When it is time to buy bitcoin on Revolut with DCA Strategy, it is easy. Follow the steps below and you’ll be setup in a matter of minutes.

Table of Contents

How to Buy Bitcoin on Revolut with DCA

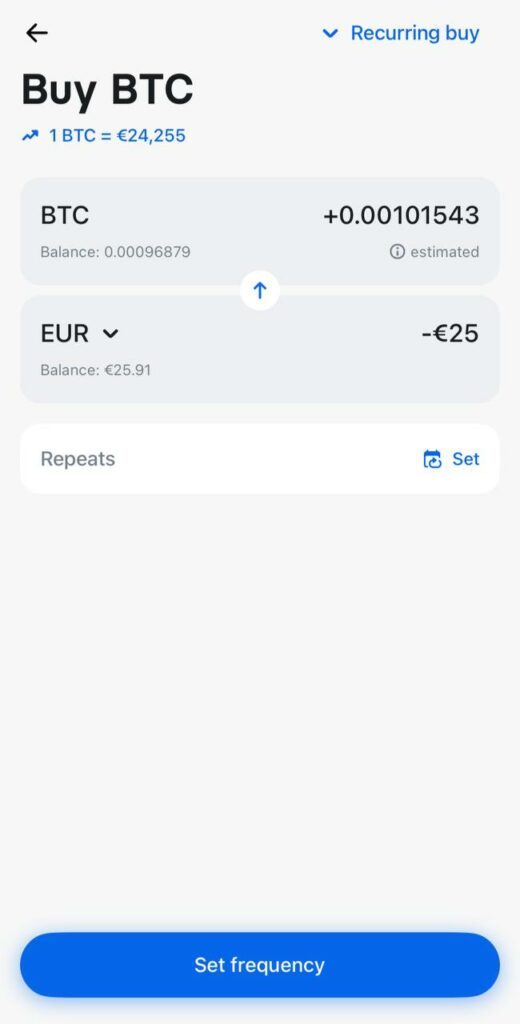

1. Open Revolut, find ‘Recurring buy’

Open Revolut App and go to “Crypto” tab.

Then find “Recurring buy” under the “more” button.

Enter the amount you wish to buy on a regular basis.

Next, hit “Set frequency”

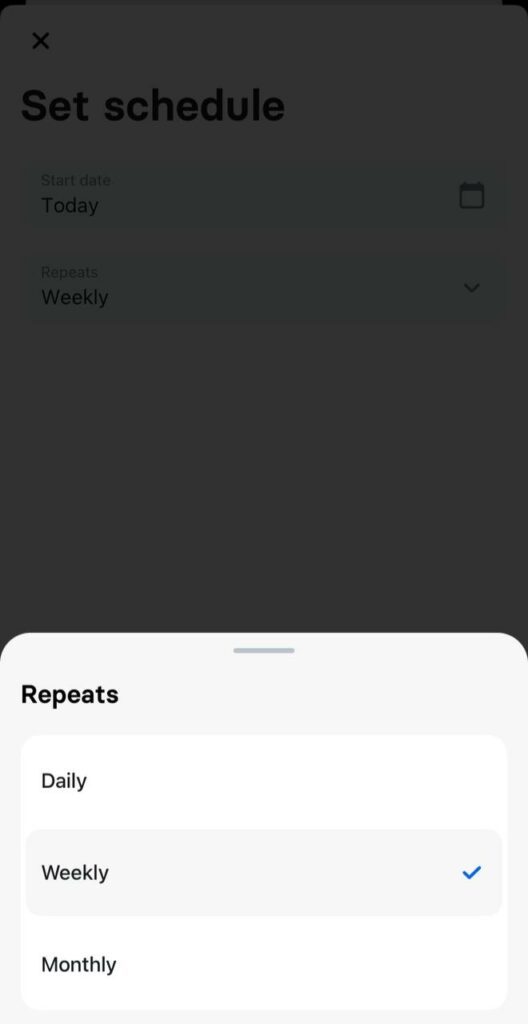

2. Set frequency

Now you can choose between daily, weekly or monthly buys.

According to statistical data weekly or daily frequency is favorable.

