DCA is a method of investing that involves spreading out purchases over time to combat market volatility. This article will go through how to dca bitcoin and provides an example comparing the results of DCA investing versus trying to time the market. It also offers tips for setting up an exchange account, using automatic DCA parameters, and understanding storage options for cryptocurrencies. Additionally, the article discusses the expectations, pros, and cons of DCA investing and provides a table outlining its suitability for different types of investors.

Table of Contents

Basics of how to DCA Bitcoin

Bitcoin is the best performing asset in the last decade. It is becoming a staple in several of the largest investment fund portfolios. But what is the best strategy to efficiently allocate capital like a pro?

The introduction of the DCA strategy.

What is the DCA investing strategy? DCA is the acronym for Dollar-Cost-Averaging. It is known as the weapon to combat volatility. Think about it this way: if an investor tries to “time the market” and exit and enter trades when they see fit, unless said investor has insider information or can see into the future, the price paid for the assets is going to be greatly impacted by the volatility of the market.

DCA strategy spreads out the purchases, so they are less affected by the swings in the market price. It is remarkably effective for long-term investors. Instead of catching uncontrollable highs and lows, set a control standard for how capital flows into the market. For example, instead of relying on emotions and exhaustive technical analysis, invest $20/week at the same time every week to “average the market.”

Make a DCA Plan

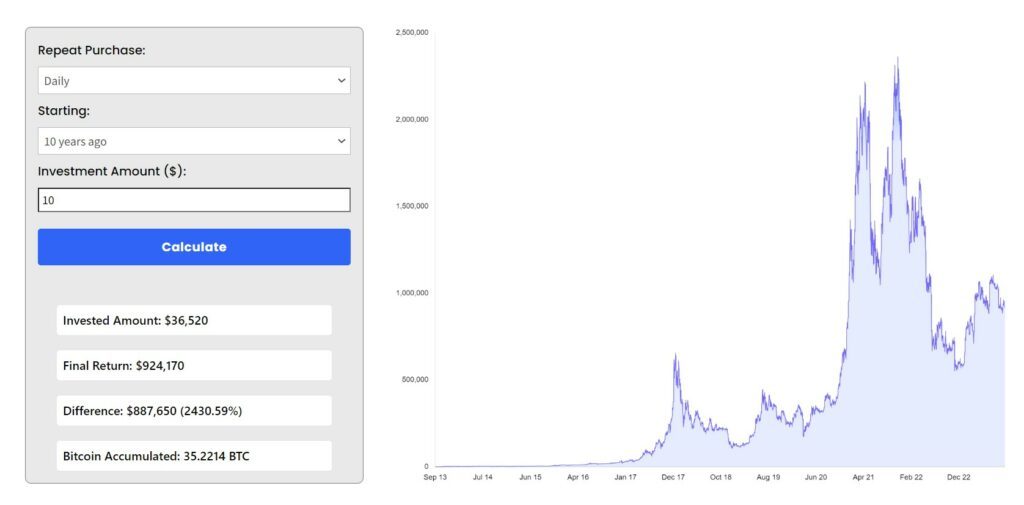

Part of this strategy includes making a plan. Without planning, investment strategies are doomed subject to the will of the market-maker. Try our free Bitcoin DCA calculator to see historical returns using the DCA strategy:

To illustrate this with numbers, here is an example:

Bill has $5200 to invest in Bitcoin. Instead of waiting until he thinks “it is a good time to buy,” Bill decides to distribute the $5200 over every week for the next 5 years ($20/week). By the end of the 5 years (2018-2023), Bill will have an investment value of $11,117.58(113.8% ROI).

Jack also has $5200 to invest in Bitcoin. He decides he will buy when the time is right. January 2021, Jack decides the time is right and Bitcoin is only going up from here, all his friends are buying and getting RICH. He enters the trade at $40,257. He was right because when November came Bitcoin was worth $68,000!!! He was sure it was going to $1,000,000! He waited for the pump, but the pump never came. The Bitcoin price continued to sink and swing through the supply-demand frenzy. Fast forward to January 2023, the Bitcoin price is at $16,605. Jack is now down to $2145(-58.75%).

This is a simple example of these investment strategies. DCA is the “slow and steady wins the race” approach. Timing the market is a need for speed; sometimes you win big, sometimes you lose big.

Set Up Exchange Account

There are several mediums to apply this strategy. Here are some reputable examples:

- Coinbase Exchange: Largest exchange in the U.S. They have been around since 2012 and the only exchange that is publicly traded on the stock exchange. They have a very simple user-interface and is a fantastic option for beginners.

- River: One of the largest Bitcoin-only exchanges in the world. Ideal option for DCA as they have 0 trading fees on recurring buys.

