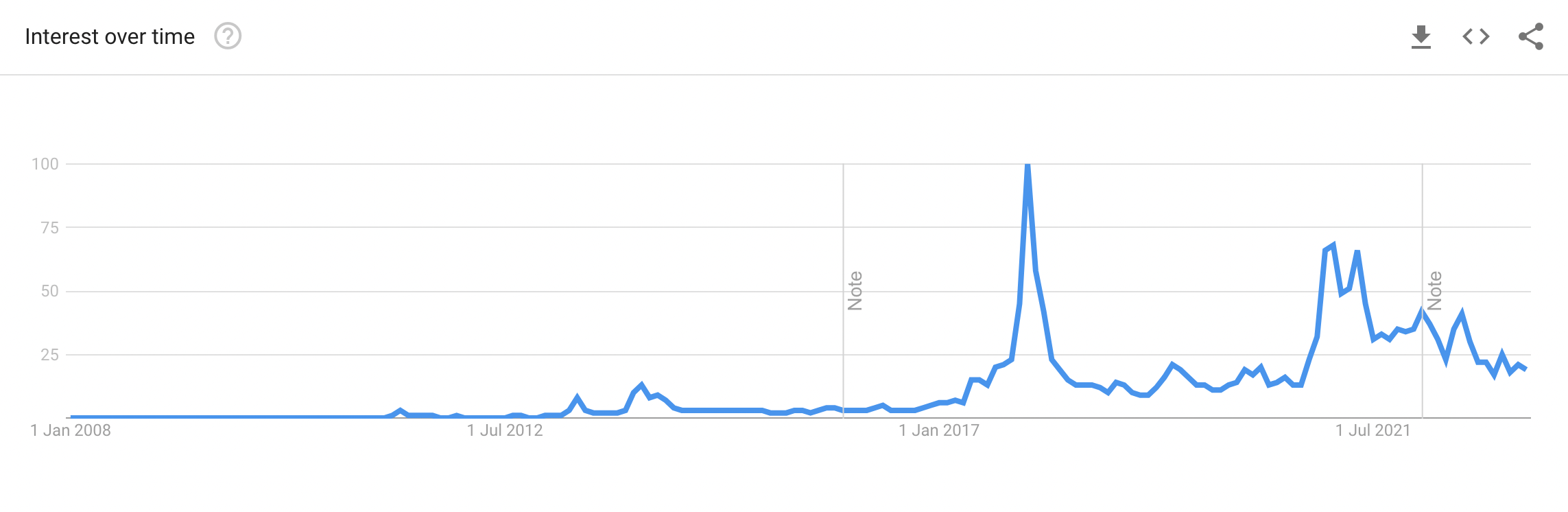

The Bitcoin Google Trends Chart reveals how the search query “Bitcoin” correlates with the bitcoin price and overall sentiment:

This article is presented by RankPlan

Table of Contents

What is the Bitcoin Google Trends Chart?

The Bitcoin Google Trends shows the search volume of the keyword “Bitcoin” on Google. Google Trends is a publicly available platform that analyzes the popularity of search queries on Google Search across time and geographic regions. The Bitcoin Google Trends Chart reveals how Google searches for the keyword “Bitcoin” performs over time.

What is Bitcoin?

Bitcoin (BTC) has revolutionized finance but remains a notoriously volatile asset, its price swings often fueled by investor sentiment.

Traditional financial indicators provide valuable insights but often fall short of capturing the full spectrum of market emotions.

This is where Bitcoin Google Trends Chart, a powerful tool analyzing search query patterns, offers a unique lens into understanding Bitcoin sentiment and its potential influence on market behavior. Let’s dive into how Bitcoin Google Trends charts can reveal valuable information for investors, analysts, and cryptocurrency enthusiasts.

Understanding Google Trends for Bitcoin

- What is Google Trends? Google Trends provides normalized data on the popularity of specific search terms over time and across geographic regions. It doesn’t reveal absolute search volumes but rather trends relative to overall search activity.

- Google Trends & Bitcoin: Analyzing Google Trends charts related to Bitcoin search terms (“Bitcoin,” “BTC,” “buy Bitcoin,” etc.) sheds light on evolving public interest, which can offer clues about market sentiment.

Decoding Sentiment with Bitcoin Google Trends Chart

- Identifying Sentiment Shifts: Spikes or declines in Bitcoin-related searches can signal shifts in investor sentiment. Increasing searches often indicate growing interest and potential bullish sentiment, while downtrends could suggest waning enthusiasm or bearishness.

- Sentiment Analysis for Deeper Insights: Tools like VADER (Valence Aware Dictionary and sEntiment Reasoner) analyze language to categorize Bitcoin-related searches as positive, negative, or neutral. Surges in searches like “Bitcoin crash” highlight fear, while increases in terms like “Bitcoin future” suggest optimism.

- Context is Key: Interpreting Google Trends data requires context. News events, regulatory announcements, and even tweets from influential figures can trigger sentiment shifts reflected in search trends.

Can the Bitcoin Google Trends Chart Reveal Market Behavior?