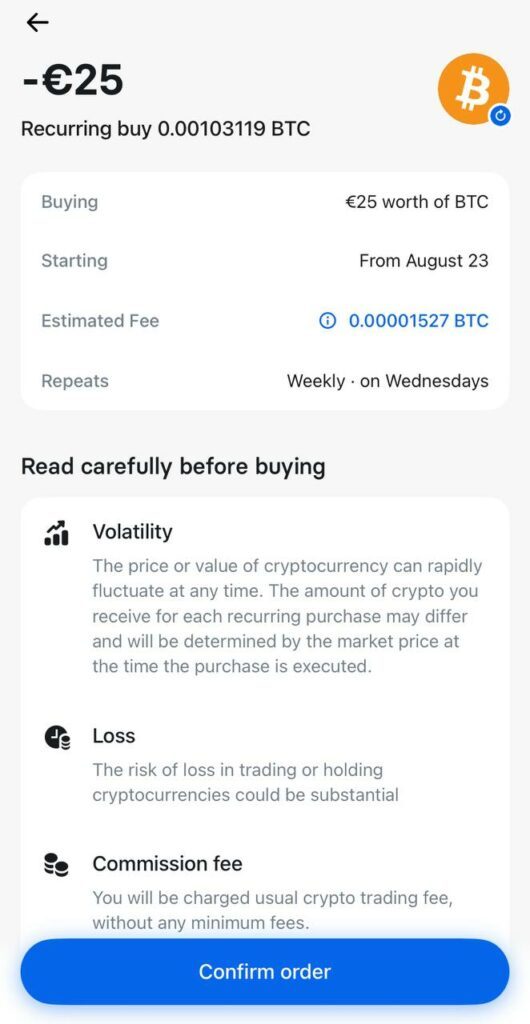

3. Review & confirm

On the next screen you can review your DCA setup.

The last thing to do is to check if everything is correct and hit “confirm order”.

After that, you’re all set, congratulations!

And don’t worry, if you want to change or cancel the DCA order you can do it any time.

The DCA strategy, also known as Dollar Cost Averaging, is a method of investing in which you invest a set amount of money in a particular asset at regular intervals.

This strategy is often used to reduce the risk of investing in volatile markets, such as the cryptocurrency market.

By investing a fixed amount of money at regular intervals, investors are able to purchase more of an asset when prices are low, and less when prices are high.

This strategy is often used to reduce the risk associated with investing in volatile markets and can be used to purchase Bitcoin on Revolut.

In this article you will learn how to buy Bitcoin on Revolut with DCA

What is Revolut?

Revolut is a digital banking platform that allows users to buy, sell and store Bitcoin. It has become a popular platform for Bitcoin investors due to its simple user interface and convenient features. On Revolut, users can deposit funds from their bank account or credit card and then use these funds to purchase a variety of Bitcoin, including Bitcoin.

Don’t have Revolut? Don’t Worry!

- Set up a Revolut account: The first step is to sign up for a Revolut account. You will need to provide your name, email address, and phone number in order to create an account. You will also need to upload a valid form of ID, such as a passport or driver’s license.

- Fund your account: Once your account is set up, you will need to fund it with the amount of money you plan to invest. You can do this by linking your bank account or credit card to your Revolut account.

- Set up a recurring payment: Once you’ve funded your account, you will need to set up a recurring payment. This will ensure that you are investing a fixed amount of money into Bitcoin at regular intervals.

- Select the amount and frequency: You will need to select the amount of money you want to invest each time and the frequency of the payments. This should be based on your individual investment goals and risk tolerance.

- Buy Bitcoin: Once the recurring payment is set up, your account will be automatically credited with Bitcoin each time the payment is made. You can then use these funds to purchase Bitcoin on Revolut.

Pros and Cons of How to Buy Bitcoin on Revolut with DCA

The DCA strategy on Revolut is a popular strategy for investing in volatile markets, such as the Bitcoin market. While it can help to reduce the risk associated with investing in these markets, there are also some potential downsides to using the DCA strategy with Revolut. Below, we will take a look at the pros and cons of using the DCA strategy with Revolut.

The Pros

- Easy to set up a Revolut account: Signing up for a Revolut account is a straightforward process and can be done in a few minutes. All you need to do is provide your name, email address, and phone number, as well as upload a valid form of ID.

- Convenient way to fund your account with bank account or credit card: With Revolut, you can easily link your bank account or credit card to your Revolut account in order to fund it. This makes it easy and convenient to add funds to your account.

- Ability to set up a recurring payment to invest a fixed amount of money at regular intervals: Setting up a recurring payment on Revolut makes it easy to invest a fixed amount of money into Bitcoin at regular intervals. This helps to reduce the risk associated with investing in volatile markets.

- Helps to reduce the risk associated with investing in volatile markets: By investing a fixed amount of money at regular intervals, investors are able to purchase more of an asset when prices are low, and less when prices are high. This helps to reduce the risk associated with investing in volatile markets.

- Can purchase more of an asset when prices are low: By investing a fixed amount of money at regular intervals, investors are able to purchase more of an asset when prices are low. This helps to reduce the overall cost of investing in the asset.

- Can purchase less of an asset when prices are high: The DCA strategy also helps to reduce the cost of investing in an asset when prices are high. By investing a smaller amount of money at regular intervals, investors are able to purchase less of an asset when prices are high.

The Cons

- May take a long time to accumulate a significant amount of Bitcoin: The downside of using the DCA strategy is that it may take a long time to accumulate a significant amount of Bitcoin. This is because the amount of money invested in each payment is relatively small, and it may take some time to accumulate a substantial amount of Bitcoin.

- Amount of money invested in each payment is relatively small: As mentioned previously, the amount of money invested in each payment is relatively small. This means that it may take some time to accumulate a substantial amount of Bitcoin.

- DCA strategy does not guarantee any returns: The DCA strategy does not guarantee any returns and may not be suitable for all investors. As with any form of investing, there is no guarantee of profits and you should always do your own research before investing.

- May not be suitable for all investors: The DCA strategy may not be suitable for all investors due to the risk associated with investing in volatile markets. It is important to assess your own risk tolerance and financial situation before investing.