What is Dollar Cost Averaging Bitcoin?

In this short article we explain the fundamentals of Dollar Cost Averaging (DCA) as well as the particular case to apply the strategy to grow a bitcoin portfolio.

Table of Contents

Key Takeaways:

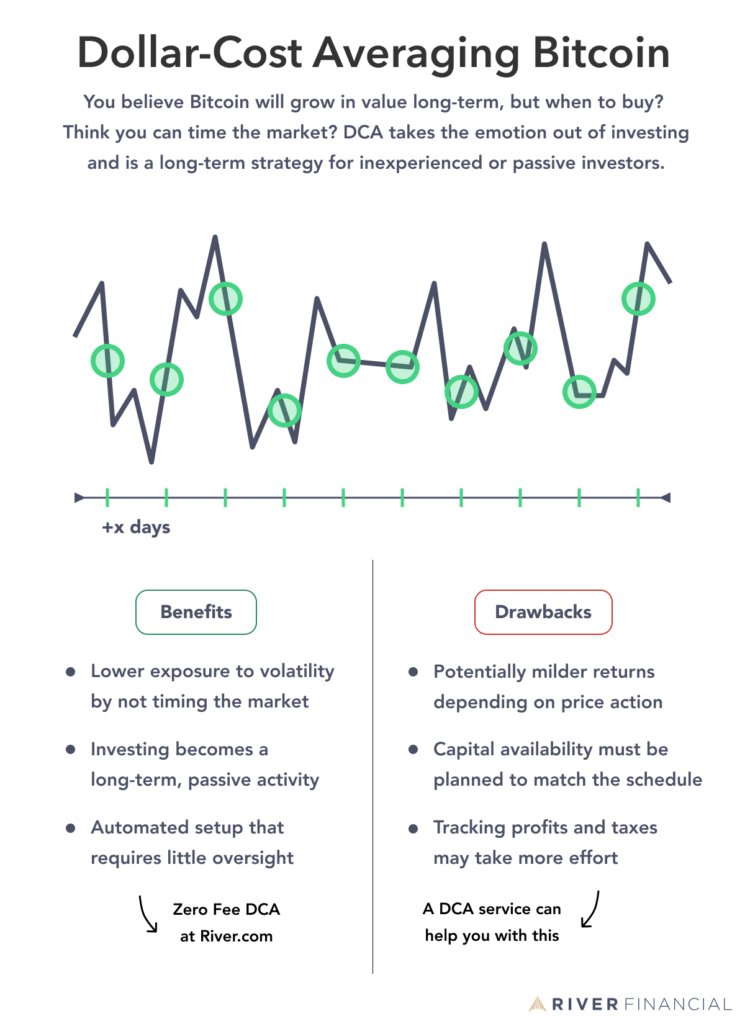

- Dollar cost averaging bitcoin is an automated strategy to grow a portfolio over long-term and accumulate more bitcoin.

- Dollar cost averaging is an easy strategy for inexperienced or passive investors who are interested in hard assets, such as bitcoin.

- There are various benefits and drawbacks to dollar cost averaging.

Investing in Bitcoin can be challenging due to its significant price volatility, which often leads to uncertainty and fear among investors. Instead of attempting to time the market, a recommended approach is Dollar-Cost Averaging (DCA). But is it a good strategy, and what are the risks involved?

What is Dollar Cost Averaging?

Dollar-Cost Averaging, also known as the constant dollar plan, is a long-term investment strategy that involves dividing the total investment amount into regular purchases over time. By doing this, investors can reduce their exposure to short-term market fluctuations and work towards their investment goals steadily.

The process is simple: you set up automated periodic purchases of Bitcoin, such as on a daily, weekly, bi-weekly, or monthly basis. For instance, if you want to invest $2,500 in Bitcoin, you could purchase $50 worth of Bitcoin every week for 50 weeks, rather than investing the entire amount at once. You are not bound to this schedule and can modify or stop the purchases as you wish.

Dollar-Cost Averaging is already a common strategy, unknowingly used by many in the U.S., particularly in 401(k) retirement plans where investments are made regularly from paychecks.

The main advantage of DCA is that it helps remove emotions from investing. It encourages investors to stay committed to their investment plan despite short-term price fluctuations. Timing the market is difficult, even for experienced investors, and DCA offers a disciplined and gradual approach to building a Bitcoin position over time.

It’s essential to adopt a long-term outlook and exercise discipline when using DCA. Although it may not always yield the highest returns, it can lead to steady growth in your Bitcoin holdings. Now you’ve got the basics of the DCA Strategy. Perhaps you might wonder: “What is Dollar Cost Averaging Bitcoin?”

So, What is Dollar Cost Averaging Bitcoin?

Dollar-cost averaging is particularly suitable for assets like Bitcoin that are expected to increase in value over the long term but are subject to volatility along the way. As investors continue to accumulate Bitcoin through DCA, they can also enhance their understanding of the technology and its implications.

DCA is not without its drawbacks. It may not be the best strategy for investors seeking exceptionally high returns or for those exposed to the risk of declining market prices. Additionally, DCA might delay the deployment of capital, potentially negating the value of early investments.

However, the benefits of DCA make it an attractive option for many investors. It automates the investment process, reduces risk by averaging out purchase prices, and requires less attention and analysis compared to other strategies.

To practice DCA in Bitcoin:

- Determine your total allocation to Bitcoin.

- Plan the size and frequency of your purchases.

- Find a service that allows recurring orders, like River, which offers DCA without additional fees beyond the initial setup.

Remember that all investments carry risks, especially in volatile assets like Bitcoin. Conduct thorough research, invest only what you can afford to lose, and consider consulting a financial advisor before proceeding.

If you had the same question, What is Dollar Cost Averaging Bitcoin? We hope that now you know and can tell your friends.