Bitcoin in heavy accumulation is a report from Adamant Research published by Bitcoin investment expert Tuur Demesteer.

Key Takeaways

- Bitcoin is likely in the accumulation phase of its bear market, marked by recovering sentiment and strong commitment from long-term holders.

- Strengthening fundamentals, millennial adoption, and a rapidly evolving ecosystem position Bitcoin as a disruptive technology and valuable financial asset for institutions.

- Despite potential price drops, Bitcoin’s risk-reward ratio is highly favorable compared to other assets, with a projected trading range before a potential new bull market.

- A decade of development sets the stage for widespread Bitcoin adoption over the next five years, establishing it as a hedging instrument, reserve asset, and significant payment network.

Table of Contents

Overview

Bitcoin in heavy accumulation includes the following topics:

- Risk analysis

- Accumulation; where it leads

- Fundamental drivers of the bitcoin price

Highlights of report:

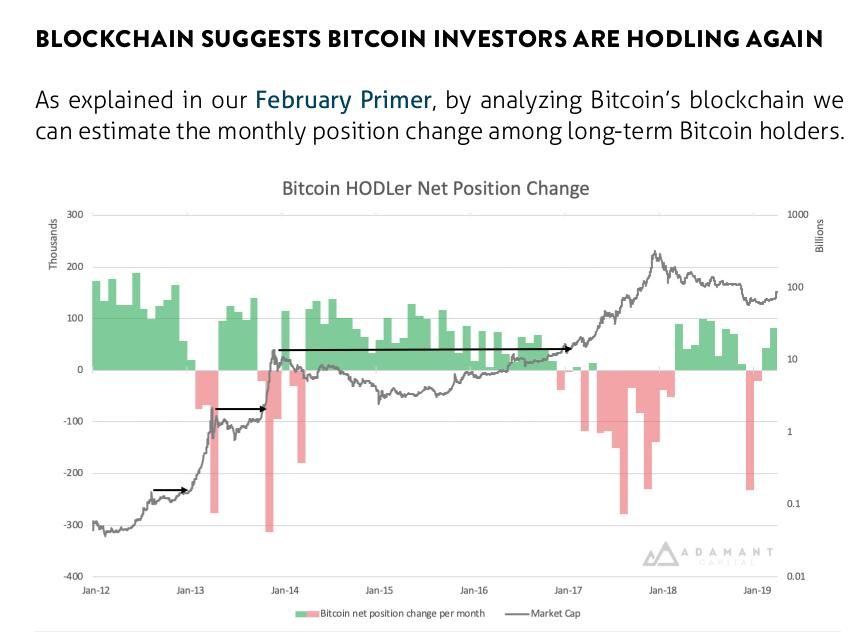

- Blockchain analysis suggests Bitcoin whales are now accumulating

- Significant parallels with the 2014-15 bear market have emerged

- HODLers almost break-even, with est. aggregate losses of $3 billion

- Recent volatility lows suggest retail apathy, market bottoming

- Demand shocks still possible from exchange hacks, miner capitulation

- Bitcoin’s secular bull market is supported by strong fundamentals

Download report

You can download Bitcoin in heavy accumulation here

Abstract

Bitcoin in heavy accumulation shows the movement of markets from being overvalued to undervalued involves a shift of assets from disappointed and impulsive investors to more composed and patient ones.

Value investors, considered “strong hands,” accumulate assets over an extended timeframe by purchasing during price declines. In contrast, those swept up in previous market excitement, who didn’t anticipate a prolonged downturn, sell when prices rise.

During the accumulation phase, the market typically trades within a range. Sellers aiming to exit the market profit from rallies, establishing resistance levels. Meanwhile, those seeking to accumulate buy at the range’s bottom, which eventually stabilizes prices. This process can be lengthy, with preparation for major market movements sometimes lasting several months.

A comparable accumulation pattern was observed in the previous Bitcoin bear market, where BTC traded between $200 and $400 from February 2015 to May 2016.

In this context, Richard Wyckoff’s analogy of the “Composite Man” refers to the hypothetical figure driving market fluctuations. The Composite Man accumulates stocks during market ranges, capitalizing on fear-driven downward movements.

As the trading range progresses, fewer sellers are left, causing shorter downswings and the Composite Man amassing more stocks.

Bitcoin in Heavy Accumulation: Financial Evolution and Millennial Adoption

The concept of “bitcoin in heavy accumulation” has gained rapid momentum in its financialization journey. Notably, LedgerX and CME have initiated Bitcoin Futures platforms, while ICE, the NYSE owner, is introducing Cryptocurrency Data Feed and the soon-to-launch BAKKT Bitcoin Futures.

Investments from major players like Goldman Sachs in Bitgo and TD Ameritrade in ErisX highlight growing interest.

Anticipated in 2019 are innovations like Fidelity Digital Custody, Nasdaq’s Bitcoin futures, and cryptocurrency custody by Northern Trust.

Remarkably, Bitcoin futures already represent over 30% of spot volumes, while the collateralization and lending market, with Genesis Capital processing more than $1.1 billion in transactions, centers primarily around bitcoin.