- Swan Bitcoin: Another reputable Bitcoin-only exchange. Great option for integrating Bitcoin into tax-advantageous retirement accounts.

For more information on Bitcoin exchange options, check out our partners and receive up to $50 in Bitcoin for signing up. https://dca-signals.com/deals/

Auto DCA

Setting up automatic investing parameters is simple. You can easily adjust preferences for amount and frequency when scheduling buy orders. There is also an option for automatic withdrawals to wallet your address when balance reaches a defined threshold. Monitoring is made easy with the “set-it-and-forget-it” approach by telling your investment capital what to do and when. Any movement is captured by 24/7 real-time price action data. You can also look back on order history to see what your average entry point is.

Storage Basics

When your portfolio begins to experience growth, it is important to have a grasp on the concept of self-custody. You may have heard the phrase, “Not your keys, not your coins.” This stems from the concept of the public key and the private key. You can store Bitcoin in a variety of ways; from a piece of paper to a physical “hard drive.” Each varies in convenience and security.

Picture Bitcoin as a string of code in the cloud that represents a number. To store this, you need a public key (Similar to a routing number). You can either buy the coin through an exchange and they will send the amount to your public address or receive it from a friend etc. This is the public part of the transaction. Now if you want to send or sell some coins from your public address you need to use the private key (Similar to account number pin).

You use the private key to unlock the amount you want to send. If anyone else has this key that can control where your coins go. This is why it is important where you store your private key. It can be stored on a piece of paper as mentioned before, but that is very risky as you can lose a piece of paper. If you lose the private key, you can never access your coins again.

Exchanges will hold your coins for you when you buy them, but this also carries risk if they cannot pay back their depositors, as most are not FDIC insured like a bank. The other option is a cold/hot wallet. A cold wallet is a hardware device that holds your keys. It is self-custody because the user controls the keys. A hot wallet is a digital wallet (like an app) that is controlled by the user. Cold wallets are more secure(offline) and less convenient.

Hot wallets are less secure (online, could be hacked) and more convenient (easier to transact your coins). This is a basic rundown of Bitcoin custody and there are plenty of educational resources available online. Always be cautious when handling your own keys, if you send them to the wrong address they cannot be recovered.

Expectations

The DCA strategy is used by investors all around the world. It is best applied to investments the investor has conviction about and plans to hold for a longer time. Warren Buffet famously said, “”If you are not willing to own a stock for 10 years, do not even think about owning it for 10 minutes.” The DCA strategy is right for you if you have a strong investment thesis and are determined to accumulate.

There will always be investors that profit more than the DCA strategy, as well as those who lose more. The DCA strategy removes the highs and lows from investing. It is a long-term wealth building strategy, not a get-rich-quick scheme. Here are some Pros and Cons:

Pros –

- Reduces Emotional Component, invest mechanically and systematically.

- Avoids bad timing, never invest directly on the peak.

- Makes a habit of investing, set a schedule and automate the process

Cons –

- The market rises over time, one lump sum may perform better than a spread put investment

- Does not mean the asset will perform well, research should always come before an investment

Here is a table that outlines DCA fit for each investor type:

| Investor Type | DCA Suitability Score |

| Risk-Averse Beginner | 9.22/10 |

| Experienced/Professional Trader | 8.4/10 |

| Long-Term Investor | 9.5/10 |

| Small Budget Investor | 9.2/10 |

| Impatient Speculator/Get Rich Quick Trader | 5/10 |

Frequently Asked Questions – FAQ

Is Dollar-Cost Averaging a Good Idea?

It can be. When dollar-cost averaging, you invest the same amount at regular intervals and by doing so, hopefully lower your average purchase price. You will already be in the market when prices drop and when they rise. For instance, you will have exposure to dips when they happen and don’t have to try to time them. By investing a fixed amount regularly, you will end up buying more shares when the price is lower than when it is higher.

Why Do Some Investors Use Dollar-Cost Averaging?

The key advantage of dollar-cost averaging is that it reduces the negative effects of investor psychology and market timing on a portfolio. By committing to a dollar-cost averaging approach, investors avoid the risk that they will make counter-productive decisions out of greed or fear, such as buying more when prices are rising or panic-selling when prices decline. Instead, dollar-cost averaging forces investors to focus on contributing a set amount of money each period while ignoring the price of the target security.

How Often Should You Invest With Dollar-Cost Averaging?

Regarding the strategy, how often may depend on your investment horizon, outlook on the market, and experience with investing. If your outlook is for a market in flux that will eventually rise, then you might try it. If a persistent bear market is the norm for market conditions, then your approach might look different. If you are planning to use it for long-term investing and wonder what interval for buying makes sense, consider applying some of every paycheck to the regular purchases.