In the dynamic world of finance, not all strategies are ethical or legal. “What are Pump and Dump Schemes?” is a question that unravels a dark underbelly of the investment landscape.

This article aims to shed light on Pump and Dump Schemes, their mechanisms, the motives behind them, and the implications for investors.

Inhaltsübersicht

What are Pump and Dump Schemes?

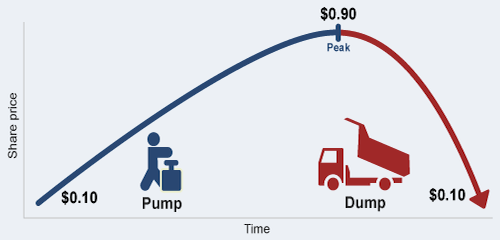

Pump and Dump Schemes involve artificially inflating the price of an asset, often a stock or cryptocurrency, through deceptive tactics. Once the price is artificially “pumped” to an inflated level, the orchestrators “dump” their holdings, leading to a sudden price crash, resulting in losses for unsuspecting investors.

What are Pump and Dump Schemes? The Basics Explained

Imagine a situation where someone artificially inflates the price of a stock, cryptocurrency, or other assets. This is what’s called a “Pump and Dump Scheme.” The people orchestrating the scheme deceive investors by spreading false information or exaggerated claims about the asset’s potential. This creates a buzz and leads many investors to rush in, hoping to make a quick profit.

But here’s the twist: Once the price is artificially pumped up and more investors have bought in, those behind the scheme suddenly sell off their own shares, causing the price to crash. This leaves the latecomers, who bought at the inflated price, with significant losses.

The Steps Behind a Pump and Dump Scheme

Pump and Dump Schemes follow a specific pattern that involves several phases:

Accumulation Phase

In this phase, schemers quietly start buying up a large number of the target asset at a low price. They do this before the scheme becomes public knowledge.

Hype and Promotion Phase

False information or exaggerated claims are spread to create excitement around the asset. This can happen on social media, online forums, or even through misleading news articles. The goal is to lure in unsuspecting investors.

Pump Phase

As more people get caught up in the hype and start buying the asset, its price starts to skyrocket. This is the “pump” phase, where the asset’s value gets artificially inflated.

Dumping Phase

Once the price reaches a desirable level, the schemers start selling off their accumulated shares. This creates a rush of selling activity.

Price Collapse Phase

With the schemers selling, the asset’s price crashes. Many investors who bought during the hype are now left with significant losses.

Motivations Behind Pump and Dump Schemes

Understanding the motives driving Pump and Dump Schemes can help investors grasp the psychology behind these deceptive practices:

1. Quick Profits

Schemers aim to cash in on the price surge generated during the hype phase. By selling off their assets at the artificially inflated prices, they secure gains before the inevitable crash.

2. Unsuspecting Investors

The orchestrated hype lures investors who lack thorough understanding or fail to conduct proper research. These investors become easy prey for the schemers’ profit-seeking motives.

3. Market Manipulation

Pump and Dump Schemes distort market fundamentals, artificially inflating trading volumes and creating a false illusion of genuine interest and demand.

4. Illicit Gains

Pump and Dump Schemes enable orchestrators to profit illicitly at the expense of honest participants in the market.

Real-Life Instances of Pump and Dump Schemes

Several notable examples underscore the prevalence and impact of Pump and Dump Schemes:

1. The Wolf of Wall Street

Jordan Belfort, the individual portrayed in the movie “The Wolf of Wall Street,” orchestrated Pump and Dump Schemes during the 1990s. He manipulated penny stocks to accumulate personal wealth while leaving others with significant losses.

2. Cryptocurrency Manipulation

The volatile cryptocurrency market has been vulnerable to numerous Pump and Dump Schemes. Schemers exploit the lack of regulation and misinformation to artificially inflate prices.

Consequences of Pump and Dump Schemes

The implications of Pump and Dump Schemes extend beyond immediate financial losses:

1. Eroding Investor Confidence

Pump and Dump Schemes undermine trust in financial markets and discourage participation from potential investors.

2. Regulatory Scrutiny

Suspicious market activities attract regulatory attention, potentially leading to legal repercussions for those orchestrating these schemes.

3. Market Distortion

Pump and Dump Schemes skew market dynamics, leading to inaccurate price signals and disrupting natural supply-demand dynamics.

Protecting Yourself Against Pump and Dump Schemes

Investors can adopt preventive measures to mitigate the risk of falling victim to Pump and Dump Schemes:

1. Conduct Thorough Research

Before investing in any asset, conduct comprehensive research using reputable sources to validate information.

2. Be Cautious of Hype

Exercise skepticism towards exaggerated claims or promises of instant wealth. Remember, if it sounds too good to be true, it probably is.

3. Monitor Volatility

Stay alert to extreme price fluctuations, as sudden spikes can signal potential manipulation.

4. Analyze Trading Volumes

Sudden spikes in trading volume without corresponding news can indicate abnormal market activity.

Case Study: Analyzing a Pump and Dump Scheme

Let’s consider a hypothetical Pump and Dump Scheme involving a cryptocurrency named “CryptoPump.”

| Day | CryptoPump Price | Scheme Phase |

|---|---|---|

| 1 | $0.10 | Pre-Scheme |

| 5 | $0.30 | Accumulation |

| 10 | $1.00 | Hype and Pump |

| 15 | $2.50 | Dumping Phase |

| 20 | $0.05 | Price Collapse |

Schlussfolgerung

Understanding “What are Pump and Dump Schemes?” equips investors with knowledge to navigate the investment landscape with caution. These schemes exploit vulnerabilities and distort market fairness. By remaining vigilant, conducting diligent research, and exercising critical thinking, investors can guard themselves against the traps of Pump and Dump Schemes. Knowledge is the key to making informed and resilient investment decisions in a complex financial world.