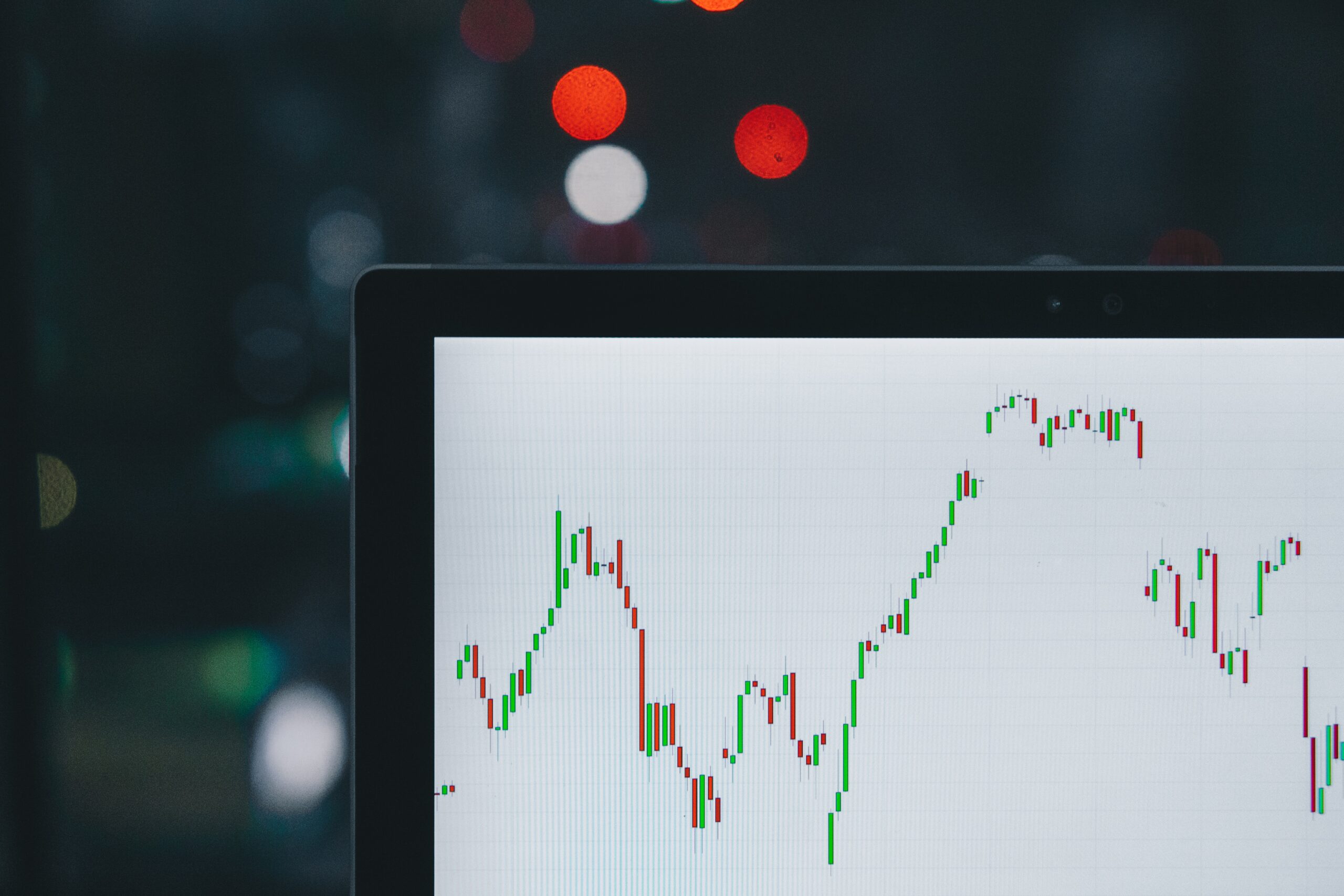

Investing in the stock market can be a daunting task, especially for beginners. With so many options and strategies available, it can be overwhelming to know where to start. One popular investment strategy is dollar cost averaging (DCA), which involves investing a fixed amount of money at regular intervals, regardless of market fluctuations.

This strategy is often used with the S&P 500, a stock market index that tracks the performance of 500 large companies listed on stock exchanges in the United States. In this article, we will discuss the benefits of using the S&P 500 Dollar Cost Averaging calculator and how it can help with investment planning.

Key-Points

- This tool is especially useful for long-term investments, such as investing in the S&P 500, as it allows investors to see the potential growth of their investments over time.

- One of the biggest benefits of using the S&P 500 Dollar Cost Averaging calculator is that it takes emotions out of the investment process.

- By inputting different scenarios, investors can see how their investments may grow over time and make informed decisions about their investment strategy using the S&P 500 Dollar Cost Averaging calculator.

Table of Contents

What is a DCA Calculator?

