The journey towards financial freedom always begins with a well-structured accumulation plan.

Whether you’re a seasoned investor or just stepping into the realm of financial growth, understanding the nuances of accumulation plans and their applicability to assets like bitcoin is crucial.

In this comprehensive guide, we delve into the intricacies of the accumulation plan, how they align with bitcoin investments, a DCA:s strategi, and the pros and cons that shape this strategy.

Table of Contents

What Is an Accumulation Plan?

An accumulation plan simply put is a plan to acquire a specific asset.

For example, you could decide to accumulate gold over a period of 20 years by investing 1/20 of the total amount every year.

Below is a table illustrating your investment of $100,000 into gold over a 20-year period, with an equal investment of 1/20th of the total amount each year:

| Year | Annual Investment | Cumulative Investment | Total Investment Value (Assuming 5% Annual Return)* |

|---|---|---|---|

| 1 | $5,000 | $5,000 | $5,250 |

| 2 | $5,000 | $10,000 | $11,025 |

| 3 | $5,000 | $15,000 | $16,176.25 |

| 4 | $5,000 | $20,000 | $21,385.06 |

| 5 | $5,000 | $25,000 | $26,654.31 |

| 6 | $5,000 | $30,000 | $31,986.02 |

| 7 | $5,000 | $35,000 | $37,382.32 |

| 8 | $5,000 | $40,000 | $42,845.44 |

| 9 | $5,000 | $45,000 | $48,377.71 |

| 10 | $5,000 | $50,000 | $53,981.60 |

| 11 | $5,000 | $55,000 | $59,659.68 |

| 12 | $5,000 | $60,000 | $65,414.66 |

| 13 | $5,000 | $65,000 | $71,249.40 |

| 14 | $5,000 | $70,000 | $77,166.83 |

| 15 | $5,000 | $75,000 | $83,169.17 |

| 16 | $5,000 | $80,000 | $89,258.83 |

| 17 | $5,000 | $85,000 | $95,438.47 |

| 18 | $5,000 | $90,000 | $101,710.39 |

| 19 | $5,000 | $95,000 | $108,077.66 |

| 20 | $5,000 | $100,000 | $114,543.54 |

Besides voluntary accumulation plans dollar-cost averaging (DCA) can be used to automate an accumulation plan.

DCA and Value Averaging (VA) are investment strategies designed to capitalize on market volatility while minimizing the risk associated with timing the market.

Instead of investing a lump sum all at once, the accumulation plan involves consistently investing into the asset, regardless of market fluctuations.

The DCA strategy mitigates the impact of market highs and lows, allowing investors to accumulate assets over time at varying prices.

By adhering to a disciplined schedule, dollar cost averaging plans offer a strategic advantage, enabling investors to buy more shares when prices are low and fewer shares when prices are high.

Accumulation Plans vs Dollar Cost Averaging

In a voluntary accumulation plan, an investor periodically contributes (at their choice) relatively small sums of money. This simply means you buy whenever you have extra cash to invest or save.

This way you accumulate more and more over time, creating a sizable stake over a considerable amount of time.

On the other hand, Investors gain from dollar-cost averaging by spreading out their payments over time since the fixed contributions will purchase more shares when its price is low than when it is high.

Anyone who wants to establish an investment portfolio but is unable to invest a sizable chunk of money at once may find this to be a fantastic alternative.

While the accumulation plan is great for almost any asset class, it’s particularly great for accumulating bitcoin

