Bitcoin’s adoption has given rise to a multitude of terms and concepts unique to the financial world.

One such term is “HODL waves,” a phrase that carries significant implications for understanding Bitcoin’s market dynamics and investor behavior.

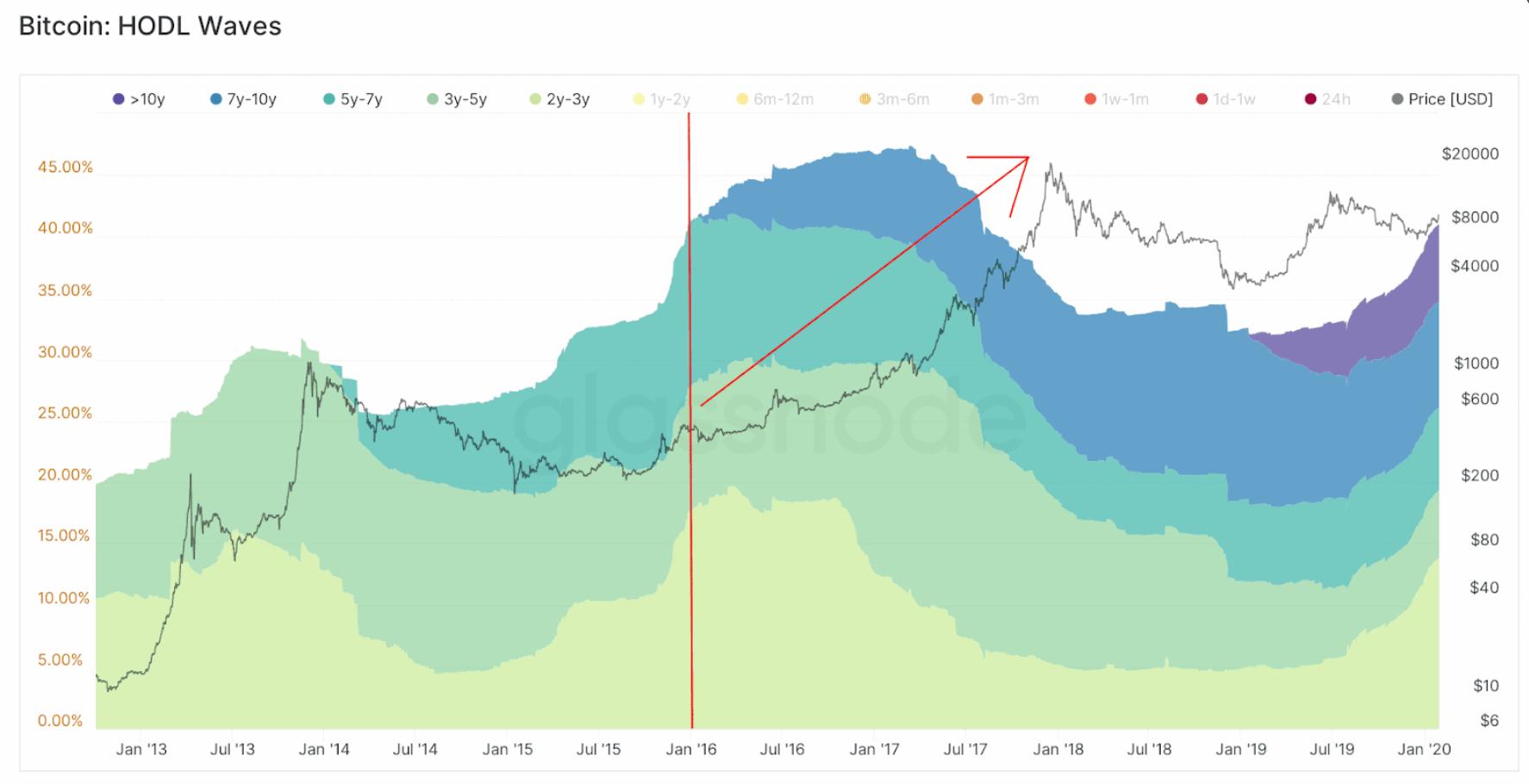

HODL waves provide insights into the distribution of Bitcoin holdings.

The waves depict holdings across different time frames, shedding light on the patterns of long-term investors, traders, and market sentiment.

What Are HODL Waves?

HODL waves refer to the distribution of Bitcoin supply based on the length of time that coins have been held without being moved.

The term “HODL” itself originated from a humorous misspelling of “hold” in a Bitcoin forum post and has since been widely embraced by the crypto community as a term representing the act of holding onto cryptocurrencies rather than selling or trading them.

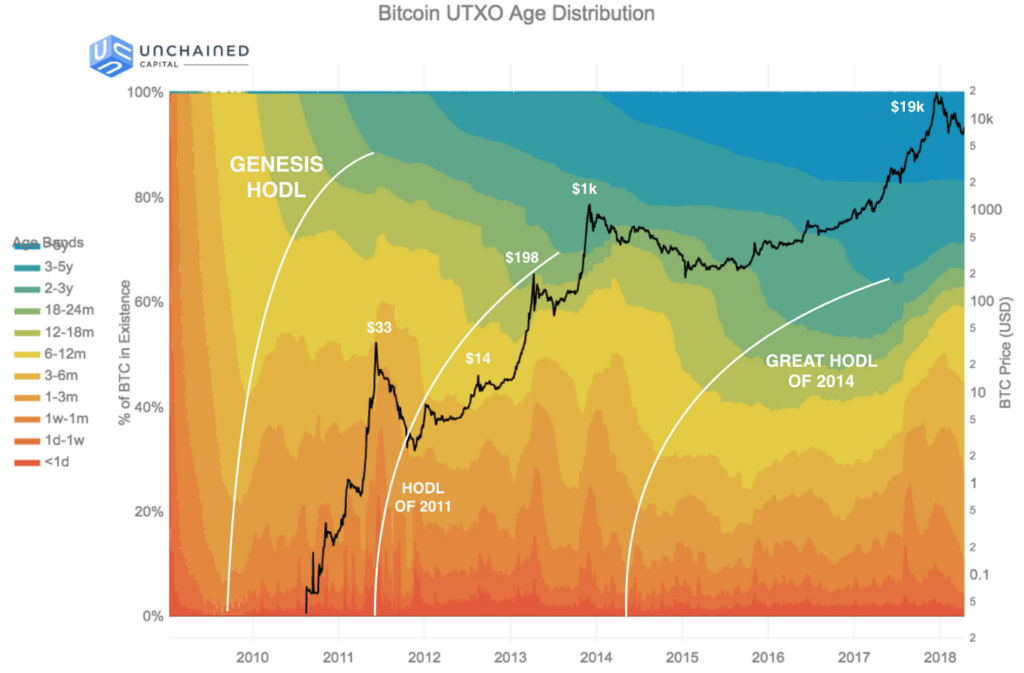

HODL waves visualize the percentage of Bitcoin supply that has remained dormant for various durations, such as 1 year, 2 years, 3 years, and so on. Each wave represents a cohort of Bitcoin that hasn’t been moved within the specified time frame. These waves offer insights into how long-term investors, speculators, and traders are behaving in the market.

Interpreting HODL Waves: What Do They Tell Us?

HODL waves can provide valuable insights into the sentiment and behavior of different types of Bitcoin holders:

- Long-Term Holders: Bitcoin held for extended periods, often referred to as “whales” or institutional investors, contribute to the early waves of the HODL wave distribution. These investors demonstrate a strong belief in the long-term potential of Bitcoin and are less likely to be influenced by short-term price fluctuations.

- Medium-Term Holders: Investors who hold Bitcoin for intermediate time frames occupy the middle waves of the HODL wave distribution. This group may include individuals who are more risk-averse and choose to hold their investments through moderate market fluctuations.

- Short-Term Holders and Traders: Traders and short-term holders are typically represented in the later waves of the HODL wave distribution. These participants engage in more frequent buying and selling, aiming to capitalize on short-term price movements.

HODL Waves Examples

HODL Waves change during bitcoin’s market cycles. By analyzing the amount of bitcoin supply traded quickly or held long-term we gain insights into market sentiment and the behavior of long-term holders versus short-term traders.

In this example, we’ll use hypothetical data for Bitcoin HODL Waves:

| Age of Coins (Days) | % of Total Bitcoins HODL’d | Market Sentiment |

|---|---|---|

| 0 – 30 | 15% | Short-term traders are active, quick buy/sell |

| 31 – 180 | 20% | Mid-term holders, some trading activity |

| 181 – 365 | 10% | Accumulation phase, anticipation of price increase |

| 1 – 2 years | 18% | Long-term holders, confidence in future growth |

| 2 – 3 years | 12% | Some profit-taking, evaluation of long-term prospects |

| 3 – 5 years | 10% | Strong hands, belief in Bitcoin’s fundamentals |

| 5 – 10 years | 8% | True HODLers, weathering market storms |

| 10+ years | 7% | Early adopters, maximalists, strong conviction |

In this table, the “Age of Coins” represents different time intervals since the last movement of the coins, the “% of Total Bitcoins HODL’d” indicates the proportion of the total Bitcoin supply held within each age category, and the “Market Sentiment” column provides insights into the potential behavior and attitudes of holders within each age group. Remember that these percentages are for illustrative purposes and don’t reflect real-world data.

HODL Waves and Market Sentiment

HODL waves provide a visualization of how the sentiment in the Bitcoin market evolves over time. During periods of market exuberance or bull runs, coins that were previously held for a long time may start moving as investors take profits. This can lead to a flattening or inversion of the HODL waves, indicating increased activity among long-term holders. Conversely, during market downturns or bear markets, more Bitcoin may accumulate in the early waves, suggesting a strong commitment to hodling during challenging times.

Implications for Investors and Analysts

HODL waves offer a tool for investors and analysts to gauge the sentiment of the Bitcoin market and make informed predictions about potential market trends. By studying the shifts in HODL wave distributions, analysts can identify periods of accumulation, distribution, or volatility, which can help anticipate market movements.

Investors can also use HODL waves to align their strategies with prevailing market sentiment. For instance, during periods of strong market optimism, investors might consider rebalancing their portfolios to lock in profits, while during times of heightened uncertainty, they might choose to adopt a more patient approach and adhere to their long-term hodling strategy.

Conclusion: Unveiling Bitcoin’s Investor Landscape

HODL waves serve as a unique lens through which to observe the distribution of Bitcoin holdings across various time frames.

They provide insights into the mindset of different types of investors, from long-term believers to short-term traders.

By analyzing the shifts in HODL wave patterns, market observers can gain a better understanding of market sentiment and adapt their investment strategies accordingly.

In the ever-changing landscape of cryptocurrency, HODL waves offer a fascinating tool for uncovering the intricate dynamics that drive Bitcoin’s price movements and investor behavior.