A DCA calculator is a tool that helps investors determine the potential returns of their investments using the dollar cost averaging strategy. It takes into account the amount invested, the frequency of investments, and the expected rate of return to calculate the potential earnings over a specific period of time.

The tool is especially useful for long-term investments, such as investing in the S&P 500, as it allows investors to see the potential growth of their investments over time.

Benefits of Using the S&P 500 DCA calculator

Takes Emotions Out of Investing

One of the biggest benefits of using the S&P 500 Dollar Cost Averaging calculator is that it takes emotions out of the investment process. Many investors tend to make impulsive decisions based on market fluctuations, which can lead to losses. By using a DCA calculator, investors can stick to their predetermined investment plan and avoid making emotional decisions.

Reduces Risk

Investing in the stock market always carries a certain level of risk. However, by using the S&P 500 Dollar Cost Averaging calculator, investors can reduce their risk by spreading out their investments over time. This means that they are not investing a large sum of money all at once, which can be risky if the market experiences a downturn.

Averages Out Market Fluctuations

The stock market is known for its volatility, with prices constantly fluctuating. By investing a fixed amount at regular intervals, the DCA strategy helps to average out these fluctuations. This means that investors are not buying all their shares at a high price or selling all their shares at a low price, which can result in better returns over time.

Comparative Analysis

You can experiment with different scenarios and compare the results. For instance, you can compare the outcomes of investing using DCA. This analysis can help you make informed decisions on which investment strategy aligns with your risk tolerance and goals.

Flexibility

The calculator allows you to adjust various parameters, such as the initial investment amount, investment frequency, and expected rate of return. This flexibility enables you to tailor your DCA strategy to your individual preferences and circumstances.

How to Use the S&P 500 DCA calculator

Dollar-Cost Averaging (DCA) is a popular investment strategy that involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. Using a S&P 500 Dollar Cost Averaging calculator involves a few simple steps:

- Input the Initial Investment Amount: Start by entering the amount of money you initially plan to invest. This is the initial sum of money you’ll use to kick start your investment strategy.

- Specify the Investment Frequency: Choose the frequency at which you will be making additional investments. Common options include monthly, quarterly, or any other regular interval. This determines how often you’ll be adding more money to your investment.

- Enter the Expected Rate of Return: Input an estimated or expected rate of return. The S&P 500 typically has historical average returns, but it’s important to note that these returns can vary over time. It’s a good practice to use a reasonable and conservative rate to make more realistic projections.

- Set the Investment Period: Specify the time period over which you plan to make your investments and calculate your potential earnings. You can set this for a specific number of years or until a certain financial goal is reached.

- Calculate: Once you’ve entered all the necessary information, simply click the “Calculate” button or the equivalent action in the DCA calculator. The calculator will provide you with the potential earnings or the value of your investment over the specified period.

- Adjust Inputs: You can experiment with different scenarios by adjusting the inputs. For example, you can try increasing or decreasing the initial investment amount, changing the investment frequency, or altering the expected rate of return to see how it affects your potential returns.

- Analyze the Results: The calculator’s output will show you how your investment would have grown over time based on your inputs. It can help you understand the power of DCA and the benefits of disciplined, regular investing.

Keep in mind that DCA is a strategy designed to reduce the impact of market volatility and reduce the risk of making poor timing decisions. By consistently investing a fixed amount over time, you may be able to take advantage of market fluctuations, buying more shares when prices are low and fewer when prices are high. This strategy is particularly suited for long-term investors who are looking to build wealth steadily over time.

When using a S&P 500 Dollar Cost Averaging calculator, it’s important to remember that it provides estimates based on the inputs you provide. The actual performance of your investments may vary from these estimates due to market conditions, fees, and other factors. It’s also crucial to periodically review and adjust your investment strategy as your financial goals and circumstances change.

Conclusion

A DCA calculator can also be a useful tool for investment planning. By inputting different scenarios, investors can see how their investments may grow over time and make informed decisions about their investment strategy. It can also help investors set realistic goals and track their progress over time.

Using the S&P 500 Dollar Cost Averaging calculator can be a valuable tool for investors looking to take a disciplined and calculated approach to their investments. By taking emotions out of the equation, reducing risk, and averaging out market fluctuations, this strategy can lead to better returns over time. So why not give it a try and see how it can benefit your investment portfolio?

Frequently Asked Questions – FAQ

Where can I find an S&P 500 Dollar Cost Averaging calculator?

Many financial websites and investment platforms offer DCA calculators. You can also find them as downloadable tools or apps

Is the S&P 500 Dollar Cost Averaging calculator‘s output guaranteed?

No, the calculator’s output is based on your inputs and expected rates of return. Actual returns can vary due to market conditions, fees, and other factors. The S&P 500 Dollar Cost Averaging calculator offers estimates, not guarantees.