- Correlation Studies: Several studies have explored the connection between Bitcoin Google Trends Chart data and its price, trading volume, and volatility. For example, Preis et al. (2013) found a potential relationship between Google Trends data and stock market movements.

- Preceding Market Shifts: In certain instances, Bitcoin Google Trends charts have seemingly foreshadowed price changes. Surges in interest preceding rallies could indicate growing buying pressure, while decreasing interest might signal potential sell-offs.

- Not a Perfect Predictor: It’s crucial to remember that Google Trends reveals correlation, not causation. Sentiment is just one factor influencing Bitcoin’s complex market dynamics.

Using the Bitcoin Google Trends Chart Strategically

- Complementary Tool: Bitcoin Google Trends chart shouldn’t be your sole decision-making tool; they work best alongside technical analysis, fundamental analysis, and an understanding of broader market conditions.

- Spotting Trend Reversals: Monitoring sentiment trends on Bitcoin Google Trends chart can help identify potential shifts in market momentum before they fully materialize in prices.

- Geographic Segmentation: Google Trends allows regional analysis. Monitoring search trends in countries driving Bitcoin adoption or facing regulatory changes can provide valuable insights.

Limitations

- Data Interpretation: Google Trends data requires careful interpretation and should be considered within a broader analytical framework.

- Population Representation: Search trends don’t necessarily represent the entire investor population or account for sentiment expressed on other platforms.

Bitcoin Google Trends Chart offer a unique window into public sentiment surrounding this dynamic cryptocurrency. As a data-driven investor, analyst, or enthusiast, understanding the relationship between search trends and Bitcoin behavior can add a valuable dimension to your decision-making toolkit.

Google trends provide insights into what people are interested in, what they’re concerned about, and how their opinions might be changing.

In the realm of finance, Google Trends has been shown to correlate with stock market movements (Preis et al., 2013) and even predict financial volatility (Da et al., 2011).

Can we use Google Trends Bitcoin Chart for Sentiment Analysis?

Let’s dive into how we can use Google Trends to gauge Bitcoin sentiment and explore its relationship with Bitcoin’s market performance:

- Search Volume as a Proxy for Interest: The most basic metric is the search volume for terms like “Bitcoin,” “BTC,” or “Buy Bitcoin.” Spikes in search volume often correlate with periods of heightened interest. This could signal increasing investor attention, potentially preceding changes in price and trading activity.

- Sentiment Analysis: Going Deeper: Analyzing search terms alongside Bitcoin queries goes even further. Tools like VADER (Valence Aware Dictionary and sEntiment Reasoner) can classify text as positive, negative, or neutral. Surges in searches like “Bitcoin scam” or “Bitcoin crash” might indicate growing fear and uncertainty, while increases in phrases like “Bitcoin future” or “Bitcoin investment” may signal optimism.

- Geographic Insights: Google Trends lets you explore search interest by region. Are certain countries showing disproportionate interest in Bitcoin? This could offer clues into evolving adoption trends or regulatory shifts that impact sentiment in specific areas.

Case Studies: Trends in Action

To illustrate this, let’s consider some real-world examples:

- 2021 Bull Run: During the 2021 Bitcoin bull run, Google searches for “Bitcoin” reached all-time highs. This surge in interest coincided with Bitcoin’s price surge, suggesting a link between search volume and market momentum.

- Negative News Cycles: Periods of negative news coverage, such as reports of hacks or regulatory crackdowns, often correlate with drops in Bitcoin prices and spikes in negative Bitcoin-related searches. This underscores how sentiment plays a role in market reactions.

Important Considerations

- Correlation, Not Causation: Google Trends data reveals trends but doesn’t necessarily prove direct causation. Other factors influence Bitcoin’s market behavior.

- Sentiment Fluidity: Public sentiment surrounding Bitcoin can be volatile, quickly switching between optimism and pessimism.

- Data Limitations: Google Trends doesn’t represent the entire population, and search terms can be ambiguous.

The Takeaway

The Google Trends bitcoin chart provides a valuable lens for understanding the evolving public sentiment around Bitcoin. As data analytics expert Bernard Marr states, “Whether we like it or not, public sentiment has a real impact on markets – and that goes double for sentiment-driven markets like cryptocurrency.” (Forbes, 2023).

By monitoring Google Trends in conjunction with other market indicators, investors, analysts, and enthusiasts can gain a more nuanced understanding of the forces shaping the Bitcoin landscape.

References

- Baek, C., & Elbeck, M. (2015). Bitcoins as an investment or speculative asset? Journal of International Financial Markets, Institutions and Money, 39, 145-157.

- Ciaian, P., Rajcaniova, M., & Kancs, D. (2016). The economics of Bitcoins price formation. Applied Economics, 48(19), 1799-1815.

- Da, Z., Engelberg, J., & Gao, P. (2011). In search of attention. The Journal of Finance, 66(5), 1461-1499.

- Preis, T., Moat, H. S., & Stanley, H. E. (2013). Quantifying trading behavior in financial markets using Google Trends. Scientific reports, 3(1), 1-6.