What is the best time and day to DCA Bitcoin? This article discusses dollar-cost averaging (DCA) for Bitcoin investment and explores the possibility of optimizing buy times for recurring purchases.

Key findings:

- Daily recurring buys: According to a report by River, 12-1 PM Eastern time has a higher chance of buying at a lower price point compared to the daily average (advantage: 1.2%). This pattern may change over time.

- Weekly recurring buys: Mondays have historically been better days to buy with a slight price advantage (14.36% over the past year). Fridays might be another option (10.94% advantage last year but less historically). The advantage is likely related to weekend news impacting markets on Mondays and Fridays.

- Monthly recurring buys: The data suggests the first two days of the month might be slightly better, but the advantage is minimal (6.83% and 3.73%) and statistically insignificant. The last three days of the month seem worse for buying.

- DCA frequency: Lower frequency purchases might accumulate slightly more Bitcoin in the long run, while higher frequency helps stay closer to the invested dollar amount for short-term conversions.

Overall:

- The best time and day to DCA Bitcoin has a small impact and may not be material for many investors.

- Past performance doesn’t guarantee future results, and market conditions can affect DCA effectiveness.

- The core benefit of recurring buys remains: reducing exposure to price volatility and making Bitcoin investing passive.

Best Time and Day to DCA Bitcoins

Dollar-cost averaging (DCA) is a popular strategy for gradually building a Bitcoin position. But is there a truly “best time and day” to buy Bitcoin with DCA?

A recent analysis by River, a platform known for zero-fee recurring buys, sheds light on this question. They examined historical Bitcoin price data to uncover potential buying opportunities (Source: River Blog).

Daily DCA Bitcoin: Afternoon Might Offer a Slight Edge

On its mission to find the best time and day to DCA Bitcoin, River’s quant team analyzed years of price history and went deep into the data.

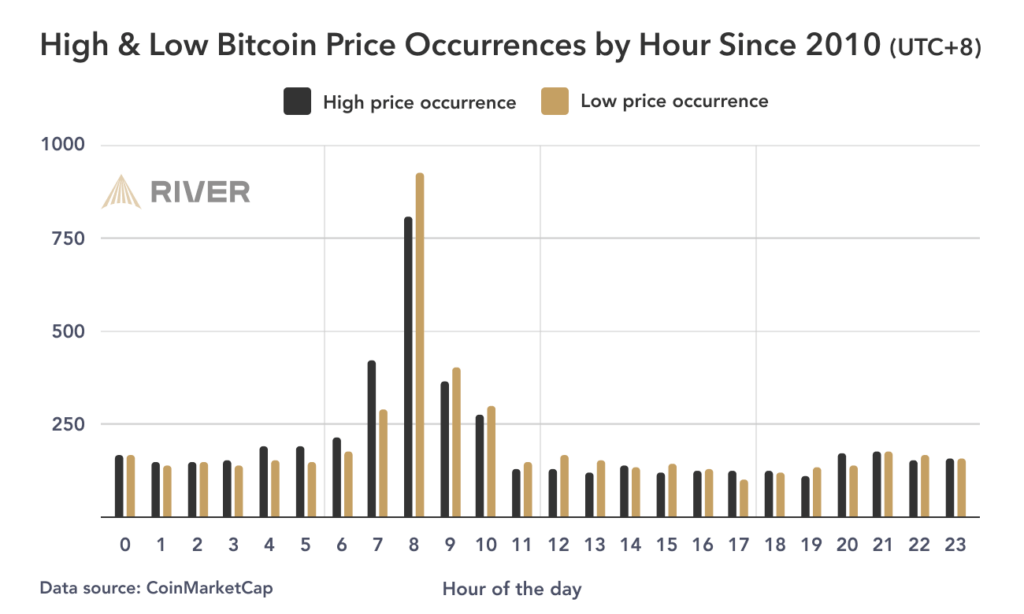

The team mapped out daily highs and lows by hour for 4860 days, and came across a clear pattern: the daily high price happened within a 4-hour window 38.5% of the time, and the daily low price happened within that same 4-hour window 39.4% of the time.

The research suggests a one-hour window (12-1 PM Eastern time) with a statistically significant chance of experiencing a lower daily price point compared to the average. This translates to 5 PM London time and 1 AM Hong Kong time.

However, the researchers caution that this pattern may change over time, and the actual advantage is around 1.2% – a relatively small gain. Besides this 4-hour window, the distribution of daily highs and lows is remarkably flat.

Weekly DCA Bitcoin: Mondays Might Be Slightly Better

The best time and day to DCA Bitcoin could also depend on a particular day. Looking at weekly trends, Mondays seem to be the best day to buy Bitcoin throughout the year, with a 14.36% theoretical advantage for recurring buys compared to the weekly average. Fridays might also be an option, although the advantage is less pronounced.

The reasoning behind this pattern? The researchers believe it could be linked to the traditional business week. Market reactions to weekend news might cause some volatility on Mondays and Fridays, potentially leading to lower entry points.

Monthly DCA Bitcoin: The First Few Days Might Have a Minor Benefit

For monthly recurring buys, the analysis suggests the first two days of the month might offer a small advantage (around 6.83% and 3.73%), but it’s not statistically significant. The last three days of the month, however, seem to be less favorable for buying.

Important to Remember:

- Past performance doesn’t guarantee future results.

- Market conditions can significantly impact DCA effectiveness.

- The overall impact of timing recurring buys is relatively small.

The core benefit of DCA remains consistent investing and reduced exposure to price volatility.

FAQ

Is there a guaranteed “best time” to DCA Bitcoin?

No, market conditions are constantly changing, and there’s no guaranteed best time. However, research suggests some potential advantages for specific days and times.

Should I focus on timing my recurring buys?

This depends on your willingness to go the extra mile. While the study explores potential optimizations, the upside is may not be as big as expected. Regardless, consistency is crucial for successful DCA. Sticking to a regular buying schedule is more important than the exact timing.

Are the other automated buying strategies?

Yes there are, but they are even more advanced. Once you get a hang of it and get more comfortable with price fluctuations, you might want to consider value averaging. This means when the Bitcoin price dips you buy a bit extra.

Does DCA frequency matter?

Yes, frequency can impact your Bitcoin accumulation. Lower frequency may lead to slightly more Bitcoin in the long run, while higher frequency helps you stay closer to the dollar amount you invested.

The source data for price history is from CoinMarketCap.