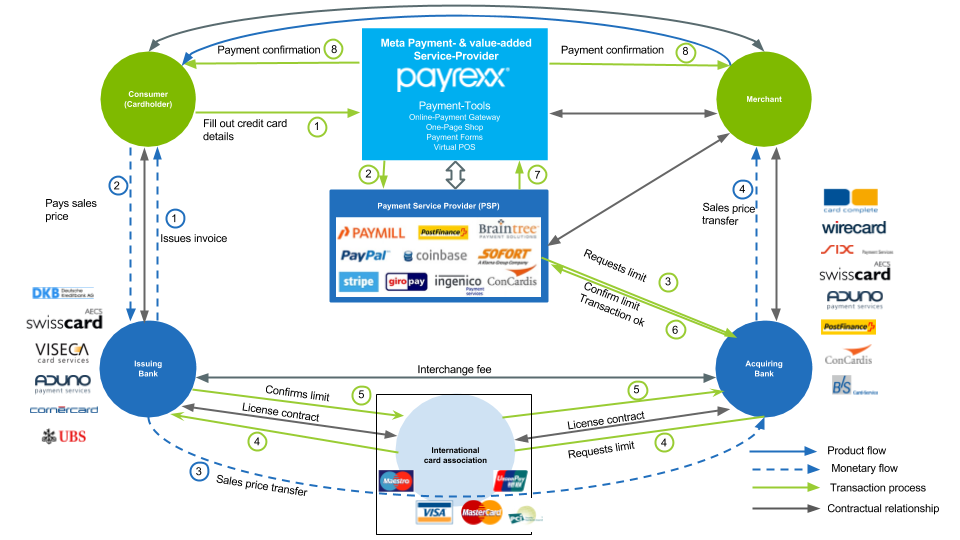

- Merchant to Processor: The merchant’s terminal isn’t directly connected to your bank. Instead, it communicates with a payment processor that acts as an intermediary.

- Onward to the Card Network: The payment processor routes the transaction information to the appropriate card network (e.g., Visa, Mastercard, Discover).

How Does the Card Network Verify My Payment?

- Reaching the Issuing Bank: The card network identifies your issuing bank (the bank that gave you the credit card) and forwards the authorization request.

- Fraud Checks and Balance: Your issuing bank performs a series of checks. They ensure your account has sufficient funds or credit, analyze transaction patterns for fraud, and may even consider your credit history.

- Approval or Decline: The issuing bank sends a response back to the card network, signifying whether the transaction is approved or declined.

What Happens After the Payment is Approved?

- Back to the Merchant: The approval response travels back through the card network, payment processor, and finally reaches the merchant’s terminal. You’ll see a confirmation!

- Settlement Period: The money doesn’t instantly reach the merchant’s account. There’s a settlement period where funds are transferred from your issuing bank to the merchant’s bank, typically within a few days.

- Your Monthly Statement: The approved transaction is reflected on your credit card statement, contributing to your outstanding balance.

Who Pays the Fees in a Credit Card Transaction?

- Merchant Fees: Merchants pay a percentage of each transaction as a fee to the payment processor and card network. This is why some businesses have minimum purchase amounts for card use.

- Indirect Costs for You: While you don’t directly pay transaction fees, merchants might factor these costs into their prices, meaning consumers may indirectly bear some of the burden.

How Do Credit Card Payments Affect My Credit Score?

- Payment History: Timely payments help build a positive credit history. Late or missed payments hurt your score.

- Credit Utilization: Your credit utilization ratio (how much of your available credit you’re using) is important. High balances relative to your credit limit can negatively impact your score.

The next time you make a credit card purchase, remember there’s a whole system working to authorize and process your payment. Understanding this process can help you make informed financial decisions, use your credit card responsibly, and protect yourself from potential fraud.