The compelling attributes of bitcoin, including political neutrality, security, liquidity, and financial policy predictability, underscore its potential as a disruptive digital gold and reserve asset within the $100 trillion investment vertical of Liquid Store of Value.

Millennials, the world’s largest and fastest-growing demographic, exhibit a strong inclination toward cryptocurrencies.

Molded by their experiences during the 2008 recession, they express substantial skepticism toward traditional banking, with a striking 92% mistrusting banks, as affirmed by a Facebook-funded 2016 research project.

Their familiarity with P2P protocols like BitTorrent and engagement with open-source codes like Linux position Millennials as enthusiastic adopters of cryptocurrencies.

Notably, initial adopters and contemporary buyers, largely male Millennials, are spurred by a combination of government distrust and growth potential. As the disposable income of Millennials continues to burgeon, the momentum of bitcoin adoption and its price appreciation is poised for further acceleration.

Bitcoin Expert and Analyst Tuur Demesteer

Tuur Demeester is a well-known figure in the cryptocurrency and blockchain space. To be more precise, he only focuses on bitcoin.

He is a prominent Bitcoin advocate, analyst, and investor. Demeester is known for his research and insights into Bitcoin and other cryptocurrencies. He has authored various reports and articles that provide in-depth analysis of the cryptocurrency market and its trends.

Tuur Demeester has been involved in the crypto community for many years and is considered a respected voice in the space. But not just that, Tuur Demsteer is also one of the most influential thought leaders in the space. He has contributed to discussions about Bitcoin’s role as digital gold, its potential as a store of value, and its broader impact on the financial industry.

Tuur Demeester’s report, titled “Bitcoin in Heavy Accumulation,” presents a compelling analysis of the cryptocurrency’s market dynamics.

The report highlights a period of intense accumulation of Bitcoin, shedding light on the behaviors of long-term investors and institutions.

Demeester’s findings suggest a growing confidence in Bitcoin’s value proposition, with evidence of substantial hodling by major players in the crypto space.

This report serves as an essential resource for those seeking insights into Bitcoin’s evolving role as a store of value and its potential for long-term growth in the ever-changing financial landscape.

Bitcoin Distribution Analysis by Balance Range

Bitcoin is incredibly profitable. However, Bitcoin in heavy accumulation can be also understood by taking a look at the blockchain.

Let’s examine the distribution of Bitcoin across various balance ranges, shedding light on the percentage of addresses, the total number of coins, and their corresponding USD values within each range. This comprehensive view of Bitcoin ownership provides insights into the cryptocurrency’s dispersion among its users.

Here is the table based on the provided data:

| Balance Range | BTC Balance | Number of Addresses | % Addresses (Total) | Total Coins (BTC) | Total USD | % Coins (Total) |

|---|---|---|---|---|---|---|

| (0 – 0.00001) | 18.36 BTC | 3,620,118 | 7.3% (100%) | 18.36 BTC | $481,635 | 0% (100%) |

| [0.00001 – 0.0001) | 418.01 BTC | 9,808,613 | 19.78% (92.7%) | 436.37 BTC | $11,444,339 | 0.02% (100%) |

| [0.0001 – 0.001) | 4,791 BTC | 12,292,051 | 24.78% (72.93%) | 5,227.38 BTC | $137,080,820 | 0.67% (99.98%) |

| [0.001 – 0.01) | 42,785 BTC | 11,519,861 | 23.23% (48.14%) | 47,012.38 BTC | $1,233,148,187 | 6.05% (99.31%) |

| [0.01 – 0.1) | 265,213 BTC | 7,887,831 | 15.9% (24.92%) | 312,225.38 BTC | $8,188,576,135 | 40.14% (93.25%) |

| [0.1 – 1) | 1,072,272 BTC | 3,453,514 | 6.96% (9.02%) | 1,384,497.38 BTC | $36,309,838,888 | 17.74% (53.11%) |

| [1 – 10) | 2,145,719 BTC | 860,928 | 1.74% (2.05%) | 3,530,216.38 BTC | $92,583,191,817 | 45.23% (35.37%) |

| [10 – 100) | 4,464,851 BTC | 141,357 | 0.28% (0.32%) | 7,995,067.38 BTC | $209,677,794,751 | 102.6% (29.14%) |

| [100 – 1,000) | 3,859,927 BTC | 13,804 | 0.03% (0.03%) | 11,854,994.38 BTC | $310,907,727,220 | 151.8% (26.83%) |

| [1,000 – 10,000) | 4,693,322 BTC | 1,906 | 0% (0%) | 16,548,316.38 BTC | $434,994,177,285 | 212.96% (23.01%) |

| [10,000 – 100,000) | 2,267,293 BTC | 103 | 0% (0%) | 18,815,609.38 BTC | $493,455,898,127 | 241.3% (19.99%) |

| [100,000 – 1,000,000) | 660,085 BTC | 4 | 0% (0%) | 19,475,694.38 BTC | $509,767,201,654 | 249.15% (16.42%) |