Accumulation Plan and Bitcoin: A Synergistic Approach

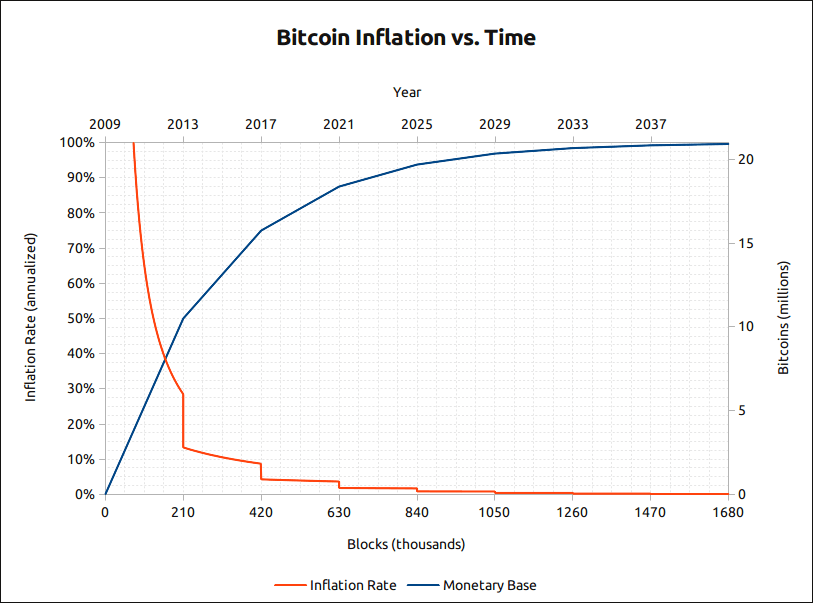

Bitcoin has a fixed supply and mathematically ensured issuance rate. This makes bitcoin the perfect savings vehicle. Bitcoin is a precious asset which is predestined to be integrated in an accumulation plan.

Further, when it comes to bitcoin—a dynamic and volatile asset—dollar cost averaging strategies as accumulation plans offer a prudent method for entering the market.

Bitcoin’s price history is characterized by dramatic fluctuations, making market timing a challenging endeavor. Aggregation plans provide a safeguard against this uncertainty and let you focus on the long-term.

By consistently investing a fixed amount in bitcoin at regular intervals, investors can navigate the price turbulence without succumbing to emotional decision-making.

This method capitalizes on the long-term growth potential of bitcoin while avoiding the pitfalls of attempting to predict its short-term price movements.

Pros and Cons of Accumulation Plans

Pros

- Mitigating Volatility: Dollar cost averaging plans act as a buffer against market volatility. By investing at regular intervals, you benefit from both market highs and lows, leading to a lower average cost per unit.

- Emotionally Resilient: Emotional decision-making is a notorious pitfall in investing. With an accumulation plan you can eliminate the emotional component, as investments are made on a predetermined schedule rather than reacting to market swings.

- Long-Term Approach: Building wealth through this aggregation strategy aligns with a long-term investment horizon. This patient approach capitalizes on compound growth, allowing your investment to potentially multiply over time. Switching strategies to fast can lead to a loss.

- Simplicity: The process of consistent investment intervals simplifies decision-making. You’re not concerned with the optimal entry point; instead, you commit to the process, reaping the benefits over the long haul. Simplicity also keeps your stress levels low which is a psychological benefit.

- Averages Out Market Volatility: DCA helps smooth out the impact of market volatility on your overall investment. You buy more shares when prices are low and fewer shares when prices are high, leading to a more balanced average cost per share over time.

- Ease of Implementation: DCA is straightforward to implement, especially with the availability of automated investment platforms. It’s suitable for investors with varying levels of experience and knowledge.

- Reduced Regret: DCA can help reduce the regret of making a lump sum investment only to see the market decline shortly afterward. With DCA, you’re less likely to regret investing large amounts right before a market downturn.

- Simplified Decision-Making: DCA removes the need to make frequent investment decisions, which can be overwhelming for some investors. This simplicity is particularly helpful for those who prefer a more hands-off approach.

- Long-Term Perspective: DCA encourages a long-term perspective on investing. Since the strategy is based on consistent contributions over time, it aligns well with goals that require sustained growth, such as retirement planning.

- Automatic Investment: DCA plans can be automated, making it convenient for investors to stay on track with their contributions without the need for constant manual intervention.

- Potential Compounding: By consistently investing over time, DCA allows your investments more time to potentially benefit from the compounding effect, where your returns generate additional returns.

- Risk Aversion: DCA can be particularly attractive to risk-averse investors who want to minimize exposure to market volatility while steadily building their portfolio.

- Lower Entry Barrier: DCA allows investors to get started with a smaller initial investment, making it accessible to a wider range of individuals.

Cons

- Missed Opportunities: In a swiftly rising market, aggregating your wealth regularly might cause you to miss out on immediate gains. While the average cost might be lower, you could have earned more by investing a lump sum at an opportune moment.

- Potential for Losses: Despite mitigating risks, these plans don’t guarantee profits. If an asset’s value consistently declines, this strategy could result in cumulative losses.

- Market Timing Concerns: While aggregation plans focus on minimizing market timing concerns, some investors still prefer timing the market to capitalize on specific trends or events.

- Psychological Stress: During periods of market downturns, continuing to invest can be emotionally challenging. It might be difficult to maintain discipline and stick to the plan when it seems like you’re investing in a declining market.

- Transaction Costs: Frequent buying of assets due to regular contributions might lead to higher transaction costs, particularly if your investment platform charges fees for each trade.

- Impact on Smaller Portfolios: For smaller portfolios, transaction costs and fees associated with regular investments could have a more significant impact on overall returns.

- Market Trend Considerations: DCA assumes that markets will experience volatility and that prices will fluctuate over time. If the market consistently trends in one direction, such as a prolonged bull market or bear market, DCA might not be as effective.

- Extended Breakeven Period: Because DCA spreads out your investments, it might take longer to reach the breakeven point compared to a lump sum investment made during a market low.

- Dilution of Returns: As you invest a fixed amount at regular intervals, you could end up purchasing more shares when prices are high and fewer shares when prices are low. This could dilute your overall returns compared to a lump sum investment at a favorable price.

- Lower Potential for Big Buys: If you have a significant amount of funds available to invest, DCA might not be the most efficient way to deploy that capital, as it could take a considerable amount of time to fully invest the funds.

- Lack of Tailoring: DCA treats all investments equally and doesn’t take into account specific market conditions, investment goals, or the potential of individual assets. It’s a one-size-fits-all approach.

Accumulation Plan Example

In the realm of financial growth, accumulation plans offer a strategic path to building wealth over time. By embracing consistency and disciplined investing, you position yourself to navigate the complexities of markets like bitcoin. As you weigh the pros and cons, remember that every investment decision should align with your individual goals and risk appetite. With an accumulation plan, you have a valuable tool to weather the tides of volatility and chart a course towards a prosperous financial future.

| Pros of Dollar-Cost Averaging | Cons of Dollar-Cost Averaging |

|---|---|

| Mitigates timing risk, as investments are spread over time. | May miss out on potential gains during strong market upswings. |

| Reduces emotional impact and impulsive decisions caused by market fluctuations. | Might result in lower returns compared to lump sum investments during bull markets. |

| Encourages discipline and consistent investing habits. | Could lead to frustration if markets experience prolonged downturns. |

| Averages out market volatility, resulting in a more balanced average cost per share. | Doesn’t eliminate all risks associated with investing. |

| Provides simplicity and ease of implementation for investors. | May require an extended period to reach breakeven compared to a lump sum investment. |

| Aligns well with long-term investment goals and encourages a patient approach. | Potential for dilution of returns if prices fluctuate significantly. |

| Minimizes regret of making a lump sum investment before a market decline. | Could lead to transaction costs with frequent small investments. |

| Suitable for risk-averse individuals who want a steady, calculated approach. | Might not be the most efficient strategy for larger sums of available capital. |

| Reduces the stress and anxiety of timing the market correctly. | Doesn’t account for individual asset performance or specific market conditions. |

| Can be automated, requiring minimal ongoing management. | Assumes that market fluctuations will occur over time. |

FAQ

Can I implement an accumulation plan for any asset?

Yes, accumulation plans are versatile and can be applied to a wide range of assets, including stocks, bonds, and cryptocurrencies like bitcoin.

What is the optimal interval for a dollar cost averaging plan?

The interval depends on your financial goals and risk tolerance. Common intervals range from daily, weekly to monthly.

Do aggregation plans eliminate the need for research and analysis?

While these plans simplify the investment process, it’s still important to research and understand the assets you’re investing in.

Can I adjust my aggregation plan if my financial situation changes?

Absolutely. Dollar cost averaging plans are flexible and can be adjusted based on changes in your financial circumstances.

Is an accumulation plan suitable for short-term gains?

Accumulation plans are best suited for a long-term investment approach. They might not yield significant short-term gains due to the consistent investment intervals.