Bitcoin mining taxation in the U.S. is a complex topic. Bitcoin mining offers a compelling blend of technological innovation and entrepreneurial opportunity, but it also presents one of the most intricate tax environments in the digital asset world. For miners—whether individuals tinkering at home or large-scale businesses—the distinction between income tax and capital gains tax is foundational. Navigating these domains with precision is crucial for legal compliance and financial optimization.

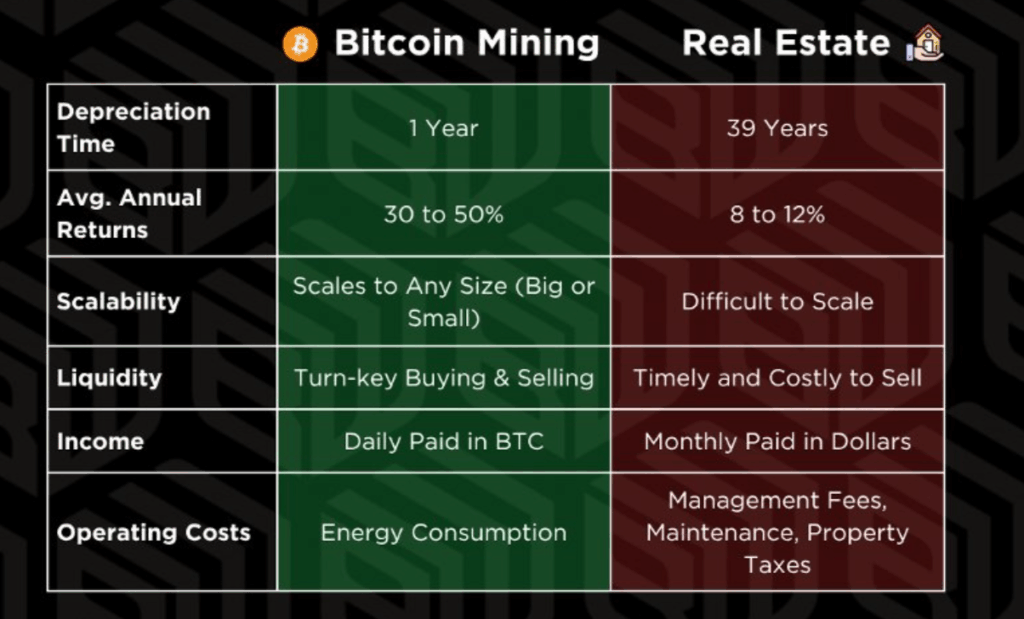

The good news? Bitcoin mining taxation just got very favorable in the U.S. Bitcoin miners can now write off 100% of mining hardware costs in the first year. Instead of writing off a property over the course of 39 years like real estate investors.

Bitcoin miners can depreciate everything instantly. Same tax shelter – Higher returns – Bitcoin income instead of fiat dollars. A good Commercial Real Estate investment returns 10% per year. Bitcoin miners consistently return 50% per year.

Table of Contents

Overview: Two Major Tax Events for Miners

Bitcoin Mining Taxation is relatively easy to grasp. Bitcoin Mining creates two major taxable events for U.S. tax purposes:

- Initial Receipt (“Mining Event”): When a miner successfully earns Bitcoin and it appears in the recipient wallet, the IRS considers this “ordinary income” taxed at regular income tax rates.

- Subsequent Disposition (“Disposition Event”): When that mined Bitcoin is later spent, exchanged, or sold, a second taxable event arises, generating a capital gain or loss. The magnitude and rate depend on several variables, including the holding period.

Initial Mining Reward: Ordinary Income Tax Details

How the IRS Sees Mining Rewards

The IRS treats any Bitcoin received from mining as ordinary income, taxable the moment it is received and based on the fair market dollar value at that time. This can occur through solo mining, pool mining, or via a hosted mining service—with identical U.S. tax implications regardless of method.

- Fair Market Value (FMV): FMV is determined by referencing a reputable exchange rate on the date and exact time the reward enters the miner’s wallet.

- Immediate Tax Liability: The miner incurs a tax liability instantly, regardless of whether the Bitcoin is held or immediately sold.

Example: If 0.5 BTC is mined and the exchange rate is $63,000 per BTC at receipt, the miner reports $31,500 as ordinary income for that tax year—liable whether or not the asset is liquidated. Bitcoin mining taxation is still subject to change as states propose new bills to bring clarity and incentives to the industry.

Applicable Tax Rates and Brackets

- Federal Rates: Ordinary income from mining is taxed based on the prevailing federal brackets ranging from 10% to 37% for individuals, as of 2024 and 2025.

- State Taxes: States may levy additional income tax, with methods and rates varying widely.

- Reporting: The income must be reported on individual tax returns (Form 1040), typically as “other income.” For those classified as businesses, income and expenses are detailed on “Schedule C.”

Record Keeping: Critical for Compliance in Bitcoin Mining Taxation

Robust and meticulous record-keeping is not optional—it’s mandatory for accurate income declaration and defense in an IRS audit. Essential records include:

- Timestamp of each mining reward

- Amount received (in BTC and USD equivalent)

- Source/pool identifier

- Associated mining fees

- Transaction receipts from mining pools or hosting providers

Negligent record-keeping is a common error that can result in penalties, missed deductions, or even legal complications.

Subsequent Disposition: Capital Gains Tax Event

Once the initial income tax has been paid, mined Bitcoin receives a cost basis equal to its FMV when acquired. When the miner disposes of this Bitcoin (e.g., sale, trade for another crypto, or spending), the gain or loss is calculated as the difference between the net proceeds and the original cost basis.

- Short-Term Capital Gains: If disposed of within 12 months, gains are taxed at the same ordinary income rate as wages.

- Long-Term Capital Gains: If held for over 12 months, gains benefit from preferential long-term rates (typically 0%, 15%, or 20%, depending on the taxpayer’s overall income).

Example: If the 0.5 BTC above is sold six months later at $70,000 per BTC, the gain is (0.5×70,000)−31,500=3,500(0.5 \times 70,000) – 31,500 = 3,500(0.5×70,000)−31,500=3,500. This gain is short-term (taxed at income rates) because the holding period is under one year. If sold after 13 months, the same gain is taxed at a lower long-term rate.sazmining+1

Distinguishing Business vs Hobby Mining

Bitcoin Mining can be profitable if done right. And that’s exactly where bitcoin mining taxation draws the line. A key determination for any miner is whether their activities constitute a “business” or a “hobby.” The distinction has significant tax ramifications:

Business Mining

- Characteristics: Regular operation, profit-seeking motive, significant equipment investment, formal record-keeping, and demonstration of expertise.

- Benefits: Ability to deduct “ordinary and necessary business expenses,” including:

- Mining hardware/equipment (depreciable under Section 179 or with bonus/accelerated depreciation)

- Electricity, internet, rent, and facility costs

- Software and hosting service fees

- Professional expenses (accounting, legal, consulting)

- Full offset against mining income, reducing taxable profit

Hobby Mining

- Characteristics: Irregular or casual mining, minor investments, not operated with clear profit intent.

- Limitations: Fewer deductions allowed; expenses generally only offset directly related income and may be capped by AGI thresholds. No depreciation of equipment is permitted.

Mining Methodology and International Considerations

Solo vs Pool vs Hosted Mining

- All mined coins are taxed identically: by FMV at the time of receipt.

- Pool mining yields smaller, more frequent taxable events; solo mining less frequent, larger ones.

- Hosting (domestic or international) does not change the core tax treatment, but can introduce complexities around foreign accounts and transfer pricing for business miners.

International/Offshore Tax Factors

- U.S. persons must report qualifying foreign financial accounts, including offshore mining wallets.

- Operations outside the U.S. may access tax treaty benefits in some cases, or face additional reporting (like FBAR).

- Transfer pricing becomes crucial for businesses with cross-border ownership structure.

Deductible Expenses and Planning for Business Miners

Allowable deductions can substantially reduce the net taxable income of business miners:

- Equipment acquisition: ASICs, GPUs, supporting computing infrastructure, racks, and network hardware.

- Depreciation strategies: Current law (as of 2024) allows for up to 80% of equipment cost to be written off in the first year (bonus depreciation).

- Operational outgoings: Power, internet, rent, repairs, and cooling/ventilation.

- Service expenses: Pool or hosting fees, device management, security, professional services.

- Record-keeping tools: Mining pool logs, crypto tax calculators, and accounting software integrating with mining outputs.

Best Practices for Mining Tax Compliance

- Accurate documentation: Use both automated tax software and manual backup logs to record every reward, exchange rate at receipt, and the path of disposition.

- Understand classification: Review IRS guidance (e.g., Notice 2014-21), court cases, and professional literature to determine if activities rise to “business” status.

- Timing strategies: Selling mined Bitcoin after a 12-month holding period can reduce the tax on future gains. Delaying equipment purchases to align with year-end/deduction opportunities may improve after-tax returns.

- Tax-loss harvesting: If Bitcoin price drops, selling at a loss can offset other capital gains or income, within IRS wash sale rules.

- State taxes: Research state-specific crypto tax regimes; some states are moving to exempt or preferentially treat mining (especially for industrial-scale operations).

Common Mistakes and How to Avoid Them

- Failure to report mining rewards as income: Ignorance is not an excuse; all rewards must be declared even if never spent or sold.

- Inaccurate cost basis calculation: This leads to double taxation or lost deductions upon future disposition.

- Improper classification of operation: Missing out on business deductions due to casual or hobby status can have a significant financial impact.

- Neglecting to track small or frequent transactions: Especially in pool mining, it is easy to miss rewards or fees in records.

- Ignoring state-and-local tax obligations: These can sometimes be more aggressive than federal rules.

Looking Forward: Regulatory Trends

- New federal reporting thresholds and infrastructure legislation may soon require mining pools and hosting services to adopt tighter reporting and disclosure.

- OECD and international coordination seek to harmonize cryptocurrency tax rules worldwide.

- State innovation on economic incentives and preferential tax treatment for mining (trend in Wyoming, Texas, etc.).

Conclusion and Professional Recommendations

Understanding and optimizing U.S. taxation for Bitcoin mining demands clear awareness of two major events: the initial reward (ordinary income) and eventual disposition (capital gain or loss). Classification as a business versus hobby shapes deduction eligibility, and robust documentation underlies all compliance.

For sophisticated miners: Strategic planning should incorporate holding period optimization, expense timing, entity selection, and—where appropriate—international structure and treaty analysis.

Given the rapid evolution of laws and guidance, miners should regularly consult with qualified tax professionals who specialize in digital assets. Only by staying vigilant and proactive can miners both comply and optimize for long-term success in the sector.

Sources:

- https://gordonlaw.com/learn/crypto-mining-taxes/

- https://www.sazmining.com/blog/taxation-mined-btc

- https://www.youtube.com/watch?v=tz_Rl61lK4I

- https://www.youtube.com/watch?v=VJiKtkDTRtY

- https://www.youtube.com/watch?v=8DzRKqfbv0Q

- https://www.youtube.com/watch?v=cruWVdRGeF0

- https://www.youtube.com/watch?v=IWYfuOtrmOM

- https://www.youtube.com/watch?v=nyA7I5axGkc

- https://www.youtube.com/watch?v=sFMD1xl5rV0

- https://www.youtube.com/watch?v=7cN7nBL78rY