Buying bitcoin in a lump sum or dollar cost averaging (DCA) is an important difficult decision.

While many hard-core Bitcoiners warn you to only keep money in fiat money that you are willing to lose, research shows that DCA can an effective method to accumulate more bitcoin.

In this article we analyze both strategies and give you all the pros and cons.

Índice

Introduction:

As Bitcoin gains traction as an alternative store of value, more individuals are considering its potential as a long-term savings tool. However, with its notorious price volatility, the decision of how to approach investing in Bitcoin can be challenging. In this article, we will find the answer which of two popular methods is ideal: lump sum or dollar cost averaging.

By understanding these strategies, you can make an informed choice on the best approach to save your hard-earned money and protect it with Bitcoin.

Which investment strategy has historically performed better for Bitcoin investors? Have investors who invested their funds all at once (lump-sum) outperformed those that have spread out their buys over time (DCA)?

Lump-Sum Investing

Lump-sum investing involves putting a large sum of money into Bitcoin all at once. The main advantage of this approach is the potential for immediate exposure to the price appreciation of Bitcoin. If the price of Bitcoin continues to rise, a smart saver who opts for lump-sum investing could see significant returns on their initial investment.

Pros of Lump-Sum Investing:

a. Capitalizing on Bear Markets: By investing a lump sum during a bear market, a smart saver can maximize their gains. If Bitcoin’s price is on an upward trend, they can benefit from the asset’s potential growth during the bull run.

b. Simplified Management: Lump-sum investing allows for straightforward tracking of investments since there’s only one entry point.

c. Long-Term Potential: If Bitcoin becomes a mainstream store of value or currency, investing a significant amount early on could lead to substantial returns in the long run.

Cons of Lump-Sum Investing:

a. Exposure to Market Volatility: Bitcoin is well-known for its price fluctuations, and investing a lump sum at the wrong time could lead to significant short-term losses.

b. Timing Risk: Picking the right time to invest a lump sum is challenging, as market timing is notoriously difficult.

c. Emotional Stress: Large market swings may lead to emotional decisions, causing a smart saver to panic-sell during price downturns.

Dollar Cost Averaging (DCA)

Dollar-Cost Averaging (DCA) is a strategy where a smart saver invests a fixed amount of money in Bitcoin at regular intervals, regardless of its price. This method spreads the investment over time and reduces the impact of short-term market volatility.

On DCA Signals we have done extensive research on dollar cost averaging and you can read a number of reports, studies and comparison. In fact, our business goal is to make dollar cost averaging Bitcoin a globally recognized trend.

Pros of Dollar-Cost Averaging (DCA):

a. Risk Mitigation: By investing consistently over time, a smart saver can reduce the risk of investing a large sum at an unfavorable market price.

b. Disciplined Approach: DCA encourages a disciplined approach to saving and investing, as it eliminates the need to time the market.

c. Averaging Out Market Fluctuations: DCA helps to smooth out market highs and lows, providing a more stable average purchase price.

Cons of Dollar Cost Averaging (DCA):

a. Missed Opportunities: If the price of Bitcoin experiences a substantial and sustained increase, a smart saver employing DCA might miss out on higher potential gains compared to lump-sum investing.

b. Limited Exposure: DCA means that not all of the saver’s funds are immediately exposed to Bitcoin’s potential growth.

c. Overlapping Transactions: Frequent small investments might result in higher transaction fees, affecting overall returns.

Scientific research on lump sum vs dollar cost averaging

Lump sum or dollar cost averaging, let’s ask the scientists!

Lump-sum investing involves investing all available funds at once, while DCA involves allocating funds over regular intervals – comparing the data should reveal clear performance indications right?

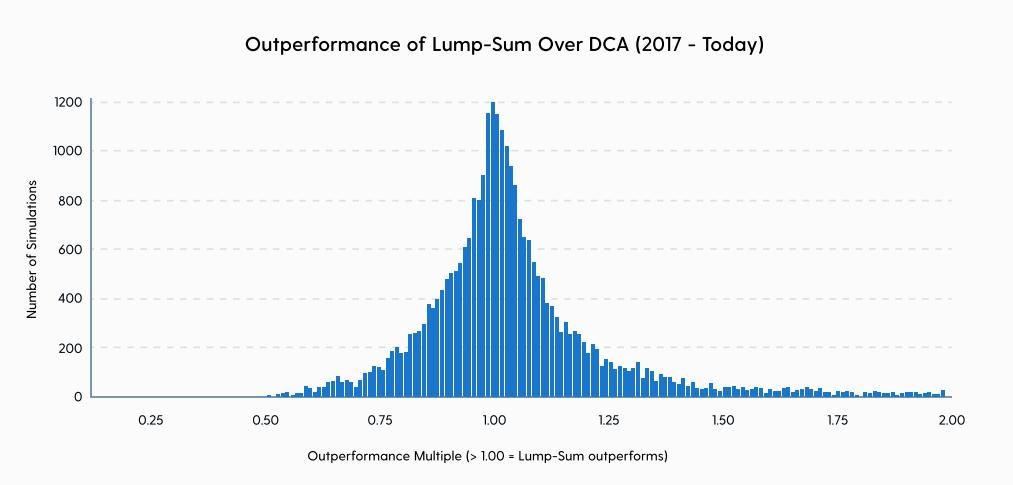

Quants at Swan Research ran the numbers and found that lump-sum investing has historically outperformed DCA strategies. This is primarily due to Bitcoin’s explosive upward price movements.

However, DCA can lead to significant outperformance during bear markets. For instance, investors who bought a large sum at all-time highs but employed DCA afterward were able to break even significantly quicker. See the simulation results .

While DCA has potential drawbacks, such as reduced returns in consistently rising markets, it remains a popular method for managing risk and promoting disciplined investing.

A value of 1.00 means that the two strategies returned equal amounts, in other words, a client accumulated the same amount of bitcoin whether they used a lump-sum or DCA strategy. A value above 1.00 means that the lump-sum strategy outperformed DCA. For instance, an outperformance of 1.03 means that the lump-sum strategy accumulated 3% more bitcoin during a given time period.

On average, the chart above indicates that lump-sum has generally outperformed DCA strategies since 2017. You can see this by observing how the majority of the simulations were greater than 1, sometimes significantly.

Lump Sum or Dollar Cost Averaging Conclusion

When deciding between lump sum or dollar cost averaging (DCA) as a smart saver looking to save in Bitcoin, it is essential to consider personal financial goals, risk tolerance, and time horizon.

If a smart saver is comfortable with the potential short-term volatility and is confident in Bitcoin’s long-term growth potential, lump-sum investing might be suitable, especially during a bull market. On the other hand, if the saver prefers a more measured approach, is risk-averse, or unsure about market timing, DCA provides a disciplined strategy to navigate Bitcoin’s price fluctuations.

Whether lump sum or dollar cost averaging, the decision comes down to your personal preferences and the asset you seek to gain exposure to. For a precious asset such as Bitcoin, choosing dollar cost averaging could mean significant downside if you are underexposed and a bull cycle is imminent. Often times lump sum investments turn out the better choice when it comes to Bitcoin.

Since most people asking if they should go with lump sum or dollar cost averaging have not yet made any prior plans to grow a bitcoin portfolio, experts would often suggest to combine the two approaches.

Ultimately, both strategies have their merits, and a smart saver may also choose to employ a hybrid approach, combining lump sum and dollar cost averaging to strike a balance between immediate exposure and risk mitigation. Whichever path a smart saver chooses, it is crucial to conduct thorough research, understand the risks involved, and seek professional advice if necessary, before embarking on their Bitcoin savings journey.