If you invest in stocks and crypto you might have heard “dumping on retail,” a concept that has gained traction in recent years due to its significant impact on retail investors.

In this article, we will delve into the meaning of “dumping on retail,” why it happens, and how retail investors can protect themselves from its consequences.

Inhaltsübersicht

What is Dumping on Retail?

“Dumping on retail” refers to a strategic and often manipulative maneuver executed by large holders or groups of holders of a specific stock or cryptocurrency. In this scenario, these individuals intentionally sell off a substantial amount of their holdings at once, causing the price of the cryptocurrency to plummet.

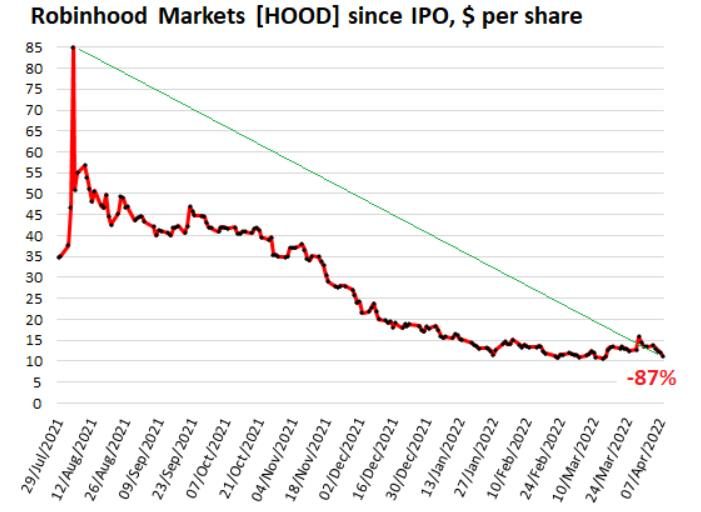

Traditionally dumping on retails is heard in the context of an initial public offering (IPO). Accredited investors, venture capitalists, friends and family, or early insiders get access to a deal before the public offering and receive favorable terms. As a result these insiders experience huge gains once the general public is allowed to invest or buy in.

Dumping on retail means that those early investors sell large amounts of whatever it is they bought to the general public (retail). This happened with many IPOs in the past and even more initial cryptocurrency offerings (ICO).

Retail investors can get stuck holding an asset that plummets in price because of all the selling. To prevent a “dumping on retail” event from happening many IPOs have lock-up periods for existing shareholders before they’re allowed to sell on an open exchange to “retail”.

Dumping on retail can cause a domino effect as the sudden and significant drop in price causes retail investors, who generally have smaller investment amounts, to panic and sell their holdings as well, exacerbating the price decline.

This tactic is often carried out with the intention of capitalizing on the panic selling that follows. By selling off their holdings when prices are high and then triggering a sharp decline, the manipulators can then buy back the same cryptocurrency at a much lower price, effectively increasing their holdings at a lower cost. This strategy can lead to massive profits for the manipulators, but it leaves retail investors with losses.

Why Does Dumping on Retail Occur?

Dumping on retail typically occurs due to a combination of factors:

- Lack of Regulation: The cryptocurrency market is still relatively young and lacks comprehensive regulations. This lack of oversight can make it easier for manipulative practices to thrive.

- Market Manipulation: Large holders or entities with significant influence can exploit the lack of regulation to manipulate prices for their own financial gain.

- Profit Maximization: Manipulators aim to maximize their profits by taking advantage of the panic selling triggered by sudden price drops. They effectively buy low and sell high.

- Illiquid Markets: Many cryptocurrencies have relatively low trading volumes, making them susceptible to price manipulation. A large sell-off can have a disproportionately significant impact on the price due to the lack of liquidity.

Understanding Dumping on Retail

“Dumping on retail” is a term that encapsulates a manipulative tactic within the cryptocurrency market. It involves the deliberate selling of a substantial amount of a cryptocurrency by large holders or groups, causing the price to plummet. This downward spiral triggers panic selling among retail investors, who often have smaller holdings, amplifying the price decline further.

The intention behind this tactic is to profit from the ensuing panic selling. By triggering a sharp price drop, the manipulators can repurchase the cryptocurrency at a lower cost, increasing their holdings at the expense of retail investors who sell at a loss.

Financial guru Raoul Pal promoted crypto scam Terra Luna as “basically risk free” knowing that it was a ponzi scheme.

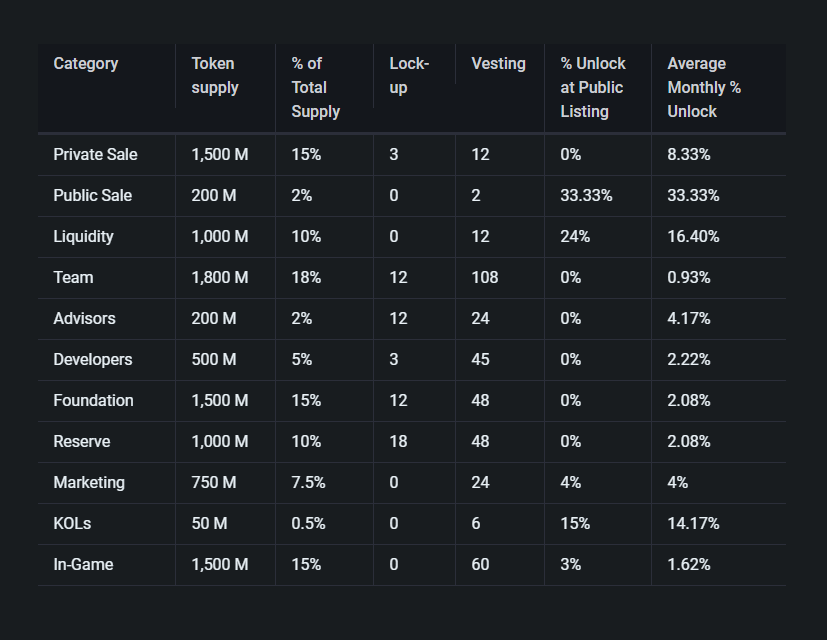

To get a clear picture of how the economics of “dumping on retail” look we found an interesting cap table that reveals the shocking reality of token allocation for the insiders.

As you can see, the majority of tokens are held by insiders, which means if you are an investor you’re constantly at risk that a large amount of the supply will be dumped on the retail investors.

Rationale Behind Dumping on Retail

Several factors contribute to the prevalence of dumping on retail:

- Lack of Regulation: The cryptocurrency market’s decentralized and unregulated nature can facilitate manipulative practices, as there are no stringent rules governing trading activities.

- Profit Motive: Manipulators are driven by the potential for substantial profits. They exploit the lack of regulation and liquidity to buy low and sell high.

- Market Influence: Large holders or entities with significant market influence can leverage their positions to manipulate prices for personal gain.

- Illiquidity: Many cryptocurrencies have limited trading volumes, making them vulnerable to price manipulation due to low liquidity.

Minimizing Risks Through Bitcoin Investment

Investing in Bitcoin offers a strategic approach to mitigate risks associated with dumping on retail:

- Established Credibility: Bitcoin is the first cryptocurrency and has maintained its position as the market leader for over a decade. Its widespread recognition and adoption provide a level of credibility that reduces susceptibility to manipulative tactics.

- Higher Liquidity: Bitcoin boasts the highest trading volume among cryptocurrencies. Its liquidity makes it less prone to sudden price swings caused by dumping on retail.

- Institutional Interest: Bitcoin has garnered significant attention from institutional investors and financial institutions, contributing to its stability and reducing the risk of manipulation.

- Decentralization: Bitcoin’s decentralized nature lessens the impact of market manipulation by reducing the influence of large holders.

- Diversification: Rather than investing in numerous individual projects, concentrating on Bitcoin provides a balanced approach that mitigates risks associated with lesser-known altcoins.

Avoid dumping on retail – Investing Wisely in Bitcoin

To maximize the benefits of investing in Bitcoin while minimizing risks, consider the following strategies:

- Educate Yourself: Gain a thorough understanding of Bitcoin’s technology, history, and potential. Informed decisions are crucial for successful investment.

- Long-Term Perspective: Adopt a long-term investment horizon. Bitcoin’s historical performance demonstrates its resilience over market fluctuations.

- Secure Storage: Safeguard your Bitcoin investments by using reputable wallets and exchanges that prioritize security.

- Stay Informed: Keep up with Bitcoin-related news and developments. Staying informed enables you to make well-timed decisions.

- Avoid Impulsiveness: Resist impulsive actions driven by market sentiment. Thoughtful decision-making is key to successful Bitcoin investment.

Schlussfolgerung

Navigating the cryptocurrency market requires a strategic approach to minimize risks and seize opportunities. Focusing on investing in Bitcoin provides a prudent path for retail investors to safeguard their interests. By leveraging Bitcoin’s established credibility, liquidity, and decentralization, investors can mitigate the potential impact of manipulative practices like dumping on retail. As the cryptocurrency landscape continues to evolve, a well-informed and balanced investment strategy centered on Bitcoin can serve as a reliable foundation for success.

Protect yourself from these risks with a solid bitcoin dca strategy and our membership.