In this article we will calculate the internal rate of return (IRR) for bitcoin. Sounds interesting? Let’s go!

Inhaltsübersicht

Introduction

Before we begin, a quick introduction. This article is intended to explain IRR in general terms and also look at Bitcoin’s IRR as a fun exercise.

Now you may think Bitcoin is a speculative asset and calculating its IRR is nonsense. Our perspective is that of Bitcoin as hard money or “sound money” which has a high probability to become a global reserve asset in coming years. Bitcoin is not speculation and Bitcoin is not a hedge to inflation, it’s the solution to inflation.

What is Internal Rate of Return?

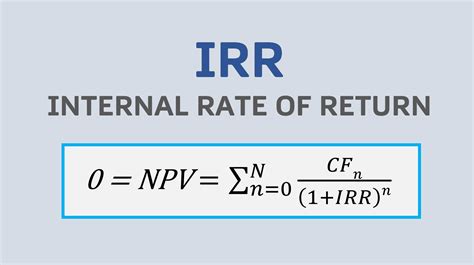

The Internal Rate of Return (IRR) is a financial metric used to evaluate the potential profitability of an investment or project over time.

It represents the annualized rate at which an investment breaks even, meaning it generates enough returns to cover its initial costs.

In other words, IRR is the discount rate that makes the net present value (NPV) of all future cash flows from the investment equal to zero.

Here are the key points about IRR:

Discount Rate: IRR is expressed as a percentage and represents the rate at which future cash flows are discounted to their present value. It’s the rate of return an investor can expect to earn from the investment.

Zero NPV: When the IRR is calculated, it is essentially finding the rate at which the sum of the present values of all future cash flows (including the initial investment) equals zero. In other words, it’s the rate that makes the investment neither a net gain nor a net loss.

Decision Making: IRR is used as a decision-making tool in capital budgeting and investment analysis. If the calculated IRR is greater than the required rate of return (often referred to as the hurdle rate or cost of capital), the investment is considered potentially profitable. If it’s lower than the hurdle rate, the investment may not be financially attractive.

Multiple Cash Flows: IRR is commonly used for projects or investments with multiple cash flows over time. These cash flows can include initial investments, revenues, operating costs, and terminal values.

Limitations: While IRR is a useful metric, it has some limitations. One key limitation is that it assumes reinvestment of cash flows at the IRR rate, which may not be realistic in all cases. Additionally, it can result in multiple solutions (i.e., multiple IRRs) for complex cash flow patterns, making interpretation challenging.

In practice, financial analysts often use IRR in conjunction with other metrics such as Net Present Value (NPV) to make more informed investment decisions. NPV provides insight into the absolute dollar value of an investment, while IRR focuses on the rate of return. Both metrics are valuable tools for evaluating the financial viability of projects or investments.

Internal Rate of Return Explained Simply

Let’s break down the Internal Rate of Return (IRR) in simple terms:

Imagine you have some money, let’s say $100, and you want to invest it in something. You want to figure out how much you could make from this investment, and you want to know if it’s a good idea.

IRR helps you with that. It tells you the annual interest rate at which your $100 investment would grow or “break even” over time. In other words, it’s like asking, “If I invest $100, how much money will I have in the future, and what’s the equivalent annual interest rate?”

If the IRR is higher than what you’d expect or want (like a bank’s interest rate), it might be a good investment. If it’s lower, you might consider other options.

So, IRR helps you decide if an investment is worth it and how much you could potentially earn, all in terms of an annual interest rate.

IRR Example

Imagine a company faces a decision between two potential projects. The company’s cost of capital is set at 10%. Below are the projected cash flows for each project:

Project A

- Initial Investment = $5,000

- Year one = $1,700

- Year two = $1,900

- Year three = $1,600

- Year four = $1,500

- Year five = $700

Project B

- Initial Investment = $2,000

- Year one = $400

- Year two = $700

- Year three = $500

- Year four = $400

- Year five = $300

The company’s task is to compute the Internal Rate of Return (IRR) for each project. The initial investment (at period 0) is treated as a negative cash flow. The IRR is determined through an iterative process using the following equation:

$0 = Σ CFt ÷ (1 + IRR)^t

Where:

- CF = net cash flow

- IRR = internal rate of return

- t = period (from 0 to the last period)

Alternatively:

$0 = (initial outlay * -1) + CF1 ÷ (1 + IRR)^1 + CF2 ÷ (1 + IRR)^2 + … + CFX ÷ (1 + IRR)^X

Using the data above, the company can calculate the IRR for each project as follows:

IRR for Project A

$0 = (-$5,000) + $1,700 ÷ (1 + IRR)^1 + $1,900 ÷ (1 + IRR)^2 + $1,600 ÷ (1 + IRR)^3 + $1,500 ÷ (1 + IRR)^4 + $700 ÷ (1 + IRR)^5

IRR for Project A = 16.61%

IRR for Project B

$0 = (-$2,000) + $400 ÷ (1 + IRR)^1 + $700 ÷ (1 + IRR)^2 + $500 ÷ (1 + IRR)^3 + $400 ÷ (1 + IRR)^4 + $300 ÷ (1 + IRR)^5

IRR for Project B = 5.23%

Given that the company’s cost of capital is 10%, the optimal decision is to proceed with Project A while rejecting Project B.

The internal rate of return provides a clear indication which project is more fruitful and should be preferred from an investing perspective.

Internal Rate of Return applied to Bitcoin

Is it useful to apply the internal rate of return metric to a bitcoin investment?

Not really since bitcoin is not a business that generates cashflow. However, calculating the IRR for bitcoin is an interesting exercise that can help us compare Bitcoin’s performance to other investments.

IRR is typically used for traditional financial assets like stocks, bonds, real estate, and business projects. It may not be directly applicable to something like Bitcoin.

Bitcoin is the best performing asset in history but its value can fluctuate significantly within short periods, making it challenging to calculate a stable IRR. Moreover, Bitcoin does not generate cash flows or pay dividends, which are essential components for calculating IRR in traditional investments.

However, many experts compare bitcoin to a startup investment. Because bitcoin has similarities to a tech startup such as a strong network effect, exponential growth and a global team of developers, lobbyists, enthusiasts and advocates etc.

Let’s do the math – Bitcoin IRR over 150%

Let’s do the math. For simplicity we will not use a fictional scenario.

Let’s start with the following assumption. We will invest $25,000 into bitcoin in 2011 and we hold it until today.

The first question is how much bitcoin we receive for $25,000 in 2011. Let’s take a look at the price of Bitcoin in 2011.

| Jahr | Monat | Bitcoin Price ($) | Change ($) | Month-over-month (%) |

|---|---|---|---|---|

| 2011 | 12 | 3.06 | -0.09 | -2.85 |

| 2011 | 11 | 3.15 | -1.88 | -37.41 |

| 2011 | 10 | 5.03 | -3.27 | -39.35 |

| 2011 | 9 | 8.30 | -4.80 | -36.63 |

| 2011 | 8 | 13.09 | -2.30 | -14.95 |

| 2011 | 7 | 15.40 | 5.83 | 60.89 |

| 2011 | 6 | 9.57 | 6.54 | 215.52 |

| 2011 | 5 | 3.03 | 2.26 | 291.82 |

| 2011 | 4 | 0.77 | -0.15 | -15.88 |

| 2011 | 3 | 0.92 | 0.21 | 30.02 |

| 2011 | 2 | 0.71 | 0.41 | 135.93 |

| 2011 | 1 | 0.30 | 0 | 0 |

As we can see the price fluctuates between $0.30 and $15.40. Let’s assume the average price per bitcoin is $5.25.

Which means for $25,000 we get 4,761.90 Bitcoin.

Now we also need to define the value of the “investment” after the period of 12 years. Let’s assume that Bitcoin is now worth $25,000 per coin. That means the current value is $119,240,000.

Instead of cashflow, we will just use the capital gain of bitcoin to calculate the IRR.

If you’re assuming that the ending value of your Bitcoin holdings is $25,000 per Bitcoin, and you initially invested $25,000 in 2011 at a price of $5.25 per Bitcoin, then there has been a significant capital gain. In this scenario, the IRR calculation is as follows:

| 1. Determine the initial investment amount, which is $25,000. |

| 2. Determine the ending value of your Bitcoin holdings as of today, which is $25,000 per Bitcoin. |

| 3. Calculate the capital gain by subtracting the initial investment from the ending value. |

| 4. Calculate the holding period in years from 2011 to 2023. |

Let’s calculate the IRR using these values:

- Initial Investment = $25,000

- Ending Value = $25,000 per Bitcoin (assuming the value remains constant)

Capital Gain = Ending Value – Initial Investment

Capital Gain = ($25,000 per Bitcoin – $5.25 per Bitcoin) * Number of Bitcoins (initial investment)

Capital Gain = ($24,994.75 per Bitcoin) * (4,761.90 Bitcoins)

Capital Gain ≈ $119,240,000

Holding Period = 2023 – 2011 = 12 years

Now, we use these values to estimate the IRR using the formula:

IRR = (Capital Gain / Initial Investment)^(1 / Holding Period) – 1

IRR = ($119,240,000 / $25,000)^(1 / 12) – 1

IRR ≈ 168.63%

In this scenario, the IRR is approximately 168.63%.

This indicates an annualized return rate of approximately 168.63% on your initial investment of $25,000 made in 2011, assuming the ending value remains constant at $25,000 per Bitcoin.

IRR of Bitcoin vs other investments

Here’s a table showing hypothetical Internal Rates of Return (IRRs) for various types of investments, including traditional investments and Bitcoin.

Please note that these IRRs are for illustrative purposes and may not reflect actual market conditions or future performance. Actual returns can vary widely.

While the Stock market fluctuates a lot, most of the performance data is made public which allows us to have a good sense for typical IRRs.

Bonds are very traditional investment vehicles and performance data is easy to find and put into perspective allowing us to calculate IRR with reliable data.

Real Estate investments depend a lot on different factors such as increase demand or market downtrends as well as cost and regulation. But based on historical data we see IRR range from 4-10%.

According to a study conducted by the famous Harvard Univeristy, private equity firms can see median IRRs of 25%.

| Investment Type | Hypothetical IRR |

|---|---|

| Stock Market | 7-9% (historical average) |

| Bonds | 2-5% (varies by type) |

| Real Estate | 4-10% (varies by property) |

| Mutual Funds/ETFs | Varies based on portfolio |

| Private Equity/Venture Capital | 25% |

| Savings Account/CD | < 2% (low-risk, low return) |

| Bitcoin | Approximately 168.63% (based on previous calculation) |

Again, please remember that these IRRs are approximate and based on historical averages or hypothetical scenarios.

Real-world investment returns can be influenced by a wide range of factors, including market volatility, economic conditions, and individual investment choices.

It’s essential to conduct thorough research, consider your risk tolerance, and consult with financial professionals when making investment and business decisions.

We hope this article was insightful. If you are considering to invest into a business or project, perhaps you will think more about the IRR and consider options such as holding Bitcoin while focusing on